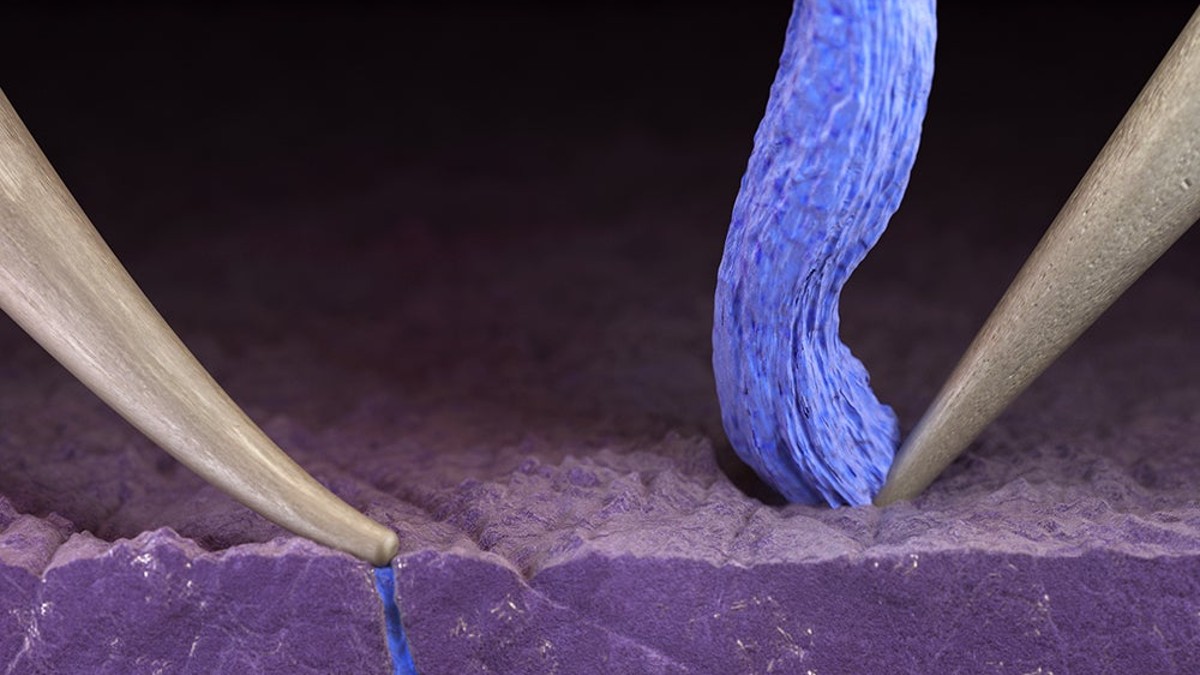

The US’s first lithium from oilfield wastewater is coming this year

Element3 just raised a fresh round of funding to launch the first US commercial lithium extraction plants, and it’s sourcing the lithium from oil and gas wastewater in Texas. That’s a big deal because it means there will be a domestic lithium supply for EVs and battery storage within a few months.

Expand Expanding Close