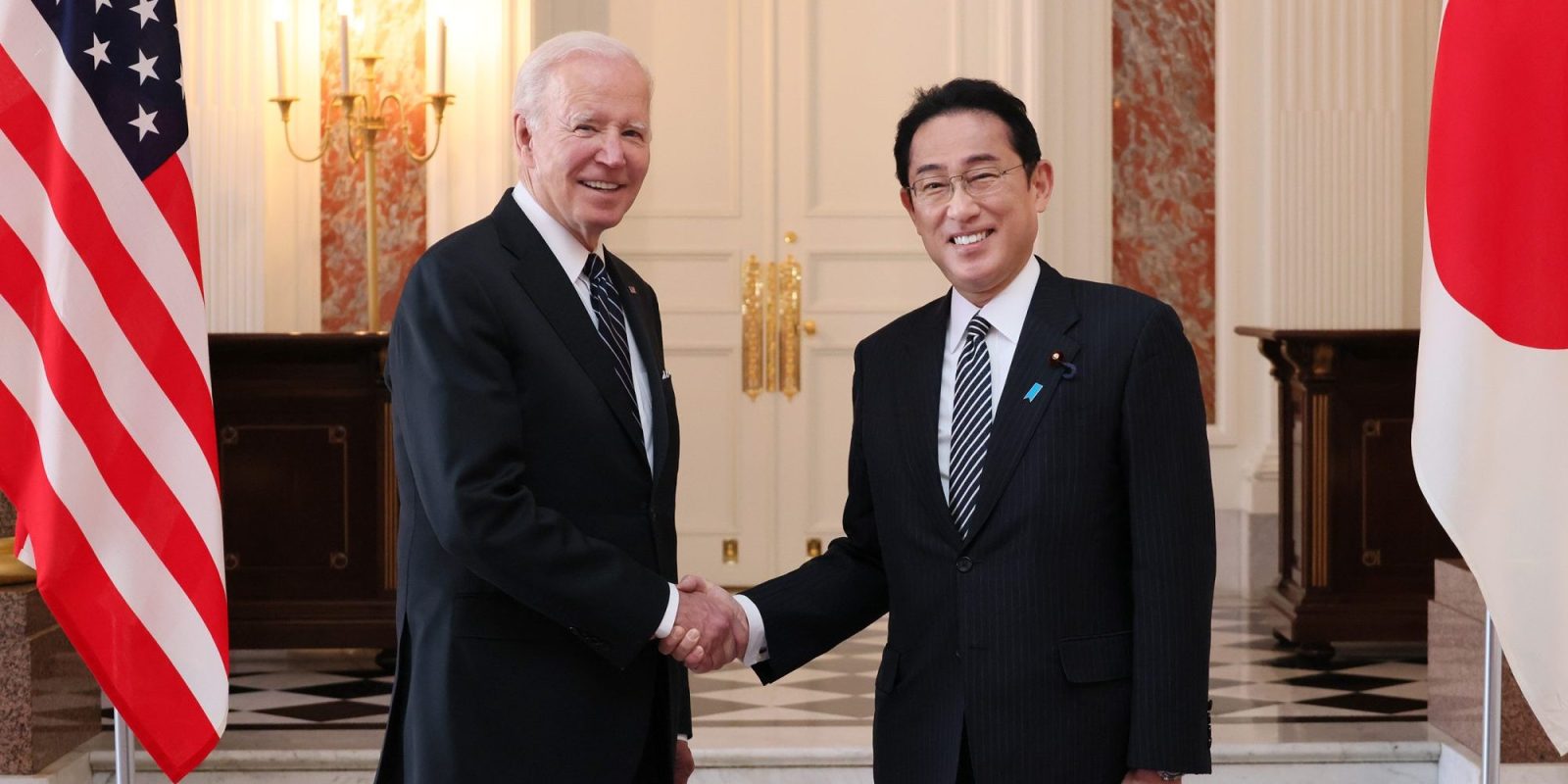

Here’s where the $154B investment and 188k jobs from Biden’s EV push are going

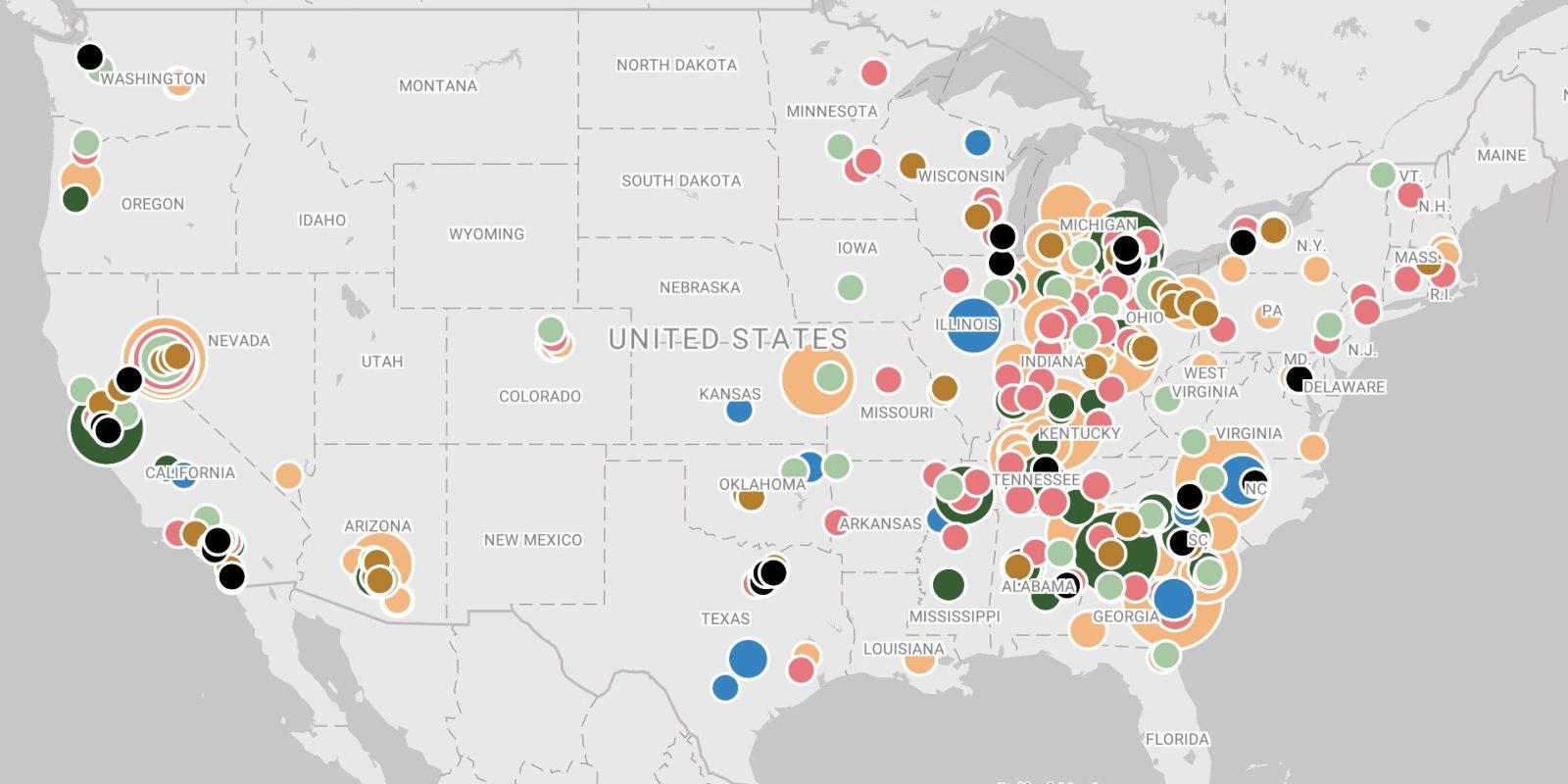

In recent years, automakers have announced new EV investments totaling $154 billion and creating 188,000 jobs, largely catalyzed by President Biden’s EV policies. A new map shows where it’s all happening in the US.

(Update: These numbers keep increasing, see this tool for updated numbers)

Expand Expanding Close