Polestar (PSNY) strengthened its financial position in Q4 as the Swedish EV maker enters an exciting year with two new electric vehicle launches.

The company’s fourth-quarter earnings are a breath of fresh air compared to most upcoming EV makers we’ve covered, with narrowing losses and surging revenues.

Polestar Q4 financial results

Polestar released its fourth quarter earnings and full-year 2022 earnings results Thursday, March 2 before market opening, highlighting a solid end to the year with slimming losses and higher-than-expected sales.

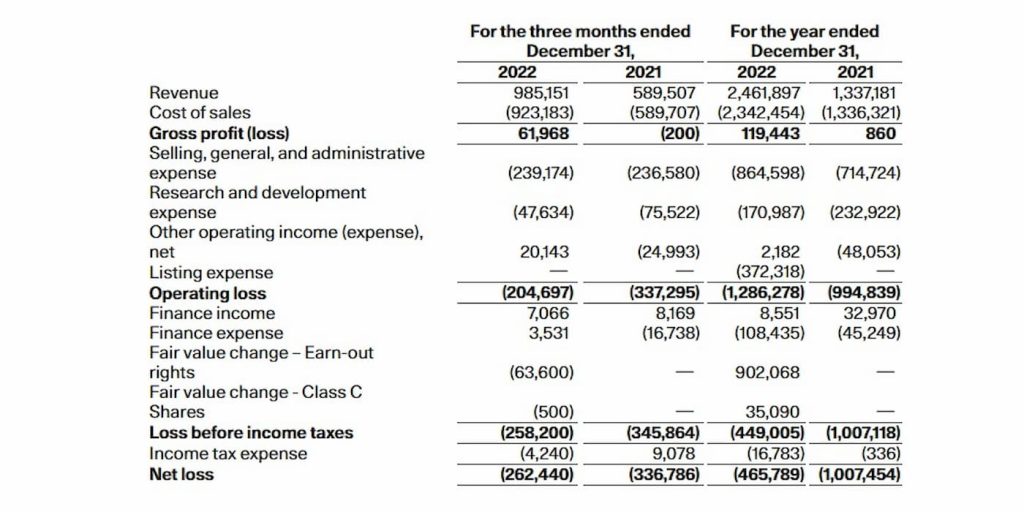

After beating its goal and delivering 51,491 cars last year, the Swedish EV marker reported revenue of $2.5 billion last year, up 84% from 2021 and exceeding Wall Street expectations of $2.4 billion.

Perhaps, more importantly, Polestar cut its losses in half last year (a rarity these days) with a net loss of $465 million, compared to over $1 billion in 2021.

Polestar says a higher gross profit of $118.5 million was due to rising Polestar 2 sales and lower fixed manufacturing costs.

In Q4, revenue swelled to $985.2 million on the back of Polestar’s first fully electric car. The company ended the year with nearly $1 billion in liquidity as it moves to expand its presence globally.

CEO Thomas Ingenlath expects the momentum to continue with an “exciting year” ahead in 2023, as he explained on the company’s earnings call.

A big year for Polestar

Polestar aims for 80,000 vehicle deliveries in 2023, an increase of around 60% from this past year.

The company launched a major update to the 2024 Polestar 2 with a new high-tech front end, more powerful electric motors and batteries, and additional rear-wheel-drive.

Polestar continues building its brand in the US, but as Ingenlath explains on the company’s earnings call, although you may not see as many Polestar vehicles in the US as brands like Rivian or Lucid, the brand is global and can be found in places these EV makers have not entered yet.

Polestar has an advantage over other upcoming EV markers like Rivian with the “agility of a startup” and “stability of established players” from parent companies Volvo and Geely.

Rather than building costly new electric vehicle manufacturing plants like other startups, Polestar can convert existing factories, such as the one opened by Volvo in Ridgeville, SC, where the Polestar 3 will be built.

The Polestar 3, the company’s first electric SUV, debuted in October with over 300 miles range. The electric SUV is expected to play a key role in expanding the Polestar brand, with deliveries expected by the end of the year.

In addition, Polestar is launching an electric performance SUV coupe this year, the Polestar 4, poised to take on top EVs in the segment like the Tesla Model Y.

Next year, Polestar will follow it up with an electric performance 4-door GT, the Polestar 5.

Polestar stock is up over 20% following its Q4 release after falling over 50% in the past 12 months as investors digest the news.

FTC: We use income earning auto affiliate links. More.

Comments