The 2022 report from South Korean firm SNE Research shows that EV battery manufacturer CATL once again holds its title as the largest in the world by installed battery capacity. That’s now six years in a row that CATL leads the global EV battery market and based on 2022’s numbers, is showing no signs of slowing down.

Contemporary Amperex Technology Co Ltd., better known as CATL, is a global energy technology company and the leading EV battery manufacturer in China. As a supplier to major EV automakers like Tesla, CATL has an ever-growing rolodex of EV clients demanding its products.

CATL also provides EV batteries to companies like NIO and Volkswagen, in addition to the Fisker Ocean SUV. In recent years, CATL has also begun developing other battery technologies and even launched its own EV battery swap brand. All on its way to becoming a globally carbon neutral brand.

Last year, SNE Research released its annual report for 2021, which showed a big lead by CATL. Following this year’s report, CATL’s share of the global EV battery market grew even more while other competitors saw their percentages shrink.

CATL’s lead in the EV battery market grew in 2022

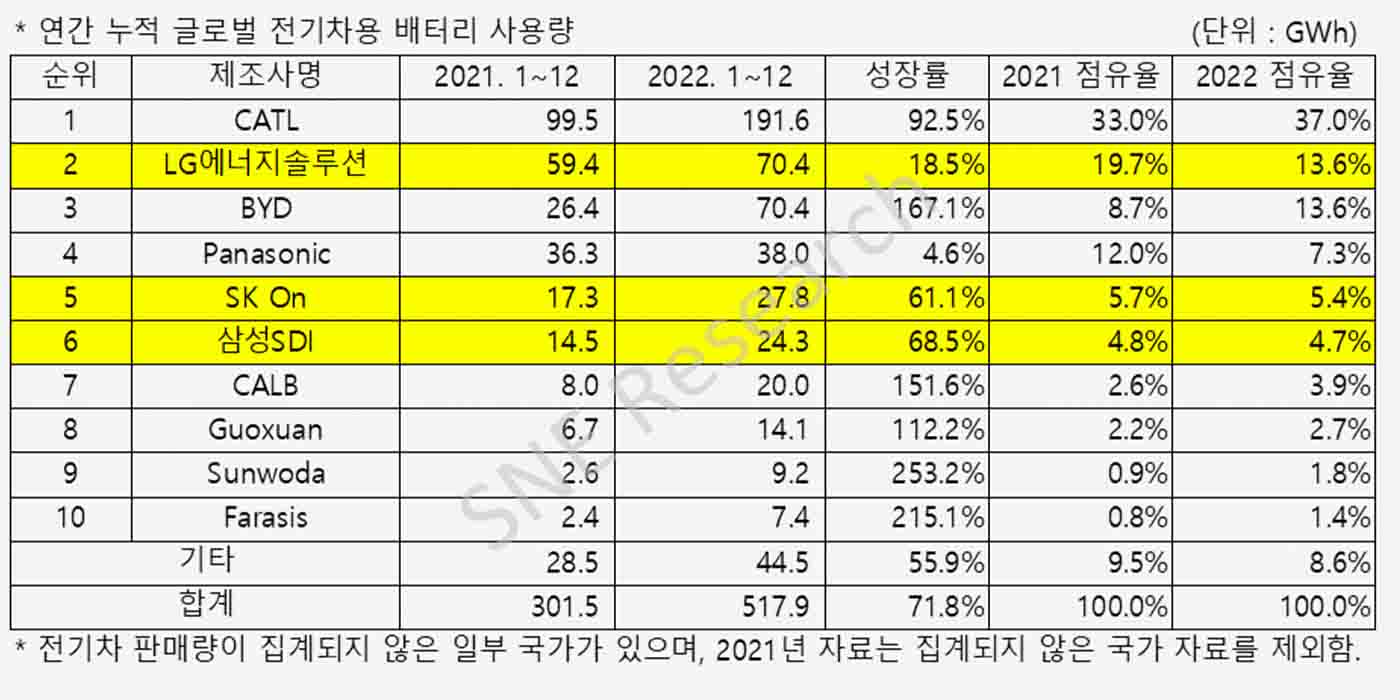

According to the most recent report from SNE Research in South Korea, global EV battery usage was 517.9 GWh in 2022, up 71.8% compared to a year prior. Based off data trends from the research firms compiled data, it predicts battery consumption will jump to 749 GWh in 2023.

Based on battery usage in 2022, CATL lead by more than double its second place competitor with 191.6 GWh. As a result, its percentage of the EV battery market grew to 37%. LG Energy Solution takes silver for a second year in a row, but saw its share of the market drop by over 6%.

Panasonic was in third place at the end of 2021, but also saw a drop in EV battery market share by nearly 5%, causing it to be usurped by Chinese battery maker BYD for bronze. In fact, BYD is the only company besides CATL in the top six of the list that saw market share growth in 2022. Per the SNE Research:

Japanese companies showed a relatively low growth rate, and their market share also decreased compared to the previous year. Panasonic grew by 4.6% compared to the previous year, and its market share decreased by 4.7%. In the case of Panasonic, as one of Tesla’s main battery suppliers, it was able to continue its growth trend thanks to increased sales of Tesla vehicles in the North American market and increased sales of TOYOTA ‘s BZ4X.

In contrast , Chinese companies including CATL and BYD showed explosive growth. CATL ‘s growth was driven by increased sales of Tesla Model 3/Y, GAC ‘s Aion Y, and Geely ‘s ZEEKR 001. BYD ‘s high growth was driven by high sales of BEVs and PHEVs in China’s domestic market, including Yuan, Han, and Qin PLUS EVs.

While CATL feels untouchable for yet another year, this is overall good news for all of these companies, who are seeing a demand for their battery products that still far outweighs their capacity. Furthermore, many are collaborating with US automakers to establish production footprints in North America to help more EVs qualify for federal tax credits.

You know, as soon as we get that tardy battery guidance from the US Department of Treasury.

FTC: We use income earning auto affiliate links. More.

Comments