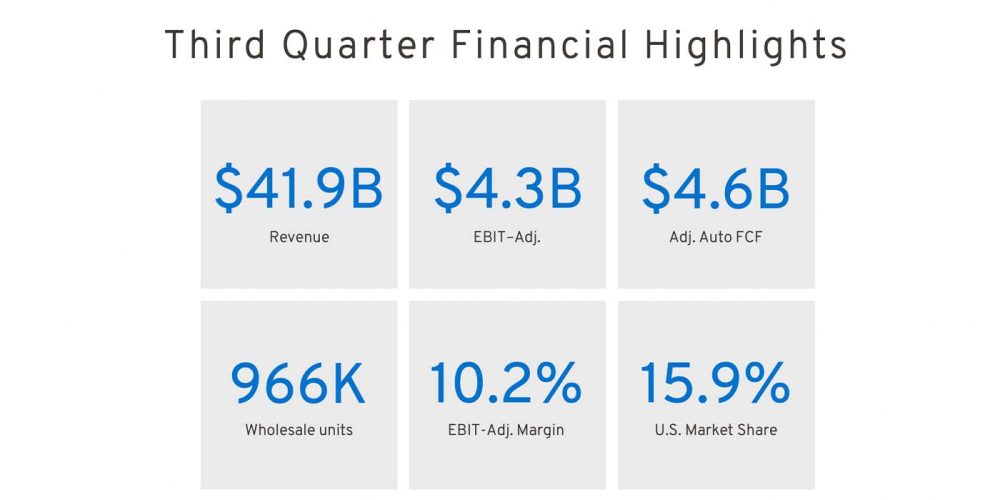

GM shared its Q3 2022 financial report today, which is highlighted by an EBIT-adjusted $4.3 billion bolstered by a quarterly revenue of $41.9 billion. As a result, the American automaker has reaffirmed its full-year earnings guidance as it continues to scale its Ultium platform and expand EV production throughout its marques.

Everyone is aware of GM ($GM) by now and its transition to become an all-electric automaker, EV charging network, and equipment provider. Although the company only has a few BEVs currently being delivered under its large umbrella of marques like Chevy and Cadillac, there are plenty more on the way.

GMC just announced an all-electric version of the Sierra Denali last week, which will join the Hummer EV pickup and SUV in early 2024. Other upcoming GM brand EVs include the ultra-lux, $300k+ Cadillac Celestiq, plus all-electric versions of the Chevy Silverado, Blazer, and very affordable Equinox EV.

Speaking of the Chevrolet brand, GM has seen a massive rebound in sales of its flagship Bolt EV and EUV, following a brutal 2021 due to a comprehensive recall. In fact, following records sales in Q3 2022, GM has decided to bolster Bolt production from 44,000 units to 70,000 EVs in 2023.

As you’ll be able to see from GM’s Q3 2022 financial documents, EVs are very much the focus of its business strategy going forward, and the American automaker looks to finish out the fiscal year with the same, if not more, momentum than it is already wielding in the EV market.

GM’s Q3 2022 report shows double-digit EBIT adj. margin

GM CEO Marry Barra relayed optimism in her recent letter to shareholders that outlined some of the highlights of Q3 2022, like record revenue and double-digit EBIT-adjusted margins. Barra spoke briefly about the success of its combustion trucks and SUVs then quickly segued into the automaker’s EV progress for the remainder of the letter.

Barra shared that GM garnered over 8% of the US electric vehicle market in Q3 2022, on the wings of the aforementioned sales of the Chevrolet Bolt EV and EUV. Additionally, the Bolts outsold Ford’s Mustang Mach-E by more than two to one in September. In all fairness, that comparison is two models versus one as well.

In the letter Barra spoke about the company’s future as it scales Ultium Platform production to support the growing number of EV models in its pipeline:

We have been very intentional to position the company for volume growth with flexibility, efficiency and increased EV profitability over time. Greater vertical integration is a key driver. That’s why we are building battery cells in Ohio through Ultium Cells LLC, with a second U.S. plant opening next year, a third in 2024 and a fourth planned. A secure and integrated supply chain will be another competitive advantage for us as we scale. As I shared last quarter, we moved early and aggressively to secure commitments for all the battery raw material we need to reach more than 1 million units of annual EV capacity in North America in 2025. For growth beyond 2025, we continue to secure our future with strategic supply agreements and direct investments in natural resource recovery, processing and recycling.

With the press release and shareholder letter, GM also shared a Q3 2022 report outlining the automaker’s financial highlights, including GMNA revenue around $34.7 billion and EV

sales around 15,200 units. Additionally, earnings per share (EPS) reached $2.25, beating Wall Street’s estimate of $1.90. You can view that report here, alongside GM’s earnings deck, complete with plenty of pretty EV pictures.

Looking ahead, GM has an Investor Day webcast scheduled for November 17, when the company intends to go deeper into the rapid scaling of its EV portfolio and share important metrics to help the public track its progress. We will be sure to tune in and report back.

FTC: We use income earning auto affiliate links. More.

Comments