Ford, GM, and Stellantis will win the largest share of the US EV market over the next four years, but it won’t be easy.

Ford, GM, and Stellantis gain on Tesla in US EV market

According to Bank of America’s (BofA) annual “Car Wars” report, “The next four+ years could be some of the most uncertain and volatile for product strategy ever,” with EV launches accelerating, uncertainty regarding ICE vehicles, and the possible last-minute product cancellations.

BofA says, “ICE dominance is over,” with electric cars expected to account for a larger portion of new model launches from 2024 to 2027 (46% EV vs. 35% ICE) with another 18% hybrid.

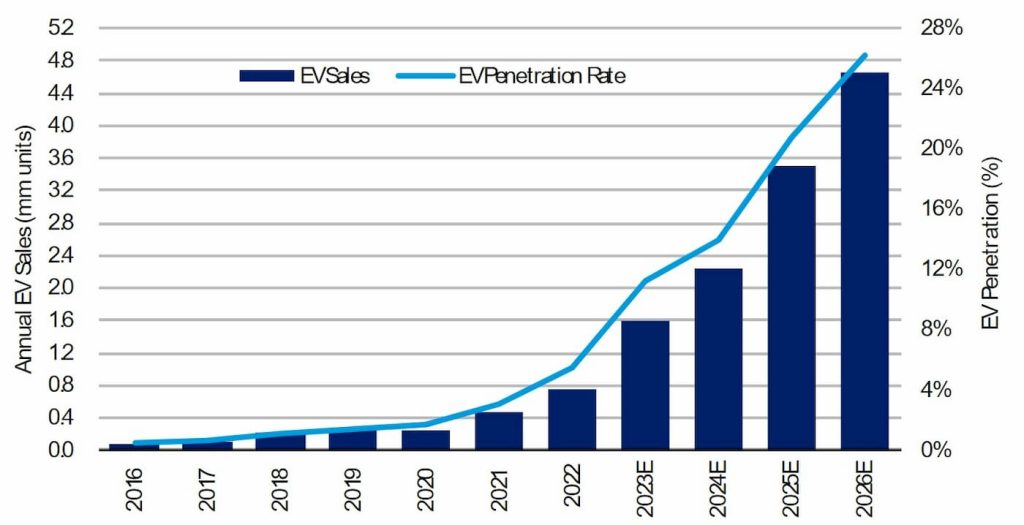

Electric vehicle sales broke another record in the first quarter of 2023, claiming over 7% of the US auto market for the first time, and the trend is only expected to accelerate from here.

The Car Wars analysis points to EVs representing as much as 26% of total US auto sales by 2026, fueled by the Inflation Reduction Act and growing demand for electric vehicles.

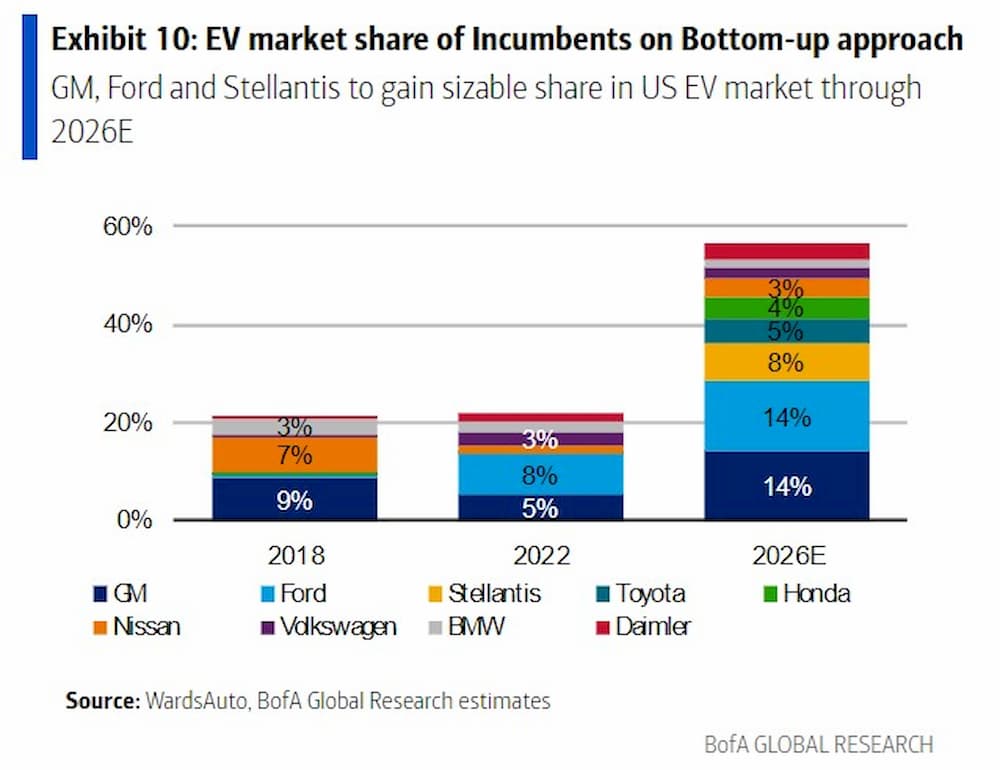

As a result, BofA says that although “Tesla’s dominance in this still nascent market segment may be coming to an end, it will remain an important factor.” The report forecasts Tesla’s market share will fall from a peak of 78% in 2018 to about 18% by the end of 2026.

Tesla will remain the most significant player in the US EV market, but Ford, GM, and Stellantis are projected to be the biggest share gainers.

Ford and GM are both projected to reach 14% EV market share in the US, while Stellantis, which has been slower than its rivals, is expected to hit 8%.

Based on product pipeline forecasts and powertrain offering expectations, the report notes GM, Stellantis, VW, and Hyundai/Kia are pushing the most aggressively into EVs, with several new models.

Detroit’s big three take different approaches

After selling over 20,000 electric cars for the first time in Q1, GM expects a breakout over the next few years with several high-volume launches from the Chevrolet brand, including a Blazer EV, Equinox EV, and Silverado EV.

By 2025, GM expects to be able to produce one million EVs annually with an electric car in 10 segments.

GM’s Cadillac is set to introduce several new EV models after teasing the electric Escalade IQ ahead of its debut on August 9. Meanwhile, GMC and Buick will have their own EV variants (perhaps, something similar to the recently launched Buick E4 electric SUV for China).

Top comment by Anthony Pelchat

BofA is the same company that at this time last year put out a report that they expected Tesla's market share of EVs to drop to 11% by 2025. Now they have moved that to 18% by 2026. Tesla's EV market share in the US will drop. That's expected. However, 11% or 18% that quickly would mean that Tesla doesn't grow while the rest of the market grows massively.

Some numbers though. The US automarket has been down recently. However, it was averaging around 18m vehicles sold each year. 26% EVs means 4.68M EVs sold. 18% for Tesla 842,400. That is only a small increase from the US runrate they are showing for Q1 this year. GM and Ford would be at 655,200 roughly. That's close to Tesla's current runrate for this year in the US. Basically, expect BofA to change their numbers next year to 21% in 2027 for Tesla.

Stellantis has so far been a laggard in the US EV market but plans to catch up by launching nearly as many electric models as GM.

The automaker aims to release 75 EV models with five million in sales by 2030. RAM, under the Stellantis umbrella, is launching its first electric pickup, the 2025 RAM 1500 REV, set to take on Ford’s F-150 Lightning. Jeep is also releasing its first EVs in the US, the Recon and Wagoneer S, later this year.

Ford has taken a different route, focusing on a few high-volume models such as the F-150 Lightning, Mustang Mach-E, and electric Explorer (released in Europe). The American automaker separated into three divisions to funnel cash from its ICE vehicle business to fund its EV strategy.

The report notes Hyundai and Kia have taken a similar approach to Volkswagen (IONIQ 4/5/6/9 vs. ID 3/4/5/6/7). The Japanese automakers, including Toyota, Honda, and Nissan, are on the lower end of the spectrum, reflecting a greater focus on hybrids. Car Wars assumes most other EV OEMs (Rivian, Lucid, Fisker, etc.) will be “moderately successful in commercializing product.”

FTC: We use income earning auto affiliate links. More.

Comments