ZEV manufacturer, Nikola Corporation, shared plans to ask its shareholders for approval to dilute their current holdings in order to add 200 million new shares, which would raise about $1.5 billion based off its closing price on Friday. The startup plans to use the funds to scale production of its Tre BEV trucks and finish building its US manufacturing facility in Coolidge, Arizona.

Nikola Corporation ($NKLA) is an American developer of zero-emission vehicles (ZEVs) that publicly showcased meteoric rise and gravity-induced tumble down the hill of the automotive world.

The EV startup has a well-documented past of overpromising and underdelivering led by former CEO and plaintiff Trevor Milton, who will stand trial for federal fraud charges next month. Nikola Motors has tried its best to move on from its previous controversy after agreeing to a $125 million settlement agreement with the SEC at the end of 2021.

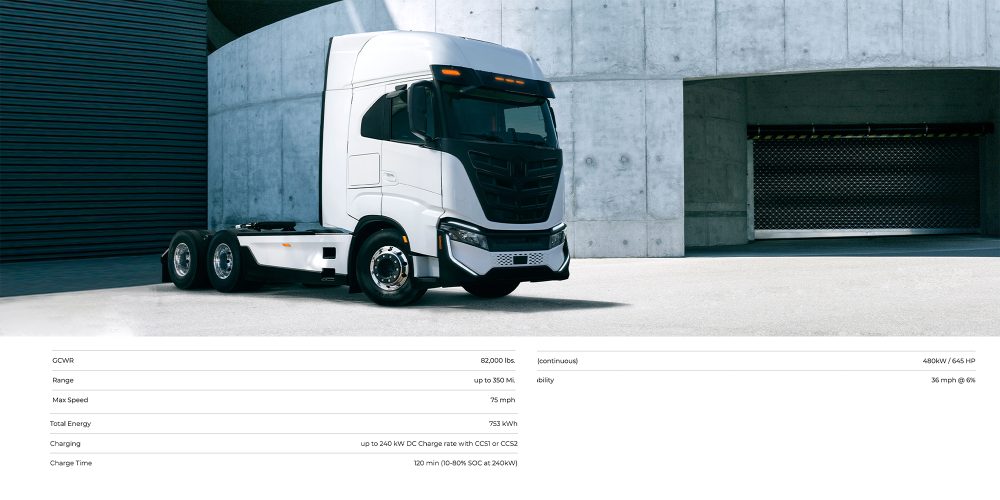

The company also dropped its own lawsuit against Tesla over a patented semi-truck design and has turned its focus toward its Tre BEV trucks, which began first deliveries this past December. Despite a slew of new executives coming in to clean up Milton’s mess, Nikola has continued to struggle for one reason or another.

Last month, we reported that the company’s entire supply chain leadership team had exited and a company-wide hiring freeze was implemented. That being said, Nikola Motors’ letters of intent for Tre trucks and supply agreements with major players like Proterra keep the remaining staff motivated to revitalize a startup that was once valued at $34 billion.

However, to get those Tre BEVs out to customers, Nikola is requesting a further dilution of its common shares.

Nikola execs going all in on future valuation of shares

According to a report from FreightWaves, Nikola Corporation is seeking shareholder approval to add 200M common shares to expedite Tre production and ward off any hostile takeover attempts (although the company stated it is not aware of at threats at this time).

Currently, Nikola is planning to build 300 to 500 Tre BEV trucks this year, beginning in Q2. Nikola currently has a manufacturing joint venture partner in Europe with Iveco. The two share a retooled factory in Ulm, Germany. On US soil, Nikola is still in the process of finishing its $600 million plant in Coolidge, Arizona – another “to-do” Nikola’s prospective proceeds from the new shares will go toward.

During its recent Q4 earnings call, Nikola execs shared that its cash on hand could fall as low as $225 million by the end of 2022. Nikola Corp. CFO Kim Brady spoke during the call:

We plan to make sure we always have adequate liquidity to fund the next 12 months of operations throughout 2022. We will monitor the equity capital markets closely and raise additional capital when appropriate in 2022.

Given the latest news, Nikola’s strategy is to keep raising funds to buy more time to scale Tre production. Five Nikola executives, including Brady and CEO Mark Russell, have agreed to a second year of $1 salaries with no bonuses in exchange for stock grants in 2023.

At the end of 2021, Nikola had roughly 413 million outstanding shares, allowing room to issue over 100 million new shares, even if current shareholders reject the proposed value dilution. However, in a proxy filing with the SEC on Friday, Nikola admitted that getting shareholder authorization would allow it to skip a separate vote later:

The issuance of additional shares of common stock will decrease the relative percentage of equity ownership of our existing stockholders, thereby diluting the voting power of their common stock and, depending on the price at which the additional shares are issued, may also be dilutive to any future earnings per share of our common stock

Shareholders approval is expected to raise $1.5 billion based on Nikola’s Friday’s closing price – more than enough for the $1 billion that Brady anticipates Nikola needs to cover its manufacturing ramp-up. Whether Nikola gets approval for the expansion of shares or not, its clear that is fighting to survive, taking one last swing for the fences to get those Tre trucks sold and manufactured.

FTC: We use income earning auto affiliate links. More.

Comments