US diesel demand plummeted to its lowest seasonal level in 26 years last quarter – but is that due to a down economy, or booming commercial EV sales?

The production of distillate, the petroleum-based fuel that powers trucking, heating, and heavy industry, plunged to 3.67 million barrels per day in March (down from more 4.1 million barrels last year) according to monthly data from the US Energy Information Administration. That figure marks a downward revision from the agency’s previous estimates, and is even lower than the same month in 2020 (3.96 million). But, while less oil is generally good for people and planet, it’s not always good for profits.

“The deteriorating diesel market is a warning signal that broader oil demand growth could be at risk,” according to a quote attributed to Dennis Kissler, senior vice president for trading at BOK Financial Securities, by Transport Topics. “Consumption of the fuel tends to fall as the economy slows, and a slowing economy presages waning demand for other fuels.”

“It’s a function of the slowing of the economies in Asia and the US and how inflation is tightening consumer spending habits,” Kissler said, continuing to spin a decline in oil consumption as a bad thing. “They’re not going out and spending money like they were a year ago.”

Is it really inflation, or is it EVs?

Even in diesel-loving Europe, the diesel engine is dying a quick death. Volvo, for example, recently built its last-ever diesel vehicle, an XC90 (above), and rolled it straight off the assembly line and into a museum.

Volvo’s not alone. Companies like Nissan, Hyundai, and Daimler (parent company of Mercedes-Benz and the Freightliner and Rizon truck brands) have also backed away from developing new internal combustion engines.

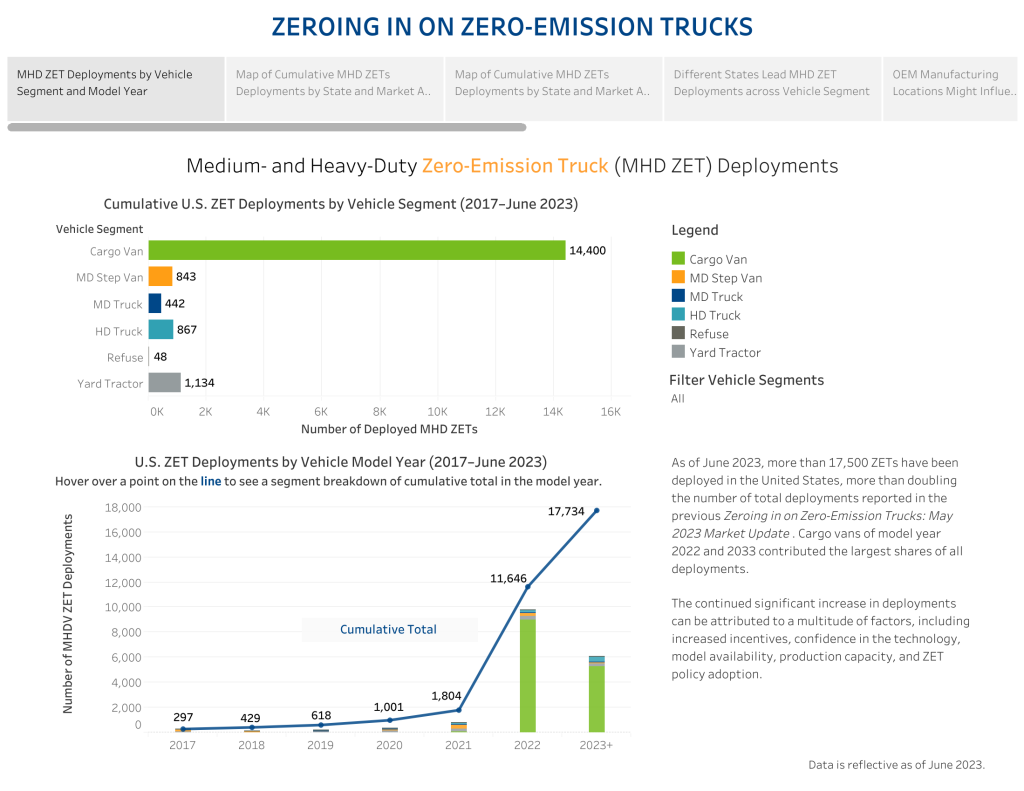

And, while we’re on the topic of Daimler’s truck brands, it’s worth noting that commercial EV sales are soaring. Despite all the doom, gloom, and wishful thinking from the pro-oil/anti-EV crowd, the numbers paint a narrative of swift expansion in the commercial EV and ZEV (Zero-Emission Vehicle) markets, with CALSTART’s latest figures revealing a remarkable 250% growth in the zero-emission heavy truck market.

Those same CALSTART figures, from January of this year, show that the US had seen the deployment of more than 14,000 battery-electric cargo vans in 2023, with a significant surge of 11,835 units deployed in the first half of that year, alone. That is a staggering 461% increase in deployments compared to CALSTART’s previous report – and the electrification of large commercial fleets is a trend that doesn’t seem to be slowing down.

Take a good look at the numbers for HD trucks. The CALSTART graph shows “just” 867 units on the road, sure – but consider some recent news stories that are blowing that number out of the water:

- Sysco takes delivery of 10 Freightliner electric semi trucks, plans to buy 800 more

- Einride orders 150 Peterbilt 579EV electric semi trucks for US fleet

- DHL puts 50 Orange EV yard trucks to work, plans to add 50 more

- Grocery giant Loblaw doubles electric semi fleet, has 25 Tesla Semis on order

- US’ largest private freight carrier adds 12 electric semis to its fleet

- Penske takes delivery of electric Freightliner eCascadia semi trucks

Top comment by ZoomZoom

So exactly how much hydrogen was sold for large vehicle use in 2023/2024?

What percentage of it wasn't just wasted natural gas?

I could keep going, but you get the idea: there are hundreds, if not thousands of electric trucks on the road today that weren’t this time last year – and if you don’t think that’s putting a damper on diesel demand I have a bridge to sell you.

Electrek’s Take

The oil industry knows that we’re past “peak oil,” and demand for diesel is going to continue to drop. Both because trucks are electrifying and switching to hydrogen, and because diesel/ICE models are becoming ever more efficient, using less diesel to move the same amount of Earth and goods. That’s why they’re not pulling the usual demand levers of lowering prices – instead, oil companies seem to be raising prices compared to crude oil and refining costs, giving this writer the sense that they’re trying to grab as much cash as they can while the grabbing’s still good.

That’s my take, anyway. What’s yours? Scroll on down to the comments section at the end of this story and let us know.

SOURCES: Equipment World, Transport Topics; other source links throughout.

FTC: We use income earning auto affiliate links. More.

Comments