Ford is cutting production of the F-150 Lightning amid “slower than expected” demand for the all-electric truck. The move comes just months after Ford pulled back output at its Rouge EV plant in mid-October.

Ford slashes F-150 Lightning production, again

Ford’s F-150 Lightning was the top-selling electric truck last year in the US last year. With over 24,000 EV pickups handed over last year, the Lightning topped Rivian’s R1T.

Despite the growth, Ford is cutting Lightning production (again) as demand slips. Ford announced plans Friday to reduce F-150 Lightning output to “achieve the optimal balance of production, sales growth and profitability.”

Although Ford expects global EV sales growth in 2024, the move comes amid “less than anticipated” demand.

Around 1,400 employees at its Rouge EV plant will be impacted as Ford transitions to one shift. Ford is transferring around 700 to its Michigan Assembly plant while others will be repositioned at other southeast Michigan plants.

Ford said, “The transition could also impact a few dozen employees” at F-150 Lightning components plants.

Meanwhile, the automaker is adding a shift to boost output of its gas-powered Bronco and Raptor pickups. Ford, like Toyota, will rely on a mix of gas-powered, hybrid, and electric vehicle production for “optimizing financial returns.”

The news comes after Ford already cut production at its Rouge EV plant in mid-October. Ford spokesperson Martin Gunsberg confirmed to Electrek that the facility has been running with three crews working two shifts. It will now go down to one crew working one shift. The changes go into effect April 1, 2024.

Ford pushed back its 600,000 EV run rate goal last year, with CEO Jim Farley explaining, “The near-term pace of EV adoption will be slower than expected.” The automaker is delaying around $12 billion in EV spending.

Farley explained the production cut is to take “advantage of our manufacturing flexibility to offer customers choices while balancing our growth and profitability.”

Ford sees EV adoption as core to its strategy. Farley said the company still sees “a bright future” with EVs for specific consumers. He added, “Especially with our upcoming digitally advanced EVs and access to Tesla’s charging network beginning this quarter.”

Gunsberg told Electrek last month that Ford is “making adjustments to pricing, production, and trim packages” for the 2024 Lightning.

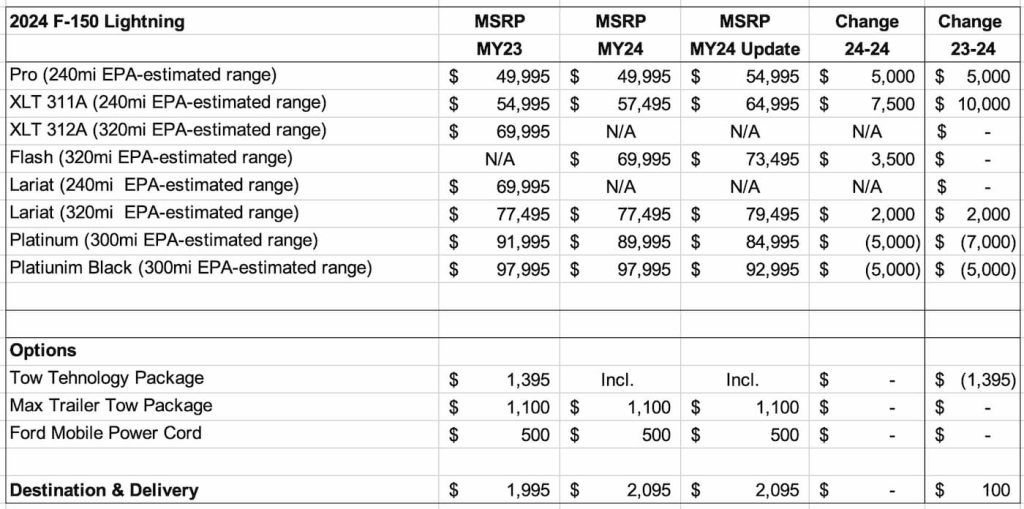

2024 Ford F-150 Lightning prices start at $54,995, $5K more than the 2023MY. The base Pro trim features up to 240 miles range. Prices for other trims, except the Platinum, increased between $2K (Lariat 320 mile range) and $7,500 (XLT 240 mile range).

Ford also added a new Flash trim to the 2024 lineup. The 2024 Ford F-150 Lightning Flash includes up to 320 miles range, a loaded tech interior, a heat pump, Ford’s Tow Tech package, and a Power Trailgate. The new model starts at $73,495.

Electrek’s Take

Despite Ford claiming EV adoption is slowing, a record 1.2 million EVs were handed over in the US last year.

New Kelley Blue Book data shows EVs accounted for 7.6% of total US auto sales last year. That’s up from 5.9% in 2022 and 3.1% in 2021.

Top comment by Ben

It still feels like Ford and GM are expecting EVs to be fill the high end of their vehicle lineups, full of high tech gadgets and fancy trims. Consumers for that are gone. The remaining consumers see a $40k truck being sold for $60k and they're right.

Ford should focus on developing EVs that make sense for people without tax incentives.

I still don't drive an EV but I won't buy another ICE car or truck. But I'm happy to wait.

EV adoption is expected to continue climbing in the US and globally. KBB expects EV share in the US to reach 10% this year, another record. The growth will come with new EVs and incentives.

Tesla is still dominating the market as the Model Y accounted for one in every three EVs (394,497) sold in the US last year alone. The Model 3 was second, with nearly 221,000 units handed over.

While Ford is taking its foot off the gas, rivals like Hyundai and Volvo look to take advantage. Volvo CEO Jim Rowan said he expects “tremendous growth” in the segment with new models like the EX30, starting at $35,000, hitting the market this year.

In November, Hyundai’s global president, Jose Munoz, told Reuters, “Based on what I see, I need more. If I had more capacity today, I could sell more cars.” The South Korean automaker has stood by its stance after EV sales doubled last year.

FTC: We use income earning auto affiliate links. More.

Comments