Japan is wondering how Chinese EV makers, like BYD, build electric cars so cheaply. After tearing apart BYD’s Atto 3, an all-electric SUV, attendees at an EV seminar in Japan asked, “How can it be produced at such a low cost?”

The Atto 3 was BYD’s first EV to launch in Japan in January 2023. BYD’s electric SUV starts at around $30,000 (4.4 million yen).

Since then, BYD has added two of its best-selling EVs to its lineup in Japan, the Dolphin and Seal, starting at $24,500 (3.63 million yen) and $33,000 (5.28 million yen), respectively.

After launching the Seal, widely seen as BYD’s answer to the Tesla Model, in late June, BYD’s electric sedan was already the top-selling imported EV by August. Now, Japan is studying how BYD and other Chinese EV makers produce vehicles at such a low cost.

The Central Japan Economic and Trade Bureau held a seminar earlier this month (via Nikkei) to explore the trends in battery electric vehicles (BEVs).

Around 70 auto parts companies from Japan attended the event, where over 90,000 parts from 16 foreign electric vehicles were on display.

BYD Atto 3 EV teardown shocks Japan

The Atto 3, NIO’s ET5, and Tesla’s Model Y were showcased, but BYD’s electric SUV stole the show. Attendees asked, “How can it be produced at such a low cost?”

Like many of its vehicles, BYD’s Atto 3 starts at under $20,000 (140,000 yuan) in China. Its cheapest EV, the Seagull, starts at under $10,000 (69,800 yuan) in its home market. BYD is able to offer vehicles at such a low cost because it makes most of its components in-house.

Starting as a battery maker, BYD has an advantage over the competition. According to data from CnEVPost, BYD is the world’s second-largest EV battery maker. Through the first nine months of 2024, BYD held a 16.4% share of the global EV battery market, second to China’s CATL with 37.1%.

An EV battery can account for over a third of total vehicle costs, but BYD still makes nearly all vehicle components in-house.

An advantage over rivals

For example, except for the windows and tires, BYD builds all Dolphin components. In Japan, the Dolphin rivals Toyota’s top-selling Prius and the Nissan LEAF.

BYD also integrates parts, like its 8-in-1 E-Axle, which includes the motor, inverter, and reducer to reduce costs.

Sho Kato, department head of Nissin Seiki, who attended the event, said, “I was surprised at the small number of parts used by BYD and Tesla. Kato added, “Our company also hopes to use the experience gained from our existing business to enter the EV field.”

The EV display center opened in March 2022 and has attracted over 450 companies so far. New models, including Hyundai’s IONIQ 6, will be added by the end of October.

Top comment by JD

It's almost 2025... is this the first teardown they've done of a Chinese competitor? "Surprised at the small number of parts used"... surprised that they "integrate parts, like its 8-in-1 E-Axle, which includes the motor, inverter, and reducer to reduce costs"...? Japan used to the be the king of engineering simplicity (as well as its associated cost benefits)... so it's worrying (and perplexing) regarding the head-scratching over competitors' electric vehicles. Labor and subsidies affecting pricing is one thing - but surprised by the construction and parts?...

Meanwhile, Japanese automakers like Toyota, have been some of the slowest to transition to all-electric vehicles.

Of the nearly 6.6 million vehicles Toyota sold through the first eight months of 2024, only 97,058 were all-electric, or less than 1.5%.

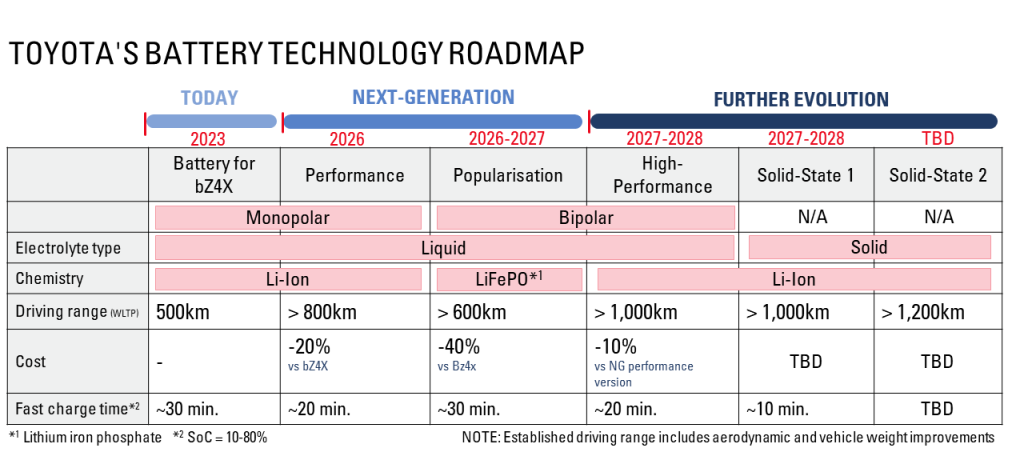

Despite this, Toyota is promising that new tech, such as advanced new batteries and next-gen EV models, will accelerate the transition.

After dominating in China, BYD is eyeing overseas markets like Japan to drive growth. For the first time, BYD sold more vehicles than Nissan and Honda in the second quarter. Since then, BYD has continued building momentum, with its fourth consecutive record sales month in September.

FTC: We use income earning auto affiliate links. More.

Comments