Amid intensifying competition in the EV market, Lucid Motors is drastically reducing prices on its Lucid Air electric sedans with some models over $12,000 off.

2023 Lucid Air electric sedan price and lease incentives

Lucid announced the price cuts across its social media pages on Saturday, slashing Air EV prices by up to $12,400.

The EV maker calls it the “Pure Summer Event” with special lease and financing deals on the 2023 Lucid Air Pure AWD and available Touring and Grand Touring models through August 31.

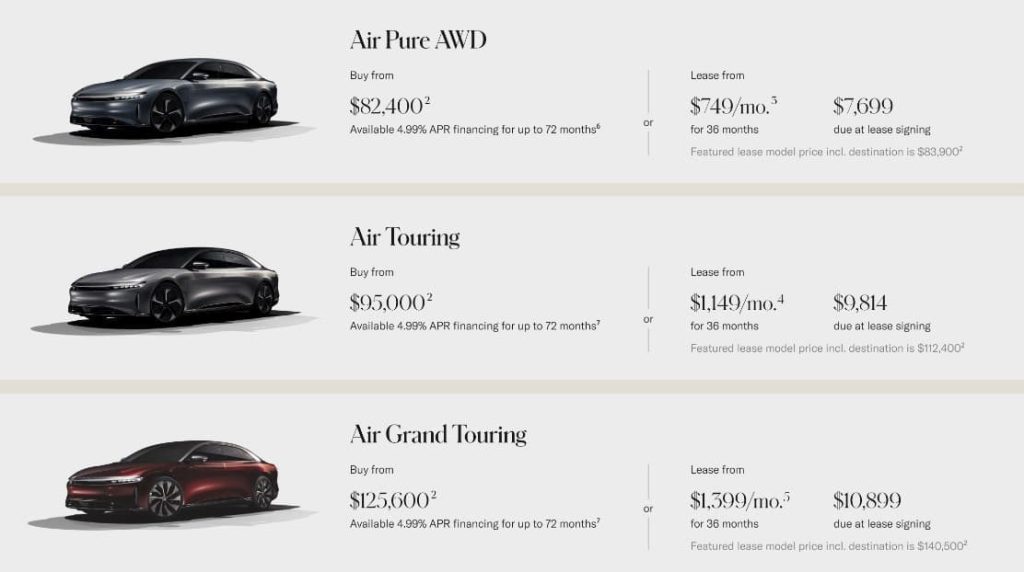

Buyers can save $5,000 with Lucid listing the Air Pure AWD at $82,400, down from $87,400, and available 4.99% APR financing for up to 72 months.

Lucid is also offering Air Pure AWD leases from $749 per month (36 months) with $7,699 due at signing ($83,900 lease model price including destination).

The Air Touring is available for $95,000 (available 4.99% APR financing for up to 72 months) or $1,149 per month lease (36 months) with $9,814 due at signing (lease model price incl. destination is $112,400).

Meanwhile, available Air Grand Touring models are on sale for $125,600 or $1,399 per month lease with $10,899 due at signing ($140,000 lease model price). Both the Touring and Grand Touring are $12,400 off.

The move comes as Lucid’s deliveries have fallen for the past two quarters. Coming off its strongest quarter in Q4 2022, delivering 1,932 EVs, Lucid’s deliveries fell to 1,406 in the first quarter and 1,404 in Q2.

Tesla’s Model S and Plaid models, direct rivals to the Lucid Air, now start at $88,490 and $108,490, compared to over $104K and nearly $136K at the beginning of the year.

Despite gradually increasing models over the past several years, Tesla has implemented significant price cuts of its own all year, with some models over 20% off.

The price cuts created a ripple effect across the US electric vehicle market with several automakers, including Ford, Hyundai, Kia, and more.

Lucid will report its second-quarter earnings Monday after the market close, with investors watching the EV maker’s losses and cash burn closely. Analysts are expecting widening losses (0.34 loss per share vs 0.33 in Q2 2022) and slight revenue growth over the first quarter ($181M).

The EV maker announced it had began material shipments to Saudi Arabia last month. Meanwhile, Lucid raised around $3 billion through a public stock sale in June, with over $1.8 coming from its largest sharehgolder, Saudi’s Public Investment Fund (PIF).

If you’re ready to take advantage of Lucid’s latest price cuts, you can use our link to reach out today.

FTC: We use income earning auto affiliate links. More.

Comments