The US DC fast charging industry slowdown never showed up in 2025. In fact, according to Paren’s new “US EV Fast Charging” state of the industry report, fast charging networks set records last year, with infrastructure buildout and charging demand both jumping about 30% year-over-year.

Fast‑charging buildout accelerated

US fast‑charging networks added more than 18,000 new DC fast‑charging ports in 2025. That follows about 14,000 new ports added in 2024, meaning deployment actually sped up, even as the broader EV market narrative grew more cautious.

Paren notes that deployment is increasingly shifting toward larger, higher‑capacity stations designed for higher throughput and more consistent utilization, rather than small, sparse sites.

The biggest surprise came at the end of the year. Q4 2025 shattered all prior deployment records, with operators rolling out 5,769 new DCFC ports – 44% more than in Q4 2024.

Growth blew past expectations

That pace exceeded Paren’s own forecasts. In its Q2 2025 outlook, the firm projected 16,700 new DCFC ports for the year. Instead, the market overshot that estimate by a wide margin.

Paren says it underestimated two key trends: how many ports are now being installed at new stations, and how quickly several networks scaled.

Tesla outperformed predictions by about 13%, continuing to expand its Supercharger network at a rapid clip. But the real surprise came from newer and expanding players. Mercedes‑Benz HPC exceeded Paren’s forecast by 193%, while Ionna came in 48% above expectations, and Red‑E exceeded estimates by 43%. Several smaller charge point operators also beat projections, collectively pushing 2025 to a new high.

Paren says momentum is increasingly being driven by private operators without federal stimulus, which stands in sharp contrast to the “EV slowdown” narrative that dominated much of 2025.

Supply growth is tracking real demand

Rapid expansion hasn’t led to empty chargers. Nationwide utilization rates remained stable in 2025, suggesting that new supply is largely demand‑led rather than speculative.

Paren points to several drivers behind that demand: growing driver confidence in public charging, the rise of ride‑share and commercial EV use, and a growing group of drivers who can’t easily charge at home.

While infrastructure is still slightly ahead of demand, utilization levels are now high enough to support charging‑provider economics and continued private‑led expansion, the report finds.

That demand showed up clearly in usage data. US fast‑charging networks delivered an estimated 141 million charging sessions in 2025, a record and a roughly 30% year-over-year increase.

In other words, higher EV adoption translated directly into more charging sessions, not idle assets.

Tesla led, but the market widened

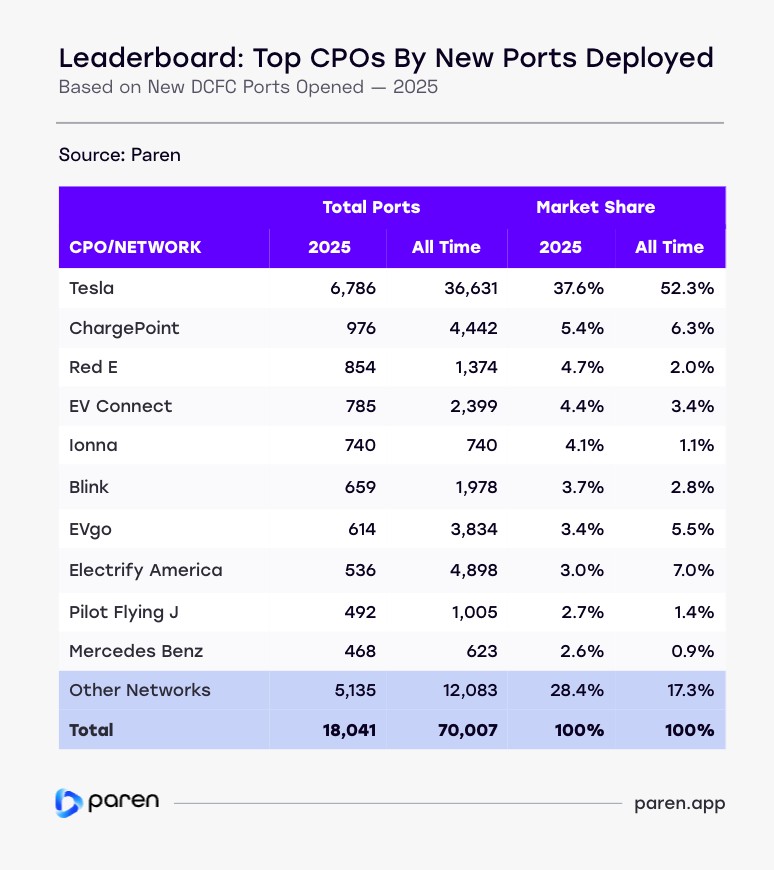

Tesla remained the dominant public fast‑charging operator in 2025, adding 6,786 Supercharger ports, more than the next nine operators combined, which added 6,126 ports.

Yet Tesla’s share of new deployments fell to 37.6% as total market growth outpaced any single company’s ability to scale.

At the same time, the US fast‑charging ecosystem continued to broaden. Paren counted more than 120 network or charge point operators active in the market in 2025.

One striking detail: the long tail of operators grouped under “Other Networks” nearly doubled the number of ports they deployed compared to 2024. While some consolidation and market exits occurred, new entrants more than offset those losses.

Paren expects that trend to continue, especially as programs like Tesla’s Supercharger for Business bring more regional and site‑specific players into the fast‑charging market.

A new era for fast charging

Paren says the surge in new ports reflects a mix of charging strategies aimed at different types of drivers, including regional operators, OEM‑backed networks, co‑located charging at retail and travel centers, fleet‑focused deployments, and networks built specifically around urban or highway travel needs.

Looking ahead, new operators are still expected to enter the market, but consolidation is coming too. As the industry matures, underperforming or aging sites are increasingly being ripped out and replaced with newer hardware and software, sometimes under new operators.

The takeaway: 2025 marked a shift. The US fast‑charging industry is moving away from a pure race to scale and toward greater focus on execution quality, asset efficiency, and sustained utilization.

Read more: Wawa now has its own self-branded Tesla Superchargers

If you’re looking to replace your old HVAC equipment, it’s always a good idea to get quotes from a few installers. To make sure you’re finding a trusted, reliable HVAC installer near you that offers competitive pricing on heat pumps, check out EnergySage. EnergySage is a free service that makes it easy for you to get a heat pump. They have pre-vetted heat pump installers competing for your business, ensuring you get high quality solutions. Plus, it’s free to use!

Your personalized heat pump quotes are easy to compare online and you’ll get access to unbiased Energy Advisors to help you every step of the way. Get started here. – *ad

FTC: We use income earning auto affiliate links. More.

Comments