Mercedes-Benz joins a growing list of EU-based automakers publishing their Q1 2024 financial reports today, and the German brand is relaying a similar story of staggering profits.

Mercedes-Benz remains one of the most well-known automakers out of Germany and one of the leaders in luxury vehicles. As an automaker committed to electrification, we’ve seen Mercedes continue to expand its EQ line of BEVs, which now includes a revamped EQS sedan for 2025 (seen above).

The automaker also recently revealed the “G580 with EQ technology” – an all-electric version of the famed G Class, complete with four motors and the ability to complete tank turns (although it seems to have sacrificed Mercedes’ dedication to aerodynamics to stay true to the combustion-clad design that preceded it).

As you’ll see below, EV sales continue to grow in Mercedes-Benz’s portfolio (although there’s a slight catch). Still, the automaker’s Q1 2024 report shows a slight revenue drop and an even more significant gap in other notable categories.

Mercedes’ Q1 2024 numbers detail steady cash flow

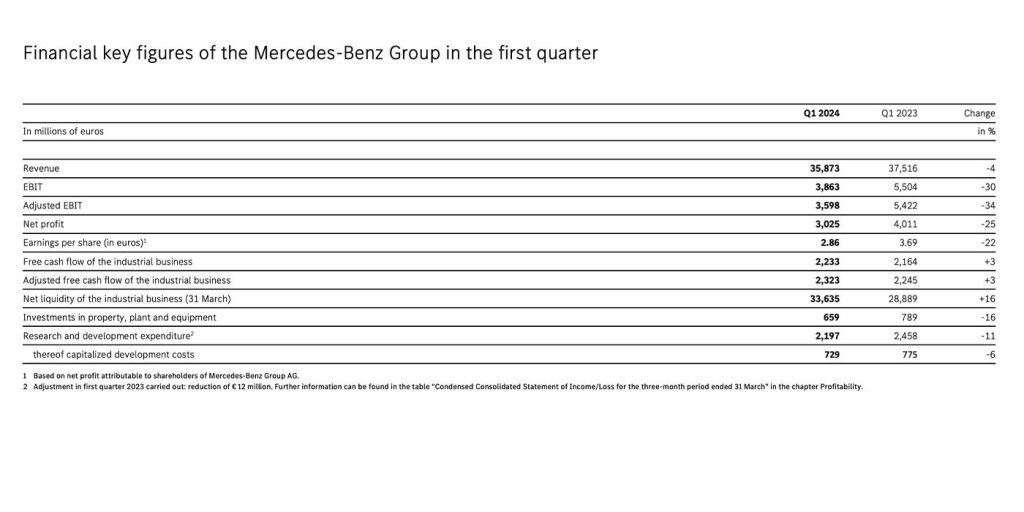

Mercedes-Benz shared multiple detailed reports for Q1 2024 today. Revenues are down, but plenty of other metrics support the German automaker’s confidence that it can maintain its financial outlook for the year.

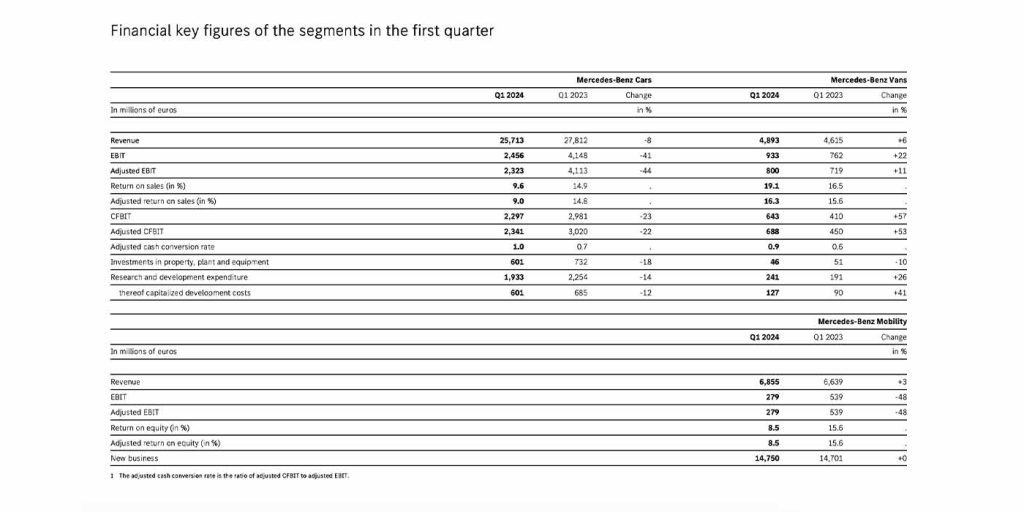

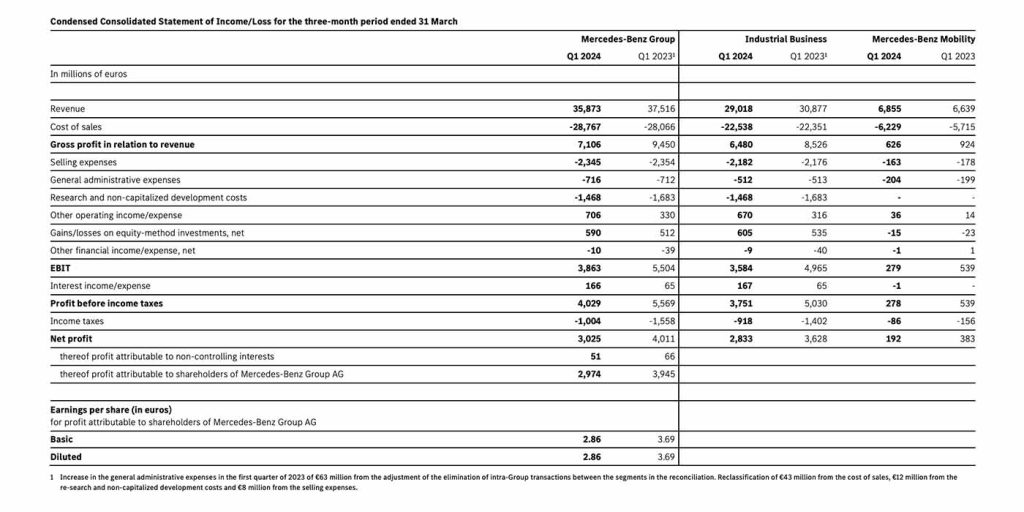

One of the most notable numbers is Mercedes’ €3.86 billion ($4.18 billion) in earnings before interest and tax (EBIT) in Q1 2024. That number saw a 30% drop compared to Q1 2023 (€5.5 billion). Mercedes-Benz Cars’ EBIT was also down, reporting €2.5 billion compared to €4.1 billion in Q1 2023. Those earnings contributed to an adjusted Return on Sales of 9.0% (down from 14.8% in Q1 2023)

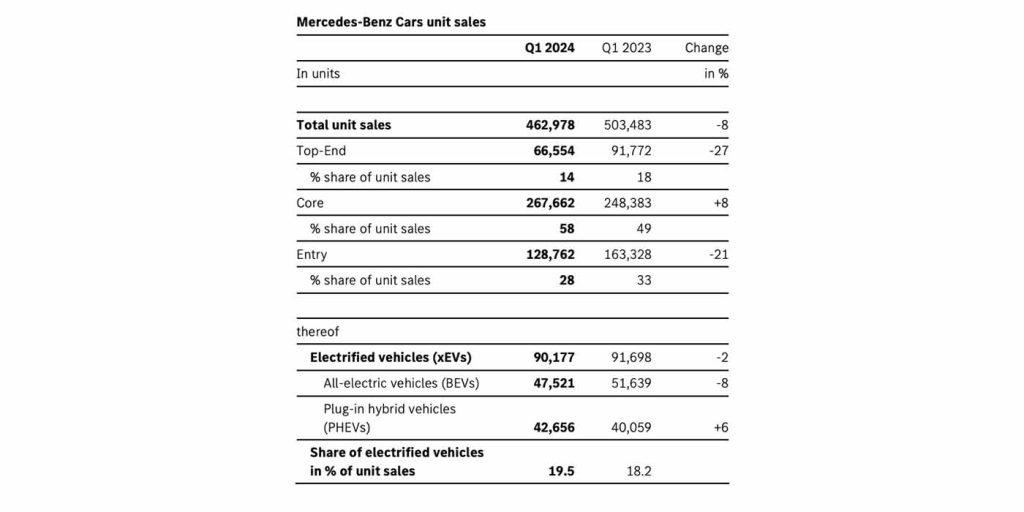

The German automaker cited a temporary decline in volumes and model transitions in its Top-End segment, as well as higher lifecycle management costs to ” keep products at the cutting edge” as the reasoning behind the declining percentages.

Despite negative YOY earnings, Mercedes remains quite liquid on the wings of bolstered free cash flow. Per the release:

The Free Cash Flow from the Industrial Business in the first quarter reached €2.23 billion (Q1 2023: €2.16 billion), supported by an adjusted Cash Conversion rate of 1.0 at Mercedes-Benz Cars. The Net Liquidity from the Industrial Business rose by 6% to a strong and very comfortable level of €33.6 billion (end of 2023: €31.7 billion). This included a share buyback of approximately €300 million in the first quarter. The Group’s investments in property, plant and equipment in the first quarter totaled €0.7 billion (Q1 2023: €0.8 billion). Research and development expenditure fell to €2.2 billion (Q1 2023: €2.5 billion).

Mercedes stated that pricing remained high in Q1 2024, and the automaker has no intention of engaging in any discount wars to stay competitive in the market. Instead, it expects its top-end models to lead sales and help it reach its financial goals for the year as targeted.

Speaking of sales, both BEV and PHEV numbers were down year over year (-2% and -8%, respectively). However, the overall share of EV sales in Mercedes’ portfolio was up in Q1 2024 – 19.5% compared to 18.2% a year ago. Still, it’s important to note that PHEV sales led to those boosted sales percentages, not BEVs.

Looking ahead, Mercedes-Benz believes it can remain competitive in its given segments without folding on price cuts. Per Member of the Board of Management of Mercedes-Benz Group AG, Finance & Controlling/Mercedes-Benz Mobility, Harald Wilhelm:

Mercedes-Benz delivered a solid Free Cash Flow in the first quarter thanks to our disciplined go-to-market approach, our desirable products and despite the volatile economic environment and external challenges. While we remain vigilant about the global macroeconomic and geopolitical outlook, we confirm our full-year financial targets for 2024.

FTC: We use income earning auto affiliate links. More.

Comments