Amid a shifting strategy, Ford (F) reported first-quarter earnings Wednesday, beating analyst expectations. However, due to fierce pricing pressure, Ford’s EV revenue fell 84% in Q1 2024.

Ford shifts EV strategy amid sales upswing

Despite EV sales surging 86% to 20,233 in the first three months of 2024, Ford is pulling back. All Ford electric models saw double (or triple) digit sales growth.

The F-150 Lightning remained the top-selling electric pickup in the US, with 7,743 models sold, up 80% over last year. Ford’s Mustang Mach-E was the second best-selling electric SUV in the US, with 9,589 vehicles delivered, up 77% over Q1 2023.

Meanwhile, Ford’s commercial Pro unit continues to appear as a dark horse for the automaker, with EV adoption rising 40%. Ford E-Transit sales were up 148% in Q1, with 2,891 units sold.

Ford’s growth propelled it to second in the US EV market (if you don’t include combined Hyundai and Kia sales).

The sales surge comes after Ford introduced significant price cuts and savings on the Mach-E and Lightning earlier this year.

Despite rising EV sales, Ford announced it is pushing back EV production at its BlueOval City facility to 2026. It is also delaying the launch of its three-row electric SUV to focus on smaller, more affordable EVs.

In the meantime, Ford said it would introduce more hybrids to the mix as it develops its next-gen electric models.

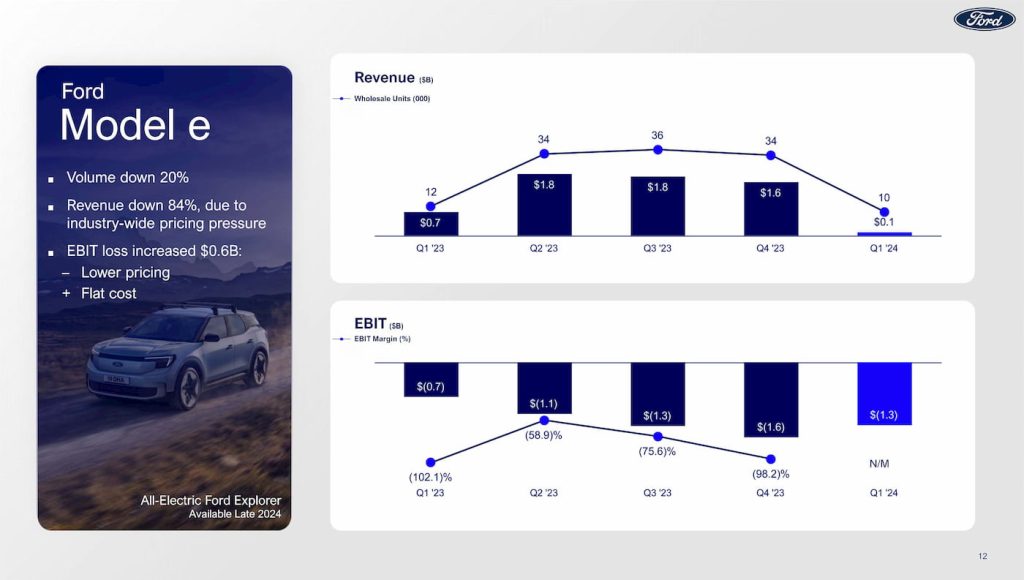

Ford’s Model e EV unit had a net loss of around $4.7 billion last year with “extremely competitive pricing” and new investments. Meanwhile, EBIT loss slipped to $1.6 billion in Q4.

Analysts expect Ford to report $40.10 billion in revenue in its Q1 2024 earnings report. Ford’s Model e, EV unit, is expected to generate around $24.5 billion in revenue with an EBIT loss of $1.65.

Ford Q1 2024 earnings results

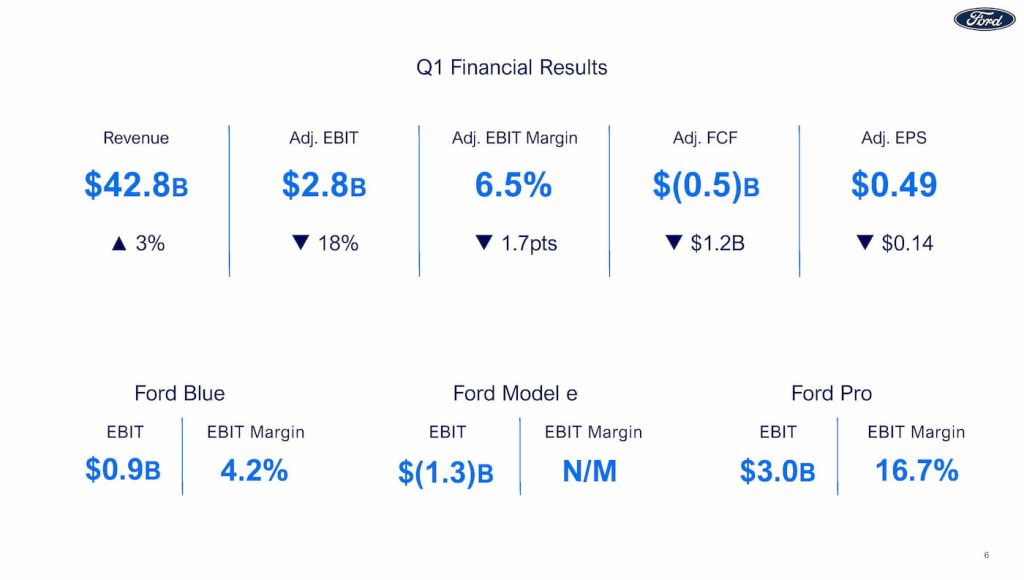

Ford reported first-quarter 2024 revenue rose 3% to $42.8 billion, topping estimates of around $40.10 billion. Ford also topped adjusted EPS estimates with $0.49 per share in Q1 vs $0.42 expected.

The automaker posted net income of $1.3 billion, down from $1.8 billion last year. Adjusted EBIT fell 18% to $2.8 billion due to lower prices and the timing of the F-150 launch.

Ford Blue, the company’s ICE business, saw revenue fall 13%, again due to the new F-150 launch.

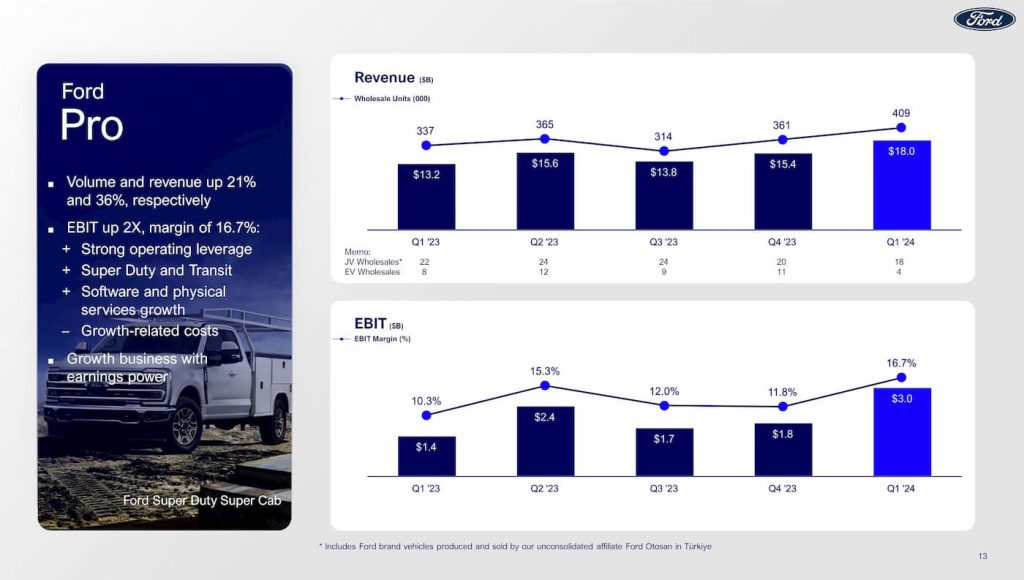

Ford Pro was the growth driver, with volume and revenue up 21% and 36%, respectively. The commercial and software business had an EBIT margin of nearly 17%, with first-quarter revenue of $18 billion.

Meanwhile, Ford Model e revenue slipped 84% due to “industry-wide” pricing pressure. With lower prices, the unit’s EBIT loss increased YOY to $1.3 billion. That’s an over $100,000 loss for every EV sold in Q1. However, this is still down from the $1.6 billion EBIT loss in Q4 2023.

Top comment by Pete Za

In the meantime, Ford said it would introduce more hybrids to the mix as it develops its next-gen electric models.

Yep, it makes perfect sense to build a more complicated vehicle that requires more parts to lower costs and raise revenue. 🙄

Ford expects EV costs to improve going forward, but it will be offset by top-line pressure.

The automaker is maintaining full-year EBIT guidance, expecting to hit the higher end of the $10 billion to $12 billion range. The company now expects to generate between $6.5 billion and $7.5 billion in adjusted free cash flow, up from the previous $6 billion to $7 billion.

According to Ford, the updates reflect recent cost-cutting actions, like the delayed EV investments. Ford’s update comes after rival GM also raised full-year guidance this week.

Meanwhile, Ford is releasing a new brand campaign called “Freedom of Choice” to promote its gas, hybrid, and EV lineup amid the strategy shift.

FTC: We use income earning auto affiliate links. More.

Comments