EV maker Rivian’s (RIVN) Q1 EV deliveries were about flat from the fourth quarter as preparations began at its Normal, IL plant to cut costs. Despite deliveries falling slightly from Q4, Rivian beat Wall Street’s expectations and confirmed full-year production guidance.

Rivian’s Q1 2024 EV deliveries and production results

Rivian announced first-quarter 2024 production and delivery numbers Tuesday as the EV startup prepares to cut costs at its manufacturing plant.

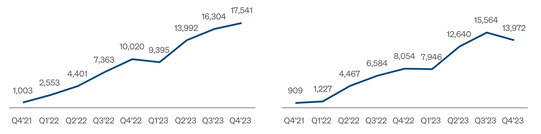

The company produced 13,980 EVs, down from 17,541 in Q4. Rivian delivered 13,588 vehicles during the quarter, down slightly from the 13,972 handed over last quarter.

Although production fell QoQ, Rivian still beat Wall St expectations of around 13,800 and its prior guidance of 13,500. The EV maker also beat delivery estimates of around 13,000 for the quarter.

Rivian expected deliveries to be about 10% to 15% lower than Q4. Yet deliveries only fell 3% in Q1.

Rivian announced plans to shut down both consumer and commercial lines during Q2 at its Normal EV plant to introduce new tech and manufacturing practices to cut costs. The company lost around $43,372 for every vehicle it built in Q4.

Although $43K is still a significant loss, it’s down from the +$124K loss per vehicle in Q4 2022. Rivian, like many startups, is managing higher interest rates and inflation.

| Q3 ’22 | Q4 ’22 | Q1 ’23 | Q2 ’23 | Q3 ’23 | Q4 ’23 | |

| Rivian loss per vehicle | $139,277 | $124,162 | $67,329 | $32,594 | $30,500 | $43,372 |

As a result, Rivian announced it was cutting 10% of its salaried workforce in February. CEO RJ Scaringe said the move was to maximize the brand’s ability to make an impact and expand.

Rivian ended the quarter with $9.37 billion in cash and equivalents. The company revealed its smaller, more affordable R2 last month, which will start at around $45,000.

To accelerate its launch, Rivian is pushing back construction at its $5B facility in Georgia to launch production in Normal.

Rivian said the move will save $2.25B, enough to fund the company through the start of R2 production. The R2 will make its way overseas as Rivian expands into new markets.

Top comment by Ryan Ballantyne

I signed up for an R2 reservation on day one; that car looks fantastic. I am not entirely sure how they plan to turn a profit on it when they are losing nearly the entire purchase price of an R2 on every R1 sold, but assuming they can get it sorted, it should be their Model 3 moment that propels the company to profitability.

Scaringe announce the R2 received over 68,000 reservations in under 24 hours. Rivian also shook the internet after revealing the even more compact and affordable R3 and R3X.

Due to the plant shutdown, Rivian expects production to remain flat this year at around 57,000. The company reaffirmed its guidance Tuesday.

After releasing Q1 deliveries and production results, Rivian’s stock is down over 4% on Tuesday. Rivian shares are trading just ahead of their all-time lows at around $11. That’s down over 65% from this time last year.

Rivian will release its first quarter financial results on May 7th, 2024 after the market close. Check back for more on the EV maker’s financial situation.

FTC: We use income earning auto affiliate links. More.

Comments