China’s leading EV maker, BYD, just hit another major milestone. The BYD Yuan family surpassed 1 million in sales this week, becoming its latest brand to cross the threshold.

BYD Yuan family tops 1 million in sales

BYD has been on a roll as it expands the brand into new territory. Its latest accomplishment comes as another one of its family of brands hit the 1 million sales mark.

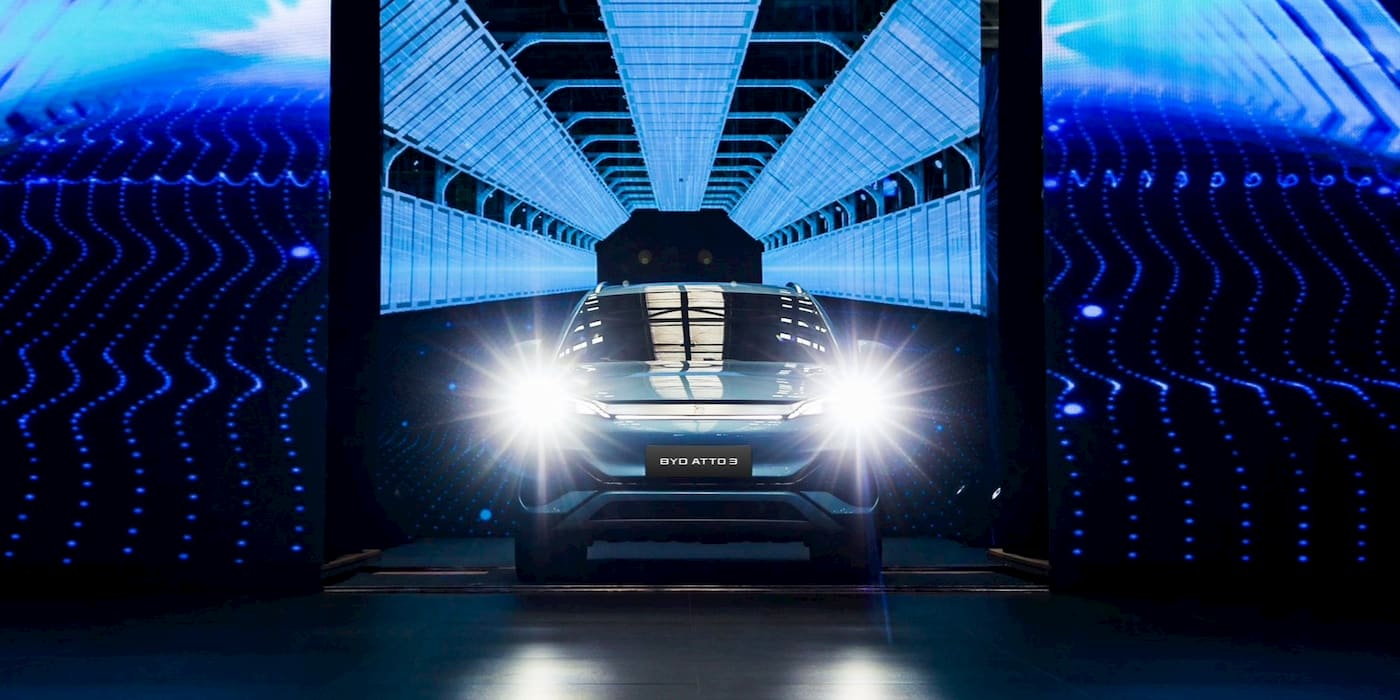

The Yuan brand topped 1 million in sales, BYD announced Thursday. BYD’s Yuan family consists of the Yuan Plus, Yuan Up, and Yuan Pro SUVs. After launching in February 2022, the Yuan Plus (known as the Atto 3 overseas) is the first electric SUV underpinned by BYD’s e-platform 3.0 for EVs.

With starting prices under $16,500 (119,800 yuan) in China, BYD’s electric SUV competes with other top-selling models like the Tesla Model Y and Volkswagen ID.4.

As the first EV built for overseas markets, BYD’s Yuan Plus (Atto 3) has quickly become a best-seller in key markets like Europe, Australia, Thailand, Brazil, Mexico, and others. In September, the 500,000th Yuan Plus rolled off BYD’s assembly line.

The Yuan Up went on sale in March 2024, starting at under $13,400 (96,800 yuan), while the Yuan Pro, which hit the market last May, is priced at $13,200 (95,800 yuan).

BYD’s Yuan is its latest series to hit the 1 million sales market following the Song and Qin brands.

With over 428,500 models sold last year, Yuan is one of BYD’s best-selling brands, accounting for 14% of 2023 sales. Through the first five months of 2024, BYD has sold nearly 135,000 Yuan models or roughly 10.5% of total sales.

After applying for an emissions and noise certification with the South Korean environment ministry this month, BYD is expected to launch the low-cost Atto 3 (Yuan Plus) on Hyundai and Kia’s home turf, where the domestic automakers dominate the market.

Hyundai and Kia’s share fell 3.5% last year to 76.6% as new EVs like Tesla’s China-made Model Y gain momentum.

Source: CnEVPost, BYD

FTC: We use income earning auto affiliate links. More.

Comments