Nikola Corporation has posted its Q1 2024 financial report ahead of a call with investors this morning, and the numbers detail a commercial vehicle developer growing amid setbacks that arose last year. Today’s update mainly focuses on hydrogen as Nikola looks to execute deliveries while making good on issues with its BEV trucks.

It’s been an eventful twelve months for Nikola Corporation ($NKLA). During its Q1 2023 financial report, the American commercial vehicle manufacturer hinted at a weaning down of staff and company spending to optimize hydrogen and BEV truck production.

By Q2 2023, however, Nikola was presented with a significant issue as the Romeo Power battery packs in its BEV trucks started catching fire. The fire was not an isolated incident either; it warranted an investigation from the local fire department amid multiple fires, eventually leading to the automaker’s fourth CEO stepping down while Nikola’s stock tanked.

Nikola had to recall all 209 BEV trucks in operation while it simultaneously worked to expand its lineup of hydrogen trucks. That process is going much more smoothly as Nikola delivered its first HFCEV this past February.

As such, much of Nikola’s Q1 2024 financial report mostly focuses on the progress of its hydrogen fuel cell technology, although there is an update to the BEV recall.

Nikola stresses ‘execution’ amid lower Q1 2024 numbers

Based on the development hurdles mentioned above, it should come as little surprise that Nikola Corporation’s Q1 2024 report details a drop in production and revenue. The automaker wholesaler 40 FCEVs to end fleets in the first three months of the year and delivered each one.

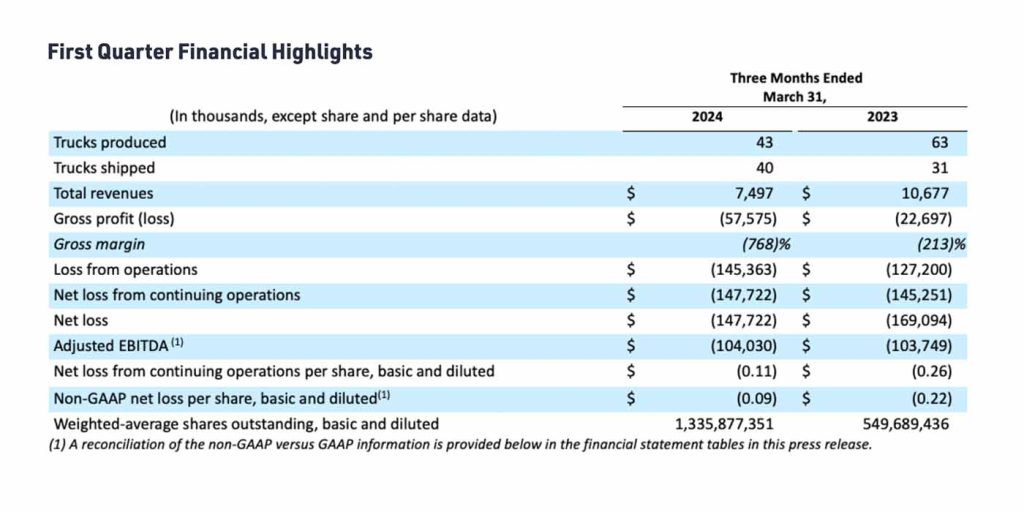

Now, through two-quarters of hydrogen truck production, Nikola has sold 75 Tre FCEVs to date. Nikola trucks produced in Q1 2024 (43) are down compared to Q1 2023 (63), but the 40 deliveries are an Improvement, up from 31 trucks year-over-year. Revenue was down in Q1 at $7.5 million compared to $10.7 million in Q1 2023, and adjusted EBITDA was slightly up ($104 million in Q1 2024 compared to $103.7 million a year ago). See below:

Nikola’s focus on hydrogen FCEV deliveries is met by positive growth in the infrastructure to support it, as the company’s HYLA arm is not only on track in its “Hydrogen Highway Plan” but ahead of schedule. The automaker has previously committed to nine additional HYLA refueling stations in California by the end of 2024 but is now expecting to hit that milestone by mid-year and aiming to put 14 hydrogen refueling stations into operation by the end of the year. Nikola president and CEO Steve Girsky spoke:

We continue to move forward rapidly and execute our plans. And please keep that in mind – we are in the execution phase, not the planning or concepting phase. Last quarter, I talked about getting on the field with the first deliveries of our hydrogen fuel cell electric trucks. Today, we are executing plays, competing, and cultivating more green shoots as we expand upon current markets and enter new ones.

As for the Tre BEV trucks, Nikola appears to have put out the fires (literally and figuratively) and has begun reintroducing the trucks into the market. Nikola shared that it has completed the first delivery of its revamped “Tre 2.0” BEV in Q1 2024 and will continue to prioritize returning those trucks to customers and dealers throughout 2024. The automaker is admittedly not out of the woods yet, however. Per the release:

Our ability to sell Nikola’s on-hand inventory, however, will be dependent upon future battery supply; we now expect to opportunistically sell on-hand inventory for revenue in 2025. We’ve also taken this opportunity to ‘future proof’ the BEV 2.0, as it now shares significant software commonality with the battery and operating systems on the FCEV, allowing customers to receive next-generation upgrades seamlessly over-the-air as they are deployed.

Nikola will hold a call with investors this morning to discuss its Q1 2024 numbers, beginning at 7:30 AM PT. You can tune into the live webcast here.

FTC: We use income earning auto affiliate links. More.

Comments