Tesla’s stock (TSLA) crashed 7% today following earnings that actually met expectations. So what is the problem? Is Tesla losing its credibility?

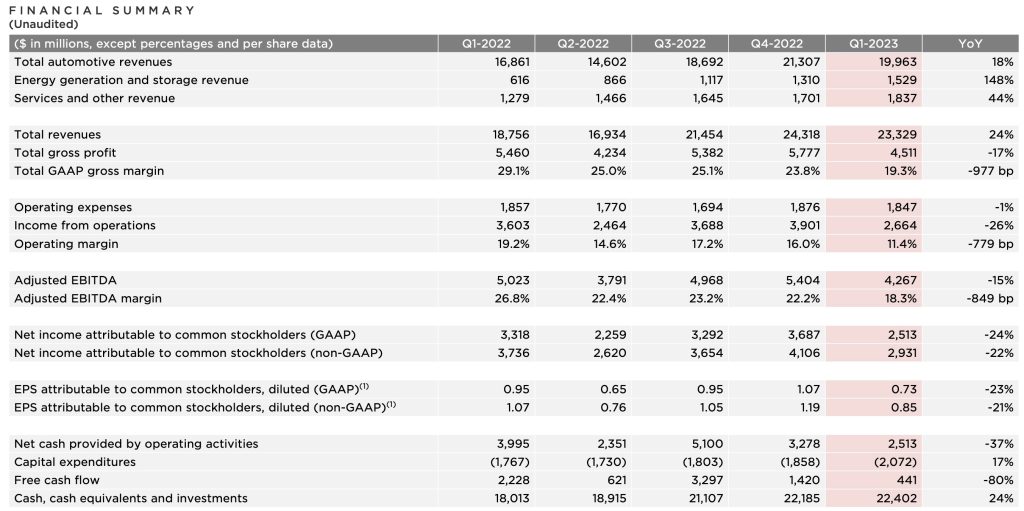

Yesterday, Tesla released its Q1 2023 financial results and met earnings expectations of $0.85 per share and even surprised many by maintaining an automotive gross margin over 19% despite significant price cuts during the quarter.

Tesla was still able to deliver an operating margin of 11% during the quarter and added hundreds of millions to its cash position.

Tesla’s costs have also improved this quarter, and the automaker shows room to be able to absorb the new price cuts that were implemented after the end of the last quarter.

That’s why it’s surprising to see the stock crashing 7% this morning after the market opened. What is happening?

Electrek’s Take

Obviously, I don’t know for a fact, but I have my suspicions. I think Tesla might be losing some credibility here.

Many Tesla fans were holding on to the idea that Tesla was reducing prices to start a price war and not because it needed to create demand. These results and the automaker’s comments yesterday confirmed what most people knew to be true: Tesla needed to reduce the price to create enough demand to match its production. Period.

But at the same time, the automaker tried to explain its pricing strategy by claiming that it is banking on achieving higher profits on the vehicles it is selling right now at lower gross margins by making them self-driving and selling future software features and subscriptions.

I think that’s where it is losing credibility.

Musk seems to believe that people don’t understand the value that Tesla can create by making its electric vehicle self-driving.

The truth is that everyone understands the value, but fewer and fewer people are starting to believe that Tesla can deliver on its full self-driving promises. That’s the issue.

Top comment by Marion & Michael

Have to say that I don't agree with the editorial - in Europe at least 'brand perception' has a very higher value, VW group sell essentially the same vehicle at considerably different price points depending which badge (Audi, VW, Seat) they put on the front. However to charge the Audi premium price they control supply carefully to maintain residuals and the brand cachet.

This premium market however is not big enough to support the type of volumes Tesla is looking to shift so they have to reduce prices to more 'mass market' levels to generate enough sales - but once this happens the product is seen as mass market rather than premium so there is no way to bring the price back up.

Double negative impact is that mass-market has lower residuals and most cars in Europe are sold on lease so the leasing cost does not depend on the list price but on the expected fall in value between new price and 24/36 month old price, this residual is generally similar for premium and mass market cars due to the limited supply in the premium market giving stronger residuals. So there will be demand for a 50k Audi at £500pm but less so for a £40k Tesla also at £500pm. Tesla will have to then cut their price to £30k for the monthlies to come in lower than £500 based on residuals.

This is what drove mass market cars such as the Ford Mondeo and Opal Vectra out of the market.

Tesla had a significant rise in stock price because it was selling more electric vehicles than anyone at a higher gross margin than anyone.

Now this is still true, but the latter is starting to become less accurate. That’s it.

It pushes people to have more concerns about Tesla’s demand. However, to be fair, I think the bulk of Tesla’s demand issues leading to those price cuts are mostly not Tesla’s fault. The high interest rates and economic uncertainty are certainly the biggest factors leading people to postpone new car purchases.

Therefore, if we see a turn around in those factors, I think Tesla will see strong demand again and won’t need to cut prices further, but the problem is that those are factors entirely out of Tesla’s control.

FTC: We use income earning auto affiliate links. More.

Comments