Rivian (RIVN) will report fourth-quarter earnings Thursday after the market closes. Although the EV maker aggressively cut costs last year, a supply shortage derailed some momentum. Rivian still stands by its goal of achieving its first positive gross profit in Q4. Here’s what to expect from the report.

Rivian expects a positive gross profit in Q4 2024 earnings

Update 2/20/2025: Rivian released fourth-quarter earnings, achieving its first gross profit (read more here).

Rivian beat expectations with 14,183 vehicles delivered in the final three months of 2024, bringing the annual total to 51,579.

Although it was enough for Rivian to meet its full-year guidance of 50,500 and 52,000, it was only slightly more than the 50,122 the company delivered in 2023.

After a supply shortage began in the third quarter, Rivian cut its full-year production target to 47,000 to 49,000 vehicles in 2024, down from 57,000. Rivian topped its (revised) target with 49,476 units produced at its Normal, IL plant last year.

Rivian’s deliveries and production include the R1S, R1T, and electric delivery and commercial vans. Despite the slower-than-expected growth last year, the company still expects profits to improve.

Last month, the EV maker confirmed that “The previously discussed shortage of a shared component on the R1 and RCV platforms is no longer a constraint” on production.

| Q1 2024 | Q2 2024 | Q3 2024 | Q4 2024 | Full-Year 2024 | 2024 guidance | |

| Deliveries | 13,588 | 13,790 | 10,018 | 14,183 | 51,579 | 50,500 – 52,000 |

| Production | 13,980 | 9,612 | 13,157 | 12,727 | 49,476 | 47,000 – 49,000 |

Rivian also said it’s still on track to post its first positive gross profit in Q4. CFO Claire McDonough told analysts on the company’s third-quarter earnings call that Rivian expects “a modest gross profit” in the final three months of 2024.

However, McDonough clarified that regulatory credit sales, lower costs thanks to plant upgrades and improved supply contracts, and other revenue outside vehicle sales would mainly drive the achievement.

| Q3 ’22 | Q4 ’22 | Q1 ’23 | Q2 ’23 | Q3 ’23 | Q4 ’23 | Q1 ’24 | Q2 ’24 | Q3 ’24 | |

| Rivian loss per vehicle | $139,277 | $124,162 | $67,329 | $32,594 | $30,500 | $43,372 | $38,784 | $32,705 | $39,130 |

Rivian’s net loss fell to $1.1 billion in the third quarter, with a gross profit loss of $392 million. Although the company lost around $39,000 on each vehicle delivered in the third quarter, this is a drastic improvement from 2022, when Rivian lost over $139,000 per unit.

Including a $1 billion convertible note from Volkswagen, Rivian ended the third quarter with $6.7 billion in cash and equivalents.

According to Estimize, Wall St expects Rivian to post Q4 revenue of $1.4 billion, up from $1.3 billion in Q4 2023, and a loss of 0.68 per share (EPS) compared to a loss of $1.36 per share.

Prepping for R2

After launching its new joint venture with VW, Scaringe said the partnership was a “meaningful financial opportunity” worth up to $5.8 billion.

According to Rivian’s Chief Software Officer, Wassym Bensaid, other OEMs are now “knocking on our door” about similar supply deals for EV tech and software.

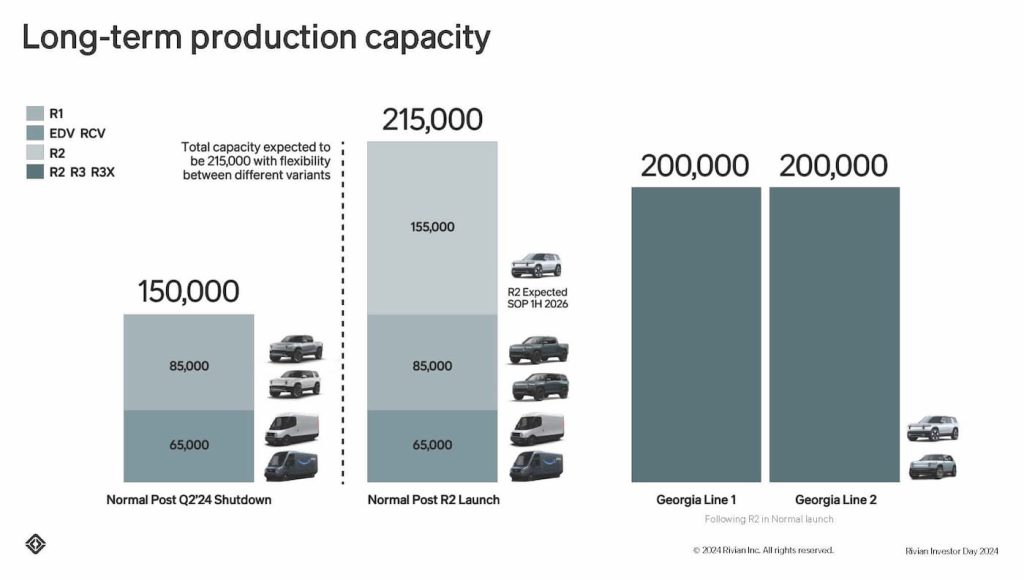

Rivian’s biggest growth driver is still yet to come. The company is preparing to launch its mid-size electric SUV, the R2, early next year. It will initially be built at Rivian’s Normal, IL facility, but production is expected to significantly expand with plans to open a second plant in Georgia.

The R2 will start at around $45,000, or nearly half the cost of the current R1T ($71,700) and R1S ($77,700). Rivian will also build a smaller, more affordable R3 crossover and high-performance R3X at the Georgia facility.

Rivian plans to build the plant in two stages, each adding 200,000 units of annual production capacity. Rivian says the R2 and R3 are “critical drivers in the company’s long-term growth and profitability.”

Although Rivian secured a $6.6 billion federal loan for the new EV plant just before Trump took office, the funding is now in jeopardy after the Administration announced plans to freeze federal loans.

Georgia Gov Brian Kemp told Channel 2 news this week that Rivian “secured that loan at the tail end of the Biden administration and, you know, I think there’s no secret that the Trump administration is taking a look at all those things.” He added, “So I don’t really know where that stands right now.”

Rivian is confident the funds will be there next year when they go to draw them. A spokesperson said, “We’re working hard to onshore US manufacturing, providing thousands of American jobs here in Georgia.”

Rivian’s stock is up since reporting third-quarter earnings in November. However, RIVN shares are still down 12% over the past 12 months and 90% from their all-time high shortly after going public in November 2021.

Check back tomorrow after the market closes for a full breakdown of Rivian’s Q4 2024 earnings report.

FTC: We use income earning auto affiliate links. More.

Comments