If you ask Lucid (Lucid) CEO Peter Rawlinson, the company is the “most immune” EV maker if President-elect Donald Trump cuts the federal tax credit for electric cars. Despite the claim, Lucid’s stock is hitting a new all-time low at under $2 a share.

Is Lucid immune to losing the EV tax credit?

Lucid is coming off its third straight record quarter of deliveries. With another 2,781 vehicles sold in Q3, Lucid’s delivery total reached 7,142 through the first nine months of 2024, already topping the 6,001 deliveries in 2023.

However, share prices are sinking following a Reuters report on Thursday that Trump’s transition team is “planning to kill” the federal EV tax credit, which provides up to $7,500 for clean car buyers.

The report also cited two sources claiming that representatives from Tesla (TSLA) told Trump’s team that they supported the plans to end the subsidy.

CEO Elon Musk, who fully endorsed Trump, said losing the credit could slightly impact Tesla’s sales but would be “devastating” to others in the US.

Although its luxury Air sedan, starting at $69,900, doesn’t qualify for the $7,500 credit, Lucid is passing it on to some through leasing. However, Rawlinson said many of its clients make more than the $150,000 for single filers and $300,000 threshold for couples filing jointly.

Because of that, even if Trump cuts the EV tax credit, Lucid’s CEO believes it’s in a stronger position than most of the competition.

When asked about Trump’s plans, Rawlinson said on Bloomberg Television on Friday that “Lucid, amongst all the EV makers, is really the most immune from that.”

Lucid’s CEO also said he isn’t worried about Musk getting favorable treatment when Trump takes office. Rawlinson explained:

We’ve really taken the mantle of technology leadership from Tesla right now, and this is not really sufficiently recognized. So, I think we’re in a very strong position to weather any such storm.

Lucid opened orders for its first electric SUV earlier this month. Starting at $79,800, the Lucid Gravity is expected to get an impressive range of 440 miles per charge.

Rawlinson calls the Gravity a “landmark product” with its most advanced technology yet, which he claims is “years ahead of the competition.” Last month, we got our first look at its lower-priced midsize electric SUV. Prices for the new model will start at under $50,000.

It will be the first of at least three midsize Lucid EVs, with production expected to begin in late 2026. Rawlinson said the midsize models are aimed “right in the heart of Tesla Model 3, Model Y territory.”

Despite the confidence, Lucid’s stock hit its lowest price on Friday since going public in July 2021. Lucid shares are down nearly 17% this week, sitting at under $2 per share.

Electrek’s Take

Ending the federal tax credit will put the entire US auto industry behind. China continues to gain more global market share as leaders like BYD expand into key overseas markets like Europe, Southeast Asia, and Central and South America.

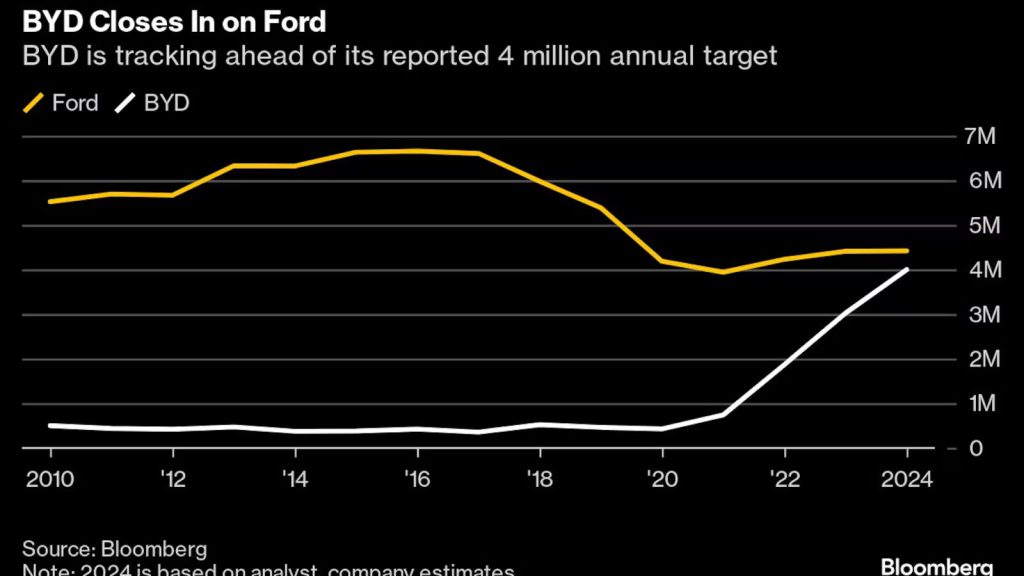

In fact, according to Bloomberg, BYD is quickly closing in on Ford in global deliveries and could even top the American automaker by the end of 2024.

BYD’s surging global presence is primarily due to its early beginnings as a battery maker. However, China’s government is also fueling EV sales growth with subsidies for those that trade in gas-powered vehicles.

Top comment by Michael Wolf

In the short term, reducing EV incentives will make ICE vehicles more attractive to consumers, and boost the revenue of any company selling ICE vehicles in the US. In the long term, any company that isn't continuing their development of EVs risks losing their market share as the EV transition continues.

According to Rho Motion, China continues dominating the global market with a record 1.2 million EVs sold in October alone. China has now sold 8.4 million EVs in 2024, up 38% year-over-year (YOY), compared to 1.4 million in the US (+9% YOY).

Rawlinson may be right. Lucid could be one of the most immune if the tax credits were cut. However, other US automakers, like Ford, GM, and Jeep-maker Stellantis, may not be as lucky.

So, what happens if the subsidies are killed off? American automakers will likely delay or cancel more EV initiatives (new models, battery plants, manufacturing facilities), which will send them further behind in the global market.

Ford’s CEO Jim Farley warned rivals earlier this year, saying if they cannot keep up with the Chinese, “then 20% to 30% of your revenue is at risk.” He added, “As the CEO of a company that had trouble competing with the Japanese and the South Koreans, we have to fix this problem.” Ending subsidies would only put them further behind.

FTC: We use income earning auto affiliate links. More.

Comments