It’s EV earnings season again, and Rivian (RIVN) is set to release critical Q2 2024 earnings on Tuesday, August 6, 2024, after the bell. Rivian has been aggressively cutting costs in an effort to achieve a gross profit by the end of the year. Here’s what to expect from its second quarter report.

Update: 8/6/24: Rivian releases its Q2 2024 earnings. You can see a full breakdown of Rivian’s Q2 report here.

Rivian delivered 13,790 vehicles in the second quarter, up slightly from the first three months of the year (13,588).

Production at its Normal, IL plant fell from over 17,500 in Q4 2023 to 13,980 in Q1 2024. The trend continued with only 9,612 vehicles built in the second quarter.

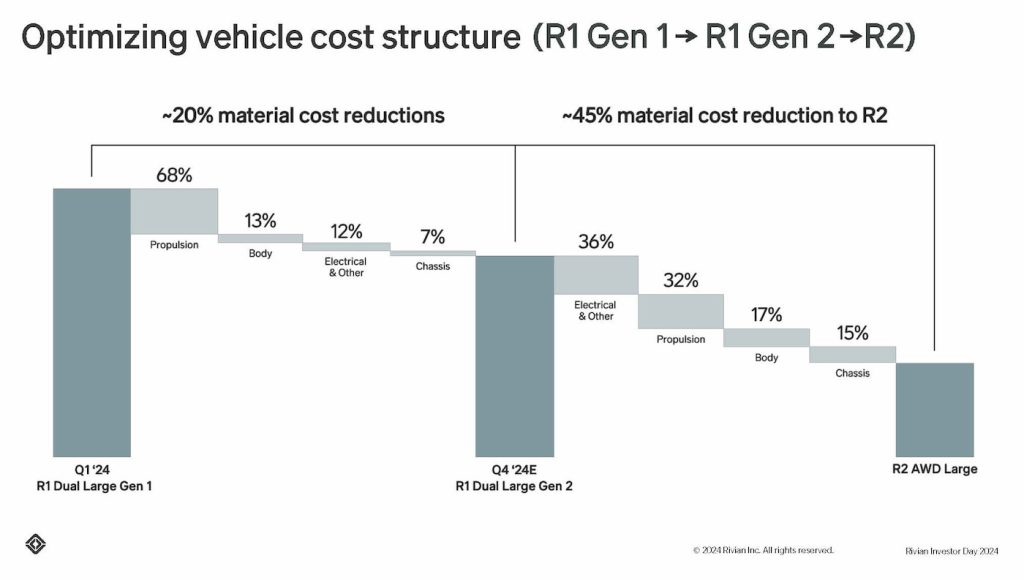

The slowdown was expected after a planned shutdown in April slowed Rivian’s momentum. CEO RJ Scaringe has said several times that the upgrades have made “meaningful” impacts on costs and efficiency.

For example, 100 steps from the battery-making process, over 50 components from the body shop, and 500 parts from the design have been eliminated.

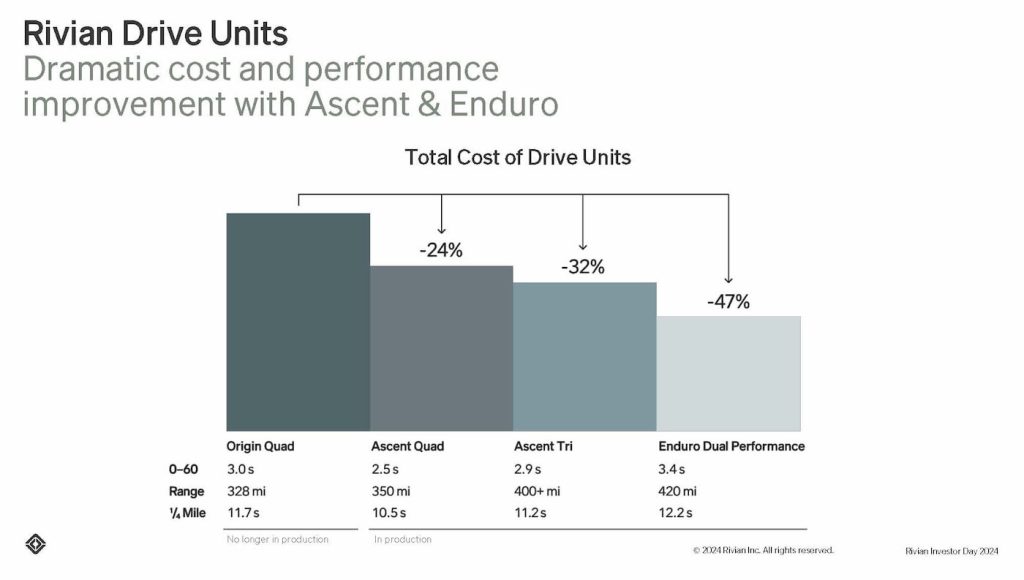

Rivian has also significantly reduced the cost of its drive units. Its latest in-house Enduro Dual Performance units cost 47% less than the Origin Quad motor.

As new tech, like its Maximus motor or “Enduro Gen 2,” is introduced, Rivian expects to cut even more costs. The new motor will be used on its next-gen R2 and R3 vehicles.

Rivian to report critical Q2 2024 earnings

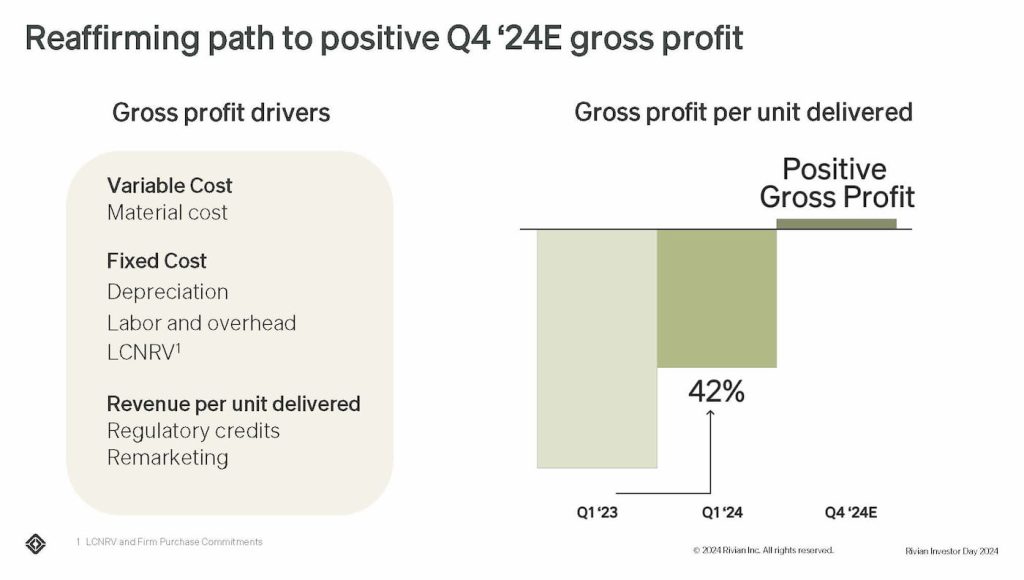

However, Rivian’s R2 is not due out until early 2026. Although it lost $1.4 billion in the first quarter, Rivian expects to achieve its first positive gross profit by the end of the year.

Rivian will release its Q2 2024 earnings report on August 6, 2024. After aggressively cutting costs, much of the progress will not be reflected until the third quarter, according to Scaringe.

| Q3 ’22 | Q4 ’22 | Q1 ’23 | Q2 ’23 | Q3 ’23 | Q4 ’23 | Q1 ’24 | |

| Rivian loss per vehicle | $139,277 | $124,162 | $67,329 | $32,594 | $30,500 | $43,372 | $38,784 |

Scaringe has already warned of a “messy” second quarter for investors with the plant shutdown and other investments.

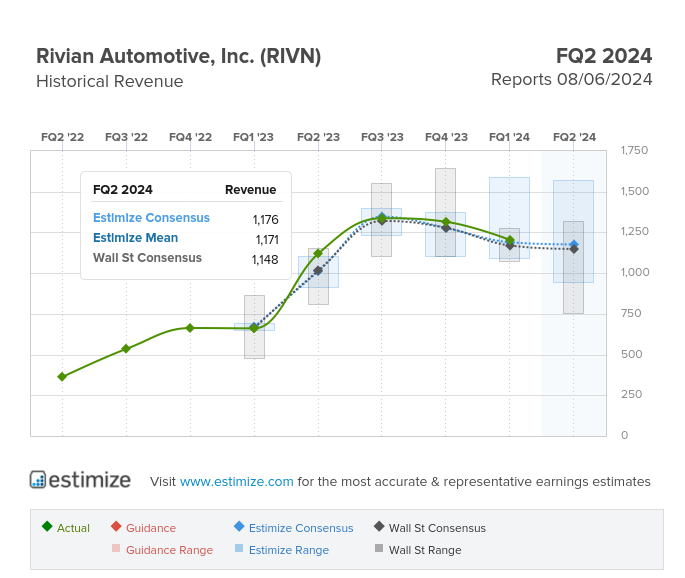

According to Estimize, Rivian is expected to report a loss of $1.17 per share on revenue of $1.18 billion in Q2 2024. Wall St expects a loss of $1.24 per share with $1.15 billion in revenue.

Despite this, Rivian remains on the path to profitability, executives continue reiterating. Rivian announced a massive deal with Volkswagen to develop a next-gen EV architecture using its software expertise.

VW will invest up to $5 billion, $3 billion of which will go to Rivian. The other $2 billion will go toward the joint venture. The investments are based on hitting certain milestones.

The deal earned Rivian stock several Wall St upgrades. Guggenheim analyst Ronald Jewsikow said, “We see a credible path to breakeven gross margins” in the fourth quarter.

Jewsikow sees Rivian’s recent plant upgrades and supplier negotiations as key to reaching positive gross profit. Meanwhile, Q2 will likely be another speed bump as Rivian plows ahead on the path to profitability.

Rivian’s stock is up 42% over the past three months, but share prices are still down 40% over the past year.

Check back tomorrow, Tuesday, August 6, 2024, for a deeper look into Rivian’s financials following its Q2 earnings release and investor call.

FTC: We use income earning auto affiliate links. More.

Comments