Rivian (RIVN) released its Q4 2023 earnings Wednesday, showing gross margin improvements over last year, but the numbers are down sequentially. Rivian also announced it will reduce its workforce by 10%. With cost-cutting measures in place and new affordable products, Rivian expects to achieve modest gross profit by the end of the year.

Fourth quarter earnings preview

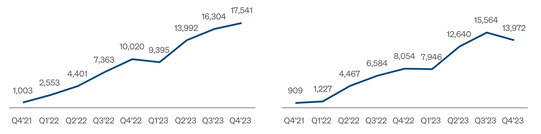

After delivering over 50,000 EVs, more than double last year’s delivery numbers, Rivian looks to keep the momentum rolling in 2024.

Despite the growth, Rivian’s pace slowed in Q4 as expected. Rivian’s CFO, Claire Mcdonough, said the company expected “a more significant gap between production and deliveries in Q4.”

The slowdown was due to Amazon limiting its new vehicle intake during the holiday season. Meanwhile, registration data shows Rivian was the fifth best-selling EV brand in the US last year, with 4% of the market.

After introducing new lower-priced R1S and R1T options (now starting at $71,700), analysts are worried about Rivian’s ability to generate a p.rofit

The EV maker reported a net loss of $1.3 billion in the third quarter, with around a $30,500 loss per vehicle. Although still high, that number is down from $139,277 a year ago.

Rivian Q4 2023 earnings results

Rivian generated $1.3 billion in revenue in Q4, primarily from the 13,972 vehicles delivered. For the full-year, Rivian’s revenue reached $4.4 billion, up 167% from 2022.

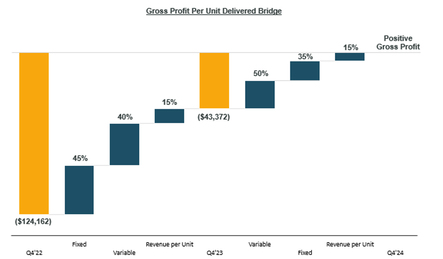

Rivian’s gross loss of $606 million is an improvement from last year’s $1 billion loss. However, it’s up from -$477M in Q3 and -$412M in Q2 2023. With lowered delivery numbers, higher gross losses were expected.

Gross margins were -46% in the fourth quarter, down from -36% in Q3 and -37% in Q2 2023. That equaled out to a $43,372 loss per vehicle delivered.

| Q3 ’22 | Q4 ’22 | Q1 ’23 | Q2 ’23 | Q3 ’23 | Q4 ’23 | |

| Rivian loss per vehicle | $139,277 | $124,162 | $67,329 | $32,594 | $30,500 | $43,372 |

Although $43K is still a significant amount, it’s an $81K improvement compared to the year before. Following a shutdown in the second quarter, Rivian expects to see further cost reductions.

Overall, Rivian posted a net loss of $1.58 billion in Q4, down from $1.79 billion the year before. For the full-year, Rivian’s net losses totaled $5.4 billion, down from $6.8 billion in 2022.

The EV maker also announced in its 8K Wednesday it will be reducing its salaried workforce by roughly 10%. Rivian CEO RJ Scaringe said on the company’s earnings call the move is to maximize the brand’s ability to make an impact.

Rivian ended the quarter with 9.37 billion in cash and equivalents. The company believes it has enough cash to fund operations through 2025.

A substantial opportunity ahead

Rivian says the “opportunity ahead is substantial” as it focuses on growing the brand. The EV maker will reveal its more affordable R2 electric SUV on March 7.

The company is focusing on driving greater cost efficiency with its R1 and RCV lineup. Rivian’s R1S was the top-selling EV in the US, priced over $70K. A smaller, more affordable version will help expand into new markets.

Rivian expects deliveries to be flat this year with around 57,000 due to the planned shutdown. The EV maker expects deliveries to be 10% to 15% below Q4’s numbers (11.9K to 12.5K)

Top comment by Jason

They need the R2 line to succeed in a meaningful way, but unfortunately the $45k EV market is more saturated than it was when Tesla needed the Model 3 to succeed in a meaningful way.

Their product is really cool, so I hope they succeed, but they don't have tons of time/capital at this point (given how long it will take for the new factory to be ready). Execution has to be really good.

With new tech and engineering upgrades, Rivian expects to achieve a “modest gross profit” in the fourth quarter of 2024.

The EV maker recently introduced leasing and new standard pack options to expand the brand to new customers. Rivian says it plans to launch new variants and trims this year to attract new markets.

Rivian’s (RIVN) stock is down over 13% in after-hours trading following the earnings release. The EV makers’ shares are down 27% since the start of 2024.

Check back for more info following Rivian’s Q4 2023 earnings call.

FTC: We use income earning auto affiliate links. More.

Comments