China’s leader EV maker, BYD, has held “active” discussions with lithium producer Sigma Lithium as it looks to expand its battery business.

After topping Tesla in EV sales in the final three months of 2023, BYD is not slowing down. The Chinese EV maker is now eyeing expanding its EV battery business.

BYD’s Brazil head, Alexandre Baldry, said discussions were held over a possible supply agreement, joint venture, or acquisition of Sigma Lithium, according to the Financial Times.

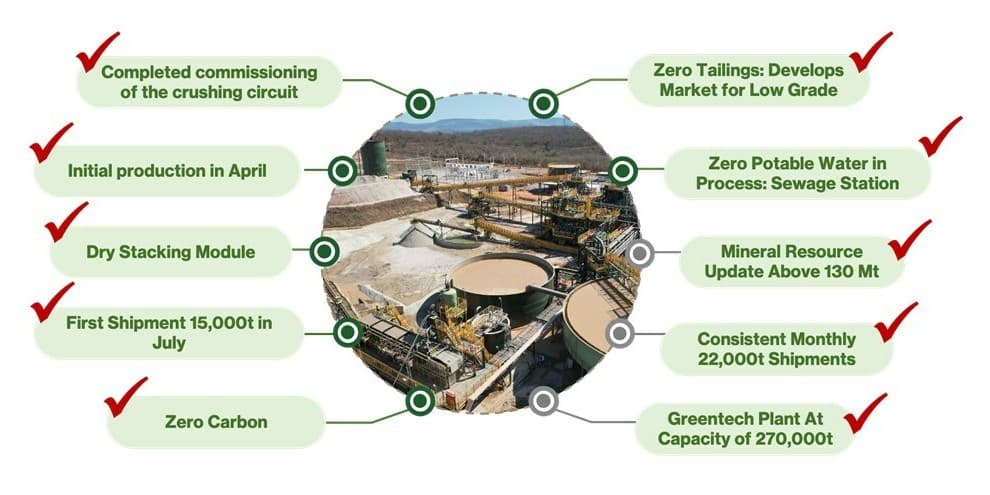

Sigma began shipping lithium from its Grota do Cirilo mine and processing plant in Brazil last year. The company went from commissioning the crushing unit in December 2022 to sustaining production levels last month.

BYD, which began as a battery maker, has built its brand on affordable EVs like the Dolphin and Yuan Plus, both starting under $20,000 in China.

A big part of BYD’s success is due to its past. BYD is now the largest global supplier of rechargeable batteries. The company even sells EV batteries like its BYD Blade battery to other automakers, including Tesla, Toyota, Ford, and Kia.

BYD is “more like an engineering company,” North American CEO Stella Li explained, with most components built in-house. For example, BYD makes every part of its Dolphin EV except the tires and windows.

BYD eyes Sigma Lithium supply deal

BYD’s affordable EVs are largely due to its control over its supply chain. A major lithium deal could help secure BYD’s position as the top EV maker globally.

Sigma posted a $19 million (CAD 25M) net loss in the first nine months of production. Its first year of production. Revenue reached nearly $97 million (CAD 129.9M).

With top battery producers like Panasonic cutting its profit outlook last year, Sigma Lithium (SGML) stock has slid over 35% in the past six months.

According to FT, Sigma’s board is reviewing an action plan that could involve selling the business or listing its Brazilian unit on the Nasdaq (or Singapore) stock exchange.

Brazilian media Exame reported Volkswagen and CATL are both also eyeing Sigma’s assets. According to the report, China’s CATL is offering more than VW.

According to a Bloomberg report last year, Tesla was also considering buying Sigma. It was “one of multiple mining locations” Tesla was exploring.

Sigma plans to triple its annual production capacity with 22,000 tonnes of battery-grade lithium shipped every month in 2024. That would be about 270,000 tonnes this year.

BYD continues expanding into new markets with the launch of its luxury brand, Yangwang, last year. BYD’s Yangway unveiled its new +1,000 horsepower U7 electric sedan, starting at around $140,000 (1 million RMB).

The EV leader is also preparing to ship its own EVs to Europe on its first transport ship. The BYD Explorer No. 1 is the first Chinese-made ship designed to carry domestic EVs overseas.

BYD’s ship arrived at Yantai Port last week before heading to Shenzen, where BYD will load vehicles. The next stop is Europe. BYD’s Explorer No. 1 can carry 7,000 EVs.

FTC: We use income earning auto affiliate links. More.

Comments