Tesla (TSLA) is about to release Q3 2023 financial results on Wednesday, October 18, after the markets close. As usual, a conference call and Q&A with Tesla’s management are scheduled after the results.

Here, we’ll take a look at what both the street and retail investors are expecting for the quarterly results.

Tesla Q3 2023 deliveries

As usual, Tesla already disclosed its Q3 vehicle delivery and production numbers, which drive the vast majority of the company’s revenue.

Earlier this month, Tesla confirmed that it delivered just over 435,000 electric vehicles during the third quarter of the year.

It’s the first time in a long time that Tesla didn’t break a delivery record.

Tesla also produced fewer vehicles at just over 430,000 units.

The automaker had warned about a lower quarter in terms of deliveries and production due to planned factory shutdowns for upgrades.

Delivery and production numbers are always slightly adjusted during earning results.

Tesla Q3 2023 revenue

For revenue, analysts generally have a pretty good idea of what to expect, thanks to the delivery numbers.

However, this year has been more difficult due to constant price cuts – making it harder to track Tesla’s revenue.

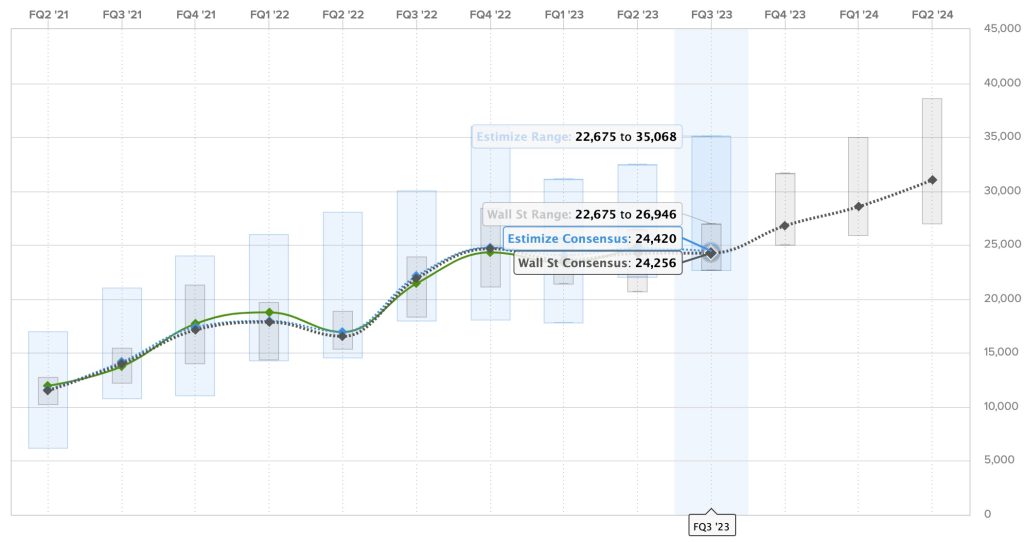

The Wall Street consensus for this quarter is $24.256 billion, and Estimize, the financial estimate crowdsourcing website, predicts a higher revenue of $24.420 billion.

Unsurprisingly, this would be significantly down from the nearly $25 billion in revenue Tesla delivered last quarter, but it is still a massive year-over-year increase from the $21.5 billion Tesla delivered during the same quarter last year.

Here are the predictions for Tesla’s revenue over the past two years, with Estimize predictions in blue, Wall Street consensus in gray, and actual results are in green:

Tesla Q3 2023 earnings

Tesla always attempts to be marginally profitable every quarter as it invests most of its money into growth, and it has been successful in doing so over the last two years now.

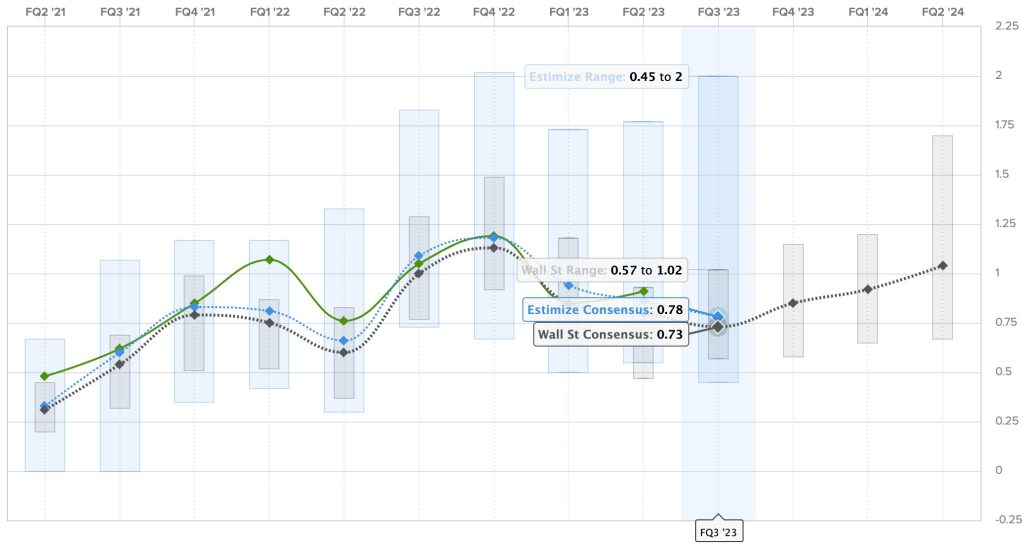

However, like revenues, it has been harder to estimate earnings this year with price cuts digging into Tesla’s industry-leading gross margins.

For Q3 2023, the Wall Street consensus is a gain of $0.73 per share, while Estimize’s prediction is higher with a profit of $0.78 per share.

But as you can see below, the range of Wall Street is quite broad as analysts are unsure what to expect.

Here are the earnings per share over the last two years, where Estimize predictions are in blue, Wall Street consensus is in gray, and actual results are in green:

Other expectations for the TSLA shareholder’s letter and analyst call

Amid declining prices to keep demand up, most shareholders are mostly concerned about Tesla’s ability to retain a high gross margin despite the lower prices.

It’s likely that Tesla will try to reassure shareholders on that front on Wednesday.

There’s been a growing effort among shareholders to convince Tesla to invest in advertising rather than cut prices. We have seen Tesla dip its toes in that lately. It would be interesting to see if Tesla can release some results of that effort and discuss the potential for a ramp-up.

Top comment by Doggydogworld

Answers to shareholder questions:

1. CT delivery next month. It's awesome, blah, blah. Lots of excitement, blah, blah. Will ramp production throughout 2024.

2. 4680 going great. A game changer. Meeting all targets, blah, blah.

3. US Highland will launch in Q1. So many improvements, it's basically a total redesign! We're swamped with orders in China, can't build 'em fast enough....

4. Mexico construction will start after we perfect our revolutionary new unboxed production system.

5. Our hearts broke when we heard some customers couldn't afford $15k for FSD, even though it'll be worth 10x that much in three months. We lowered it to $12k out of the kindness of our hearts. We're basically a charitable organization, after all, saving lives while we save the planet.

During the conference call following the release of its earning results, Tesla takes crowdsourced questions from shareholders. Here are the top-voted ones right that are likely to be answered by management:

- How many Cybertruck deliveries do you anticipate for 2024?

- Can you provide a progress update on the 4680 Cell. Particularly progress towards performance improvements and cost savings outlined on battery day. Thank you!

- When do you expect Model 3 Highland to be available in the US?

- Could you please provide an update on (i) capacity expansion plans for the company’s factories in Berlin and Austin and (ii) the opening schedule of Gigafactory Mexico?

- Why was the price dropped on FSD if it is getting better and robotaxi is expected so soon?

In general, between the price drop and the lower deliveries, it should be a fairly top quarter for Tesla. However, the automaker has also lowered inventory during the quarter, which could make things more interesting.

We will see.

You can join us live on Electrek on Wednesday evening for intensive coverage of Tesla’s Q3 2023 financial results starting at around 4 p.m. ET for the results and through the evening for news coming out of the conference call and results.

FTC: We use income earning auto affiliate links. More.

Comments