California-based Fisker Inc. (FSR) released its second-quarter earnings Friday. Despite improving profitability, Fisker lowered its annual production guidance again due to supplier constraints.

Fisker cuts 2023 EV production guidance

Fisker delivered its first Ocean electric SUV in May as the EV startup began ramping up production.

After producing 55 Ocean SUVs in the first three months of the year, well short of its goal of 300, Fisker said it planned to build between 1,400 and 1,700 vehicles in Q2.

Fisker fell short of its target again despite still producing an impressive 1,022 Ocean EVs in the second quarter. The EV maker said the production miss was due to suppliers having challenges meeting the required components.

For this reason, Fisker lowered its guidance on Friday as it expects to build between 20,000 to 23,000 vehicles this year, compared to 32,000 to 36,000 predicted earlier this year.

The EV maker pointed to a planned Magna Steyr summer shutdown to support the future volume ramp. Fisker says this will give them time to work with suppliers to ensure future component availability. Following the shutdown, Fisker will be able to resume and pick up production where it left off immediately.

Fisker hit a peak production rate of 140 units per day in July, an impressive 75% improvement from the month before. In fact, 1,009 of the 1,022 vehicles produced in Q2 were built in July.

Fisker Q2 financials and updates

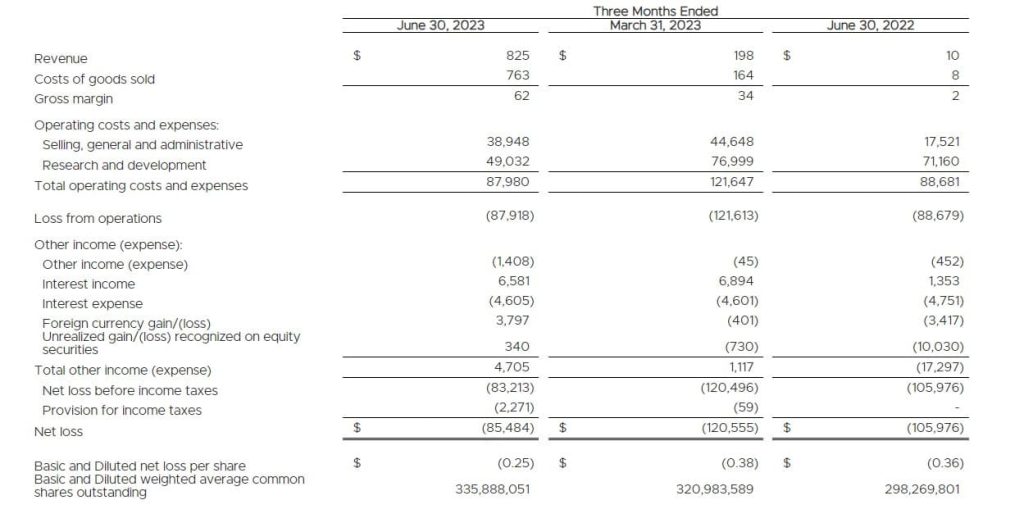

The EV maker generated $825,000 in revenue, up from $198,000 in the first quarter. Fisker highlighted that its first Ocean vehicles delivered achieved a 7.5% gross margin. Excluding early-stage investor vehicles, the gross margin was 18.5%.

Fisker’s operating expenses fell to $88K in Q2 from over $121K in the first three months of the year.

The company’s net loss was $85.5K, or 25 cents per share, compared to 35 cents per share last year, beating Wall St. estimates of around 28 cents per share.

Top comment by Lewis

On the one hand, this is a terrible balance sheet. It looks like a company headed to bankruptcy.

On the other hand, there is good reason to believe they will outproduce Lucid next year. Their balance sheet looks MUCH better than that of Lucid or Rivian.

Fisker is showing positive gross margins, which is something a startup should have at this point. Tesla had that its first year, even though it took another decade to show a real profit. Lucid and Rivian don't have that.

Lucid and Rivian both appear to make nice, desirable cars, and they appear to be true efforts to be real car companies. People on these boards want them to succeed for many reasons such as producing desirable cars and NOT being among the many outright scams (Nikola) that still has trolls pretending to like them and industry leaders (GM) dumb enough to think the scams are real. However, they are both on clear paths to bankruptcy.

Fisker is a terrible bet financially. Wishing is not a business plan. But, great businesses start with dreamers. And, it looks like a better bet now than Rivian or Lucid, who both have legions of legitimate fans on these boards.

Fisker ended the quarter with $521.8M in cash and equivalents (excluding $300M in gross proceeds) as of June 30, compared to $736.5M at the end of 2022. The company noted it raised an additional $300M from convertible bonds in July, bumping cash, cash equivalents, and restricted cash to $822M on a proforma basis (excluding $33M in VAT receivables).

The EV maker held its “Product Vision Day” on Thursday, showcasing several new products, including the new Fisker Ronin, Alaska small EV pickup, and the upcoming $30K Pear small SUV. It also teased the Fisker Ocean with the Force E off-road package.

Fisker believes these products will give it a unique advantage as it moves forward in differentiated segments.

The company also announced on its earnings call it had an agreement drawn up with Tesla to use its NACS connector. It’s just waiting on Tesla to sign.

FTC: We use income earning auto affiliate links. More.

Comments