EV startup Rivian’s (RIVN) stock price is down over 91% from its all-time high set shortly after going public on the Nasdaq exchange in 2021. With share prices falling, Rivian may be at risk of losing its spot in the Nasqaq 100 index.

Rivian stock sell-off

After going public in November 2021 with backing from Ford and Amazon, Rivian held the largest initial public offering (IPO) for an American company since Facebook in 2012.

Valued at over $100 billion after its debut, the hype pushed Rivian stock price to over $170 a share within a week. However, since then, Rivian’s stock has been stuck in what seems to be a never-ending downward spiral.

Despite ramping production from 1,000 EVs built by the end of 2021 to 24,337 last year, Rivian’s stock continued to sell off.

The Federal Reserve moving from easing the economy through the pandemic to suddenly fighting inflation resulted in interest rates rising at the fastest pace in over four decades.

Unprofitable growth companies, including EV stocks like Rivian, were among the hardest hit as investors fled for safer assets.

Rivian stock has plunged from an all-time high of over $172 per share to around $15 today, down 91%. According to JP Morgan Securities, it may be enough to lose its place in the Nasdaq 100.

Will Rivian stock lose its Nasdaq 100 place?

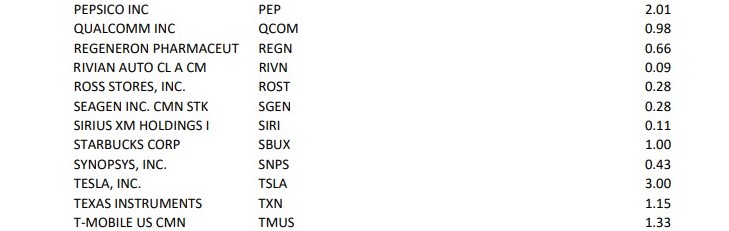

The Nasdaq 100 is a stock market index comprising the 100 largest nonfinancial companies listed on the exchange. Rivian joined the index this past December as part of its yearly rebalancing.

JP Morgan analyst Min Moon (via Automotive News) wrote in a note this week that the Nasdaq 100 generally removes the smallest member of the group if the company is weighted at less than 0.1% for two straight months.

Moon noted that Rivian was below the 0.1% mark as of April 28 and May 31, leading her to believe the EV maker will be kicked out of the index as early as this month (the third Friday in June).

According to Moon, Rivian can be replaced by ON Semiconductor, which is ranked as the top eligible company.

The news comes after bullish analyst Alexander Potter of Piper Sandler downgraded Rivian stock in April, dropping his price target from $63 a share to $15.

Electrek’s Take

Top comment by Bad Karbon

You should change the title, and some of your sentences... Losing its spot on the Nasdaq 100 is NOT the same as losing its spot on the Nasdaq.

Also I would recommend adding WHY it would make a difference to lose their spot on an index. It's not a good thing, but it certainly isn't as bad as losing their spot on the Nasdaq itself. (or the quick version: many funds buy stocks according to indexes, instead of picking individual stocks themselves. If a stock is added, they pick up some shares, and conversely if it's removed, they sell those shares)

Losing its placement in the Nasdaq would be another setback for Rivian. Although Rivian was one of the few EV makers to reaffirm its annual production goal of 50,000 after Q1, the market is what’s spooking investors.

With Rivian spending roughly twice as much to build each vehicle as it sells it for and interest rates rising, investors are hesitant to jump back in.

CEO RJ Scarinje says driving profit is equally essential to ramping production right now as the EV maker has implemented several cost-cutting measures.

Rivian says its second-generation models (R2), due in 2026, are designed to simplify production and improve margins.

FTC: We use income earning auto affiliate links. More.

Comments