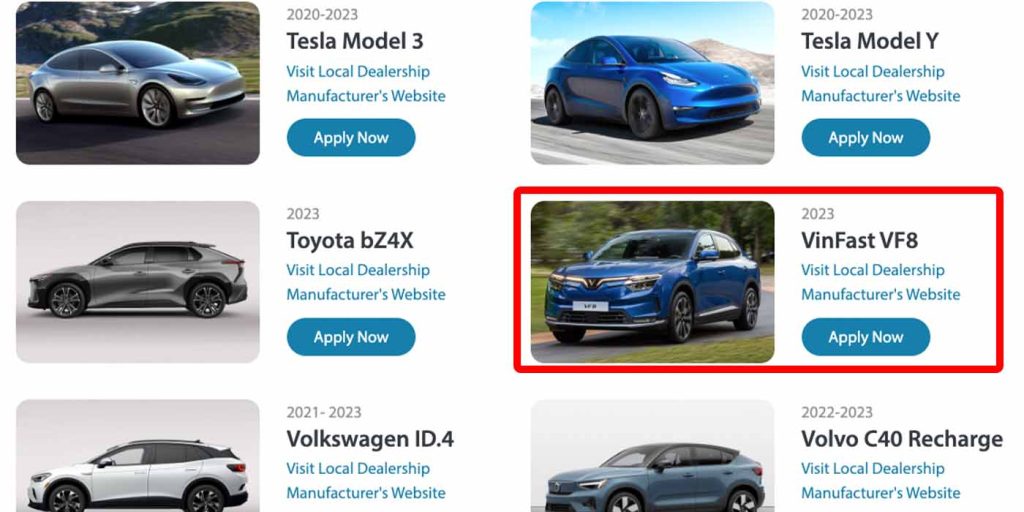

Vietnamese EV automaker Vinfast just relayed that its new VF 8 electric SUV has been added to the list of eligible vehicles under the Clean Vehicle Rebate Project (CVRP) created by the California Air Resources Board (CARB). New and existing VinFast customers can now qualify for up to $7,500 in tax rebates in California, which can extend to other participating states. Learn how to apply below.

VinFast remains a relatively young EV automaker, having caught our attention based on the sheer speed at which it has developed, announced, and begun delivering its first all-electric models. Although it has been detailing grandiose plans for expansion in the US and Europe alongside a potential IPO, several hurdles have begun to slow down the lightning-fast pace at which VinFast likes to operate.

Still, as promised, VinFast was able to ship its first batch of VF 8 SUVs from Vietnam to the US in late 2022, but customer deliveries were delayed as the vehicles required a software update. As of late March, VinFast was working on bringing a second shipment of 1,879 VF 8 SUVs stateside.

According to the automaker, that second batch left the MPC Port of Hai Phong, Vietnam, on April 16 and is expected to arrive at Benicia Port, California, in May. Of those nearly 1,900 EVs, VinFast says almost 1,100 will be eligible for tax rebates in California. Here’s the latest.

How to apply for the tax rebate on your VinFast purchase

By achieving eligibility in the CVRP, customers in California who purchase or lease a new VinFast VF 8 SUV can apply for a tax rebate between $2,000 and $7,500. In the Golden State, VinFast VF 8 and VF 9 drivers now also qualify for California’s Clean Air Vehicle Decal Program, which grants free HOV lane access on congested highways.

The automaker also shared that since the VF 8 has been approved for CARB eligibility, the SUV should qualify for several other state incentive programs overseen by the Center for Sustainable Energy, including Connecticut, Massachusetts, New Jersey, New York, Oregon, and Vermont. VinFast North America CEO Van Anh Nguyen spoke on the state tax incentives:

State incentives like the CVRP help VinFast enhance its competitiveness in the key North American market. The incentives also help motivate customers to quickly transition to electric vehicles. I believe that, with VinFast’s product quality, competitive sales policies and state incentive programs, VinFast electric vehicles will become a popular choice, further accelerating the movement to smart and green mobility.

VinFast states that the CVRP applies to all VF 8 models sold or leased in the state of California. Better yet, those purchases apply retroactively from March 2023, so nearly all VF 8 customers can still apply. VinFast states that those who might qualify can learn more and apply for the tax rebate on the official CVRP site.

FTC: We use income earning auto affiliate links. More.

Comments