Tesla’s loss in market capitalization equals almost the entire legacy auto industry combined – one of the most significant losses in value of all time.

In 2020, Tesla became the most valuable automaker in the world. The company quickly blew past that and eventually reached a valuation of over $1 trillion. But that was last year, and 2022 has been tough for Tesla on the financial markets.

There are several macroeconomic factors at play, and the broader market is also significantly down in 2022, but Tesla has undoubtedly been tracking worse in a big way over the last few months:

Tesla is down almost 69% year-to-date and erased hundreds of billions in market capitalization.

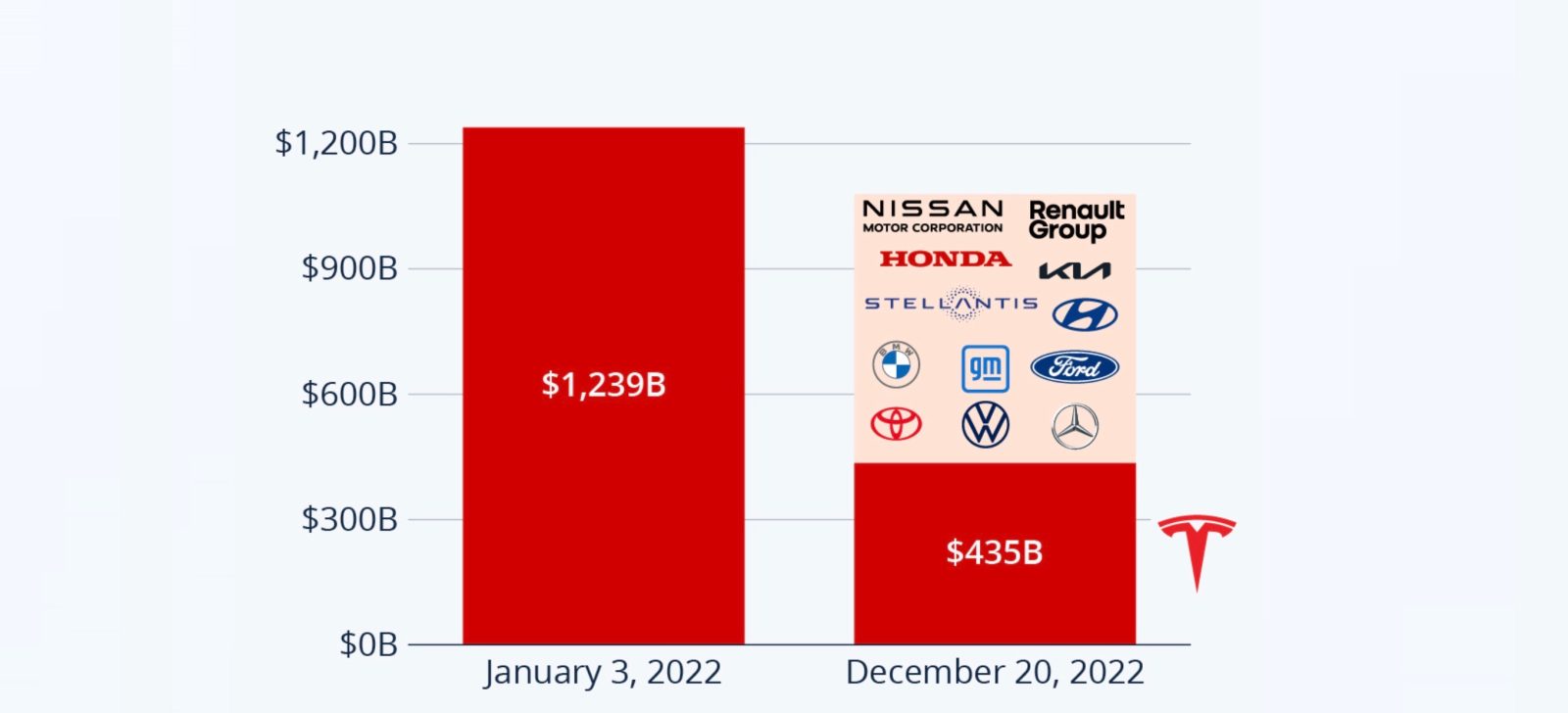

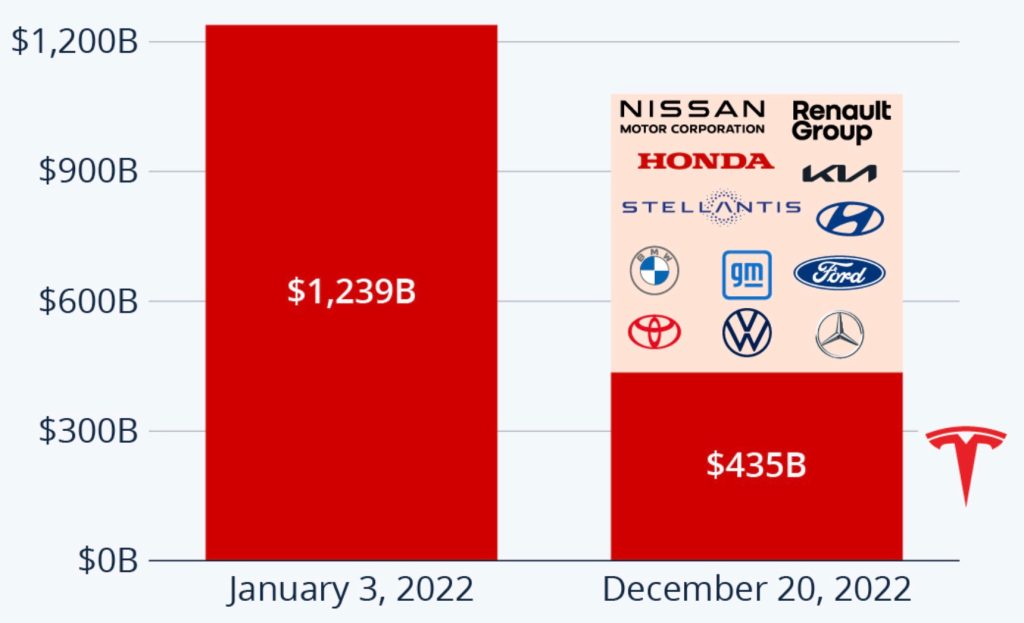

Statista did the math and realized that the loss in market cap is worth almost the entire legacy auto industry put together:

The publication noted the drop in market cap:

Shockingly, Tesla’s drop in market capitalization, roughly $800 billion from its peak, is bigger than the combined valuation of pretty much any legacy car manufacturer you could think of. As the following chart shows, the combined market capitalization of Toyota, Volkswagen, Mercedes-Benz, BMW, GM, Ford, Stellantis (Fiat Chrysler and PSA), Honda, Hyundai, Kia, Nissan and Renault is still more than $100 billion shy of Tesla’s market cap decline.

It is putting a new perspective on the loss in value.

Electrek’s Take

Top comment by pj

I felt insane over the last couple years reading all the justifications of tesla’s clearly overvalued stock price, and feeling like my brain was fundamentally broken. I feel bad for anyone who lost money in the process, but I do feel better personally that the evidence i was reading that tesla couldn’t justify the stock price was correct.

Again, there are many different factors at play, but I think it’s important to note that the stock might have also just been overvalued in the first place.

That incredible loss in value followed an incredible rise in value.

Even Elon Musk said that it was overvalued just a few years ago when it was worth less than it is now, but that was also before Tesla was generating $3 billion in free cash flow per quarter.

Either way, it is setting up to be an interesting 2023 for the automaker.

FTC: We use income earning auto affiliate links. More.

Comments