We talk a lot here at Electrek about the exponential growth of electric vehicles and the massive strain that puts on the battery supply chain. Literally, the majority of that demand and production comes from China.

But there is a massive difference between processing materials and actually having them in the ground.

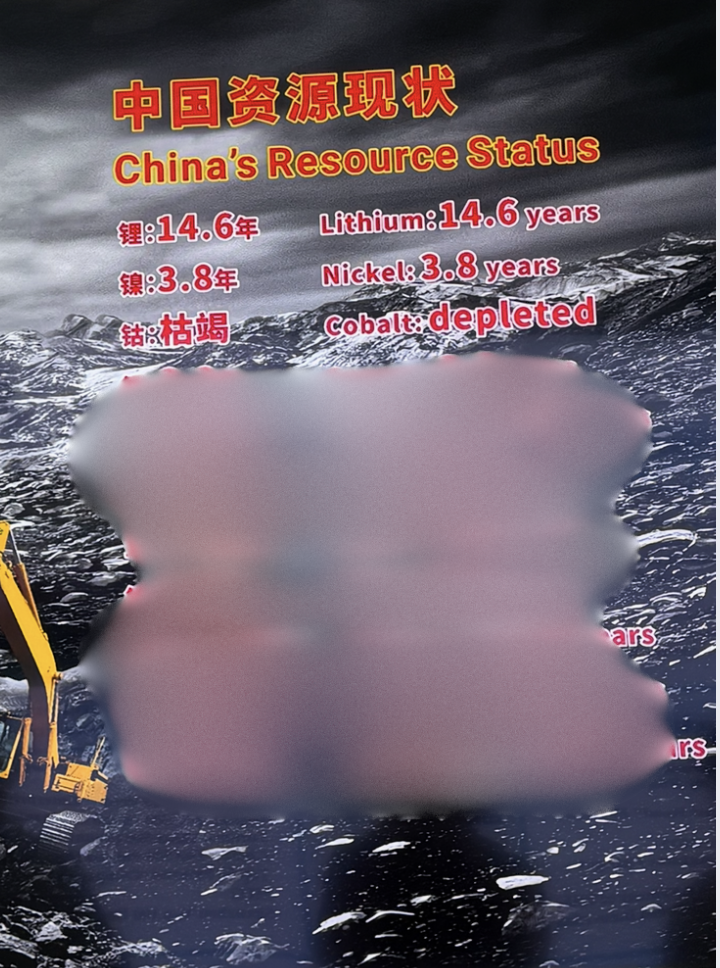

A new image from a gigantic materials mining and recycling company in China, gives us a sobering look at the reality of their domestic reserves. The data suggests that China’s own supply of the most critical battery metals isn’t just running low; in some cases, it’s already gone.

The global transition to electric transport is happening faster than most legacy analysts predicted, virtually everywhere except in the US. We are racing toward terawatt-hours of annual battery production. While battery chemistry is evolving rapidly (LFP, sodium, solid-state, etc.), high-energy-density cells, which generally kick start new electrification segments, still rely heavily on nickel, cobalt, and lithium.

China has positioned itself as the undisputed king of battery manufacturing. They refine the vast majority of the world’s cobalt and lithium. But a photo taken while visiting a major Chinese mining and recycling hub reveals just how precarious their domestic supply of raw ore actually is.

Here is the slide titled “China’s Resource Status”:

The numbers represent the remaining years of proven domestic reserves at current extraction rates. Let’s look at the big three for EV batteries:

- Lithium: 14.6 years almost 15 years might sound like a decent runway, but in the context of the hyper-growth EV market, that is the blink of an eye. Furthermore, much of China’s domestic lithium (mostly salt lakes in the high Qinghai-Tibet Plateau) is harder and more expensive to process than the lithium brine found in South America or spodumene in Australia. This 14.6-year figure explains precisely why Chinese firms are aggressively buying up lithium mines across Africa and South America. Their own supply is more of a last resort when global supply gets tighter and prices are higher.

- Nickel: 3.8 years This is perhaps the most immediate threat. Nickel is crucial for the cathodes in long-range performance vehicles (like high-end Teslas utilizing NCM chemistry). To have less than four years of domestic supply remaining is a massive strategic vulnerability. This is why China has poured billions into Indonesia to build massive high-pressure acid leaching (HPAL) plants to secure nickel supply offshore.

- Cobalt: Depleted Already gone. China has effectively zero economically viable domestic cobalt reserves left and relies on imports.

This is the smoking gun that explains China’s geopolitical strategy over the last decade. It explains why they have effectively taken control of the Democratic Republic of Congo’s mining sector, which produces the vast majority of the world’s cobalt. China must import 100% of raw cobalt ore to feed its massive refining engine.

Electrek’s Take

Why is this important? More than half of the world’s electric vehicles are produced in China, and China controls most of the mineral processing for battery production.

Top comment by Blake

On a world scale lithium, iron & phosphate are not scarce - another reason BYD’s LFP bet is paying off. Many people are realising 500km/300mi ranges aren’t necessary, so don’t need nickel manganese cobalt powered cars.

My guess would be 80%+ of the world’s vehicle travel needs could be met with LFP & sodium, including transport with battery swapping

Knowledge of their reserves is essential, as it is closely linked to their need to secure outside supplies – something China has been aggressively doing for years.

It’s also why the country is now investing heavily in battery material recycling through companies such as GEM.

While China is running out of natural resources, it is also buying the majority of the world’s EV supply (almost entirely its own), and at the end of life, those EVs have a ton of valuable materials to mine.

There are 8 other metals, less relevant to batteries and EVs, in the list, which I posted in full on my Substack, along with an analysis of each resource.

FTC: We use income earning auto affiliate links. More.

Comments