After Lucid Group’s (LCID) stock price reached a new all-time low this week, the company’s communication boss is out to set the record straight.

Lucid stock hits a new low as investors wait

Lucid is facing new headwinds in the US at a critical time as the EV maker looks to enter its next growth phase. It’s ramping up output of its first electric SUV, the Gravity, and is set to launch its midsize platform in late 2026.

Like all automakers, the company is facing new headwinds in the US under the Trump administration, but that isn’t stopping Lucid from continuing on its mission of “changing the world through innovation and efficiency.”

Lucid’s head of communications, Nick Twork, reassured investors on Thursday that while others are pulling back, the company is still plowing ahead.

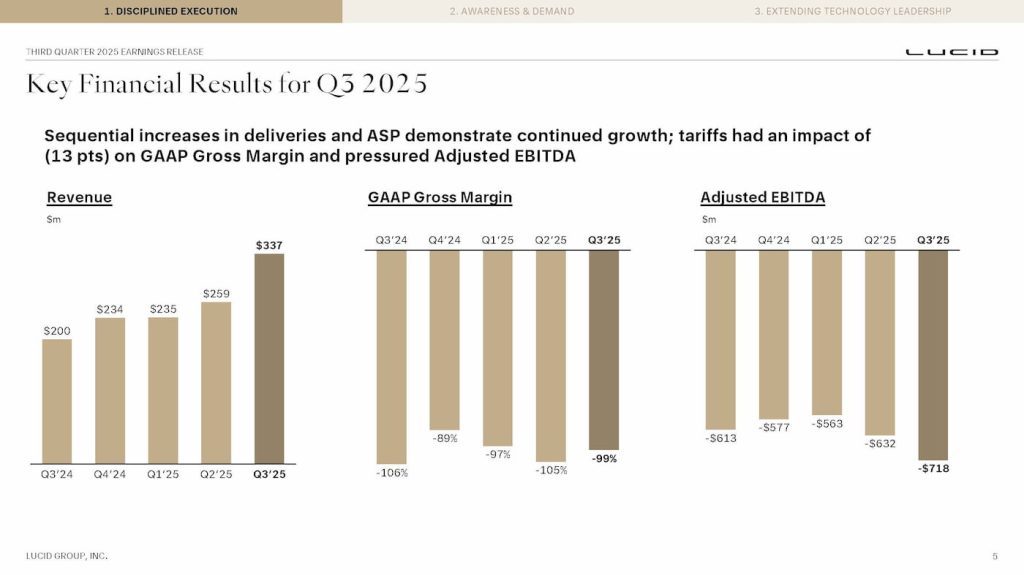

“We know it’s been a challenging period for our long-term holders,” Twork said, adding, “We are focused on execution and being transparent.” Twork reaffirmed investors that Lucid has “a strong liquidity runway,” including a $2 billion PIF credit facility, and another $2 billion in refinanced convertible notes that now mature in 2030/31.

$LCID investors: we know it's been a challenging period for our long-term holders. We are focused on execution and being transparent. As our CFO Taoufiq has said, we have a strong liquidity runway, including an undrawn $2B PIF credit facility, and we refinanced $2B of converts… pic.twitter.com/4gvzFqmpLj

— Nick Twork (@ntwork) December 18, 2025

While other automakers are scaling back EV plans, including Ford most recently, “we’re building through it and ramping,” Lucid’s communications boss said.

After a magnet shortage and other supply chain constraints hampered Gravity production early on, Lucid now expects the electric SUV to make up the majority of production and deliveries in the fourth quarter.

Speaking at the 53rd Annual Nasdaq Investor Conference last week, Lucid’s interim CEO, Marc Winterhoff, said the company “is on track” to hit its guidance of producing 18,000 vehicles this year. That’s at the lower end of its initial 20,000 to 18,000 target, but Winterhoff said output is picking up and Lucid now has “weeks where we are producing 1,000 vehicles” in a single week.”

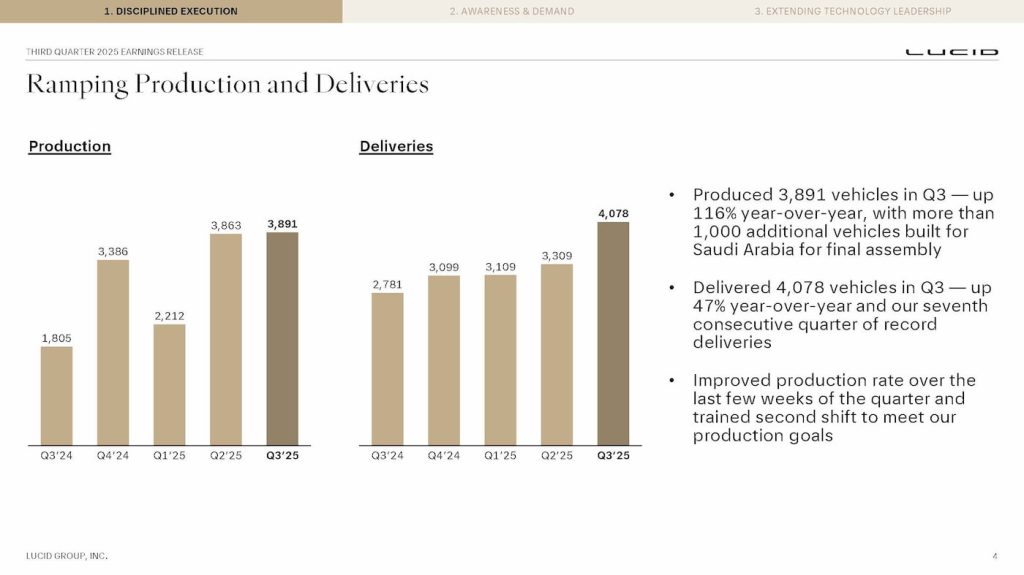

Hitting that 18,000 target won’t be easy. Through the third quarter, Lucid produced 9,966 EVs, meaning it will need to build over 8,000 more in Q4. That’s more than double the 3,891 it made in the third quarter.

Lucid had about $4.2 billion in liquidity at the end of Q3, but after agreeing with PIF to increase the delayed draw term loan credit facility (DDTL), the company said total liquidity would have been around $5.5 billion.

The capital is enough to fund it through the first half of 2027, Lucid said. Later next year, Lucid will begin production of its midsize platform, which will underpin at least three new vehicles priced around $50,000.

Top comment by Gussy23

When I have to measure liquidity in my job (which I do regularly), I look at the current and quick ratios. Also working capital. Is the $2.2 billion available working capital? That would be liquid assets less short-term liabilities (due in less than 12 months). Lucid is publicly so I suppose I could just look all that up but it would be nice if Electrek went the extra mile and put it in the article.

Also, I hope the Gravity doesn't share the same software design and performance issues the Air suffers from.

Lucid’s first midsize model will be an electric crossover SUV, followed by a more rugged version inspired by the Gravity X concept. The third is rumoured to be a midsize sedan that will compete with the Tesla Model 3.

During a fireside chat at the UBS Global Industrials and Transportation Conference earlier this month, Lucid’s CFO, Taoufiq Boussaid, said the midsize EVs will be positioned in “the heart of the market,” starting at around $50,000.

While Rivian (RIVN) and Tesla (TSLA) shares are trading up by over 50% and 27%, respectively, since the beginning of 2025, Lucid’s stock price has fallen by over 60%. Earlier this week, Lucid’s stock touched an all-time low of $11.09 per share.

Twork said Lucid will share more information about its growth plans during its Capital Market Day in the first quarter.

FTC: We use income earning auto affiliate links. More.

Comments