Even with the new 100% tariff on electric vehicles imported from China, BYD would still have the cheapest EV in the US. According to a new report, BYD’s lowest-priced EV would still undercut all US automakers at under $25,000.

After discontinuing the production of vehicles powered entirely by internal combustion engines in March 2022, BYD has been at the forefront of the industry’s shift to EVs.

However, BYD has been building its supply chain for much longer. The company began building lithium-ion batteries in 1996. BYD’s batteries powered Motorola and Nokia’s popular smartphones in the early 2000s.

Its early ventures into the battery industry helped BYD become the industry juggernaut it’s known as today.

Since releasing its breakthrough Blade EV battery in 2020, BYD has continued introducing more efficient, lower-cost tech to drive down prices.

BYD’s cheapest electric car, the Seagull EV, starts at under $10,000 (69,800 yuan) in China. Its affordable electric and hybrid models are squeezing gas-powered vehicles out of China’s auto market, especially from foreign automakers.

BYD would have the cheapest EV in the US despite tariffs

BYD has no plans to enter the US passenger vehicle market (it already sells electric buses), the company’s North American CEO Stella Li said. If it did, it could hold an advantage over US automakers.

According to AutoForecast Solutions CEO Joe McCabe (via Nikkei), BYD would still have the cheapest EV in the US, even with the new 100% tariff on Chinese electric vehicle imports.

The tariff will take effect on September 27 and is intended to “protect American manufacturers from China’s unfair trade practices,” according to a press release from The White House.

McCabe said BYD’s lowest-priced EV for the US would be $12,000. Even with a 100% tariff rate, BYD would have the cheapest EV in the US at under $25,000.

Tesla, which still holds a commanding lead (48% share in July) in the US EV market, has yet to break the $30,000 threshold.

Chinese automakers, like BYD, have an advantage with established supply chains, enabling lower prices.

Electric vehicles accounted for over 50% of passenger vehicle sales in China in July. In the US, EVs accounted for 8.5% of the light vehicle market during the same period, according to the latest S&P Global Mobility figures.

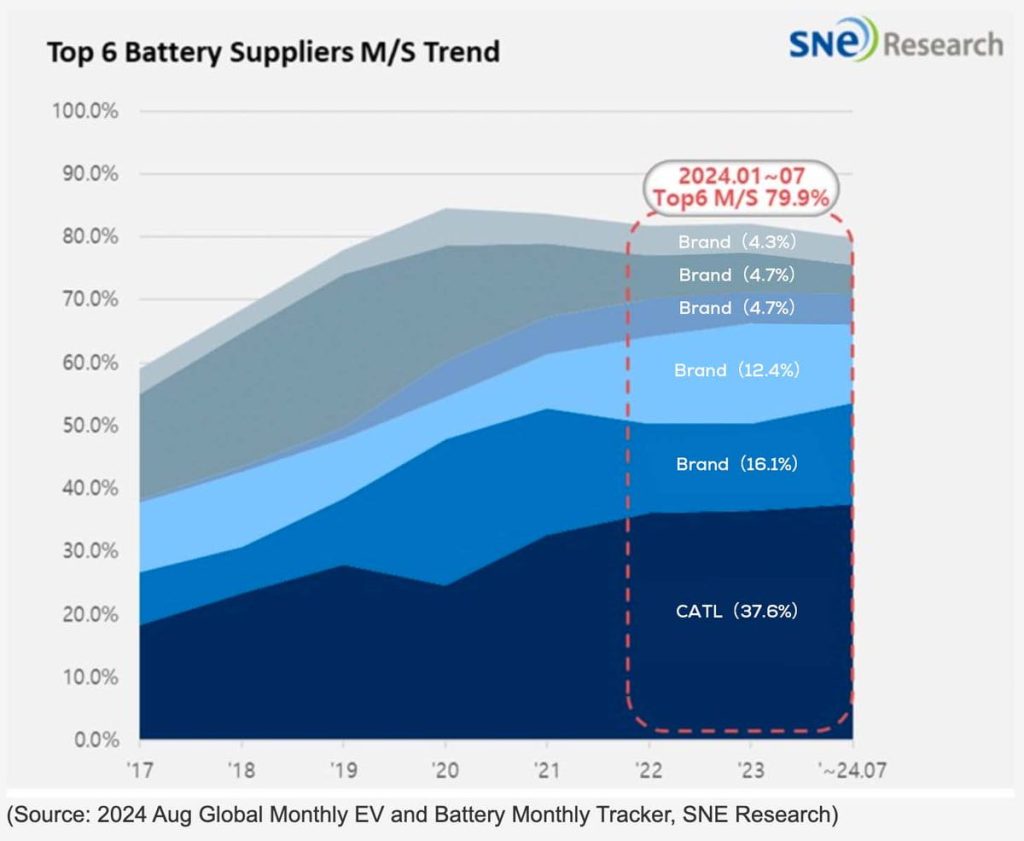

Chinese companies, including BYD and CATL, also dominate the global battery market. According to SNE Research, CATL (35.9%) and BYD (16.5%) led global EV sales in the second quarter based on shipment.

Through the first eight months of 2024, CATL accounted for 37.6% of the global EV battery market, while BYD took second with 16.1%.

Electrek’s Take

BYD is not planning to launch passenger EVs in the US, at least not in the near term. However, McCabe’s comments should spark concern among some US rivals.

As BYD continues launching lower-priced EVs with more range and advanced features, several US automakers continue delaying significant projects.

Ford canceled its three-row electric SUV, opening the door for overseas rivals like Kia and Hyundai to take advantage. GM is also pushing back its battery factory in Indiana and could turn to CATL for LFP batteries in the US, like Ford and Tesla.

Top comment by Brian

“Instead, investing in building a domestic supply chain, as it has with recent legislation, like the Bipartisan Infrastructure Law, will incentivize US automakers. A stable US domestic supply chain would help reduce the price of EVs, lowering the threshold and promoting adoption.”

This is exactly what a small group of extreme right-wing Texas oil drillers don’t want. They are stuffing the pockets of a group of politicians and friendly media outlets to demonize the EV industry, and it’s having a devastating effect on EV sales nationwide.

They and their PR teams are successfully getting mainstream media to include toxic FUD words such as “range anxiety” in every article and video, effectively scaring consumers.

They have made their demonization a political issue, resulting in knuckle-dragging, smooth-brained pickup truck owners to block public charging stations.

This polarization and FUD is protecting the status quo by dominating a false narrative. It saddens me. It’s caused companies like Ford to retreat, allowing foreign competitors to step into the void. Will a once in a lifetime opportunity be lost forever?

Ford is shifting its focus to smaller, more profitable EVs after seeing the success of Chinese automakers like BYD. Ford’s CEO Jim Farley called BYD’s Seagull “pretty damn good” as he warned rivals of BYD’s advantage.

The fact is tariffs will likely only lead to more EV delays, putting the US further behind as the global auto industry shifts to electric.

Instead, investing in building a domestic supply chain, as it has with recent legislation, like the Bipartisan Infrastructure Law, will incentivize US automakers. A stable US domestic supply chain would help reduce the price of EVs, lowering the threshold and promoting adoption.

Source: Nikkei

FTC: We use income earning auto affiliate links. More.

Comments