CATL is the world’s largest electric vehicle battery maker for a reason. New tests from Morgan Stanley show CATL’s EV batteries significantly outperformed the competition with the lowest degradation.

CATL EV batteries show the lowest degradation

In 2025, Morgan Stanley forecasts global energy storage installations will reach around 600 GWh, rising to over 900 GWh in 2026.

Controlling battery degradation will be key to developing a competitive dollar-per-cycle product, Morgan Stanley said.

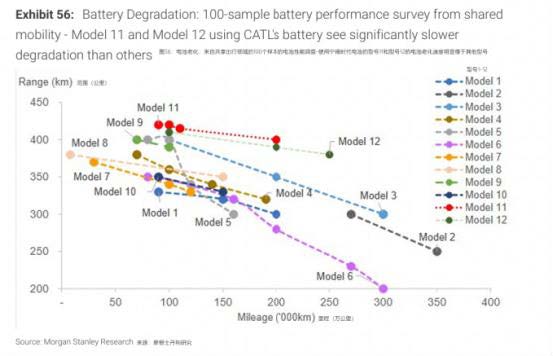

During recent tests, Morgan Stanley found that CATL’s lithium-ion batteries had the lowest degradation, “significantly outperforming competitors.”

After 2 million kilometers (1.25 million miles), CATL’s EV batteries retained about 400 km (250 mi) of range. Competitor cells, on the other hand, retained considerably less, at around 350 km (218 mi) and less.

The data is based on 12 electric vehicles, 100 sample batteries, and real-world applications across four major cities in China. You can see in the chart from Morgan Stanley Research that Models 11 and 12, which use CATL batteries, exhibit considerably slower degradation than the other suppliers.

For example, CATL is one of four LFP battery suppliers at the Zhangbei National Wind-Solar-Storage Demonstration Project in China. CATL’s batteries are the only ones that have never been replaced, retaining over 90% of residual capacity after 14 years.

CATL was also the first to deploy an LFP battery with more than 12,000 cycles in Jinjiang in 2020. The system it’s used in is expected to last over 20 years at 1.5 to 2 cycles per day.

Morgan Stanley highlights that in 2024, CATL’s warranty provision ratio was 3.8% with just 0.2% actual claims, the lowest in China.

The tests deem CATL’s 587 Ah cell to be “the optimal solution” for energy storage, as a safe, long-lasting, and efficient option. After it began mass production at its Jining plant in June 2025, CATL has already shipped over 2 GWh. The large-scale production plant is capable of producing over 220,000 battery cells per day, with cycle times of under 2 seconds.

CATL can produce the cells at a 42% lower cost with PPB-level safety, which Morgan Stanley said “reinforces CATL’s leadership in next-generation storage technologies.”

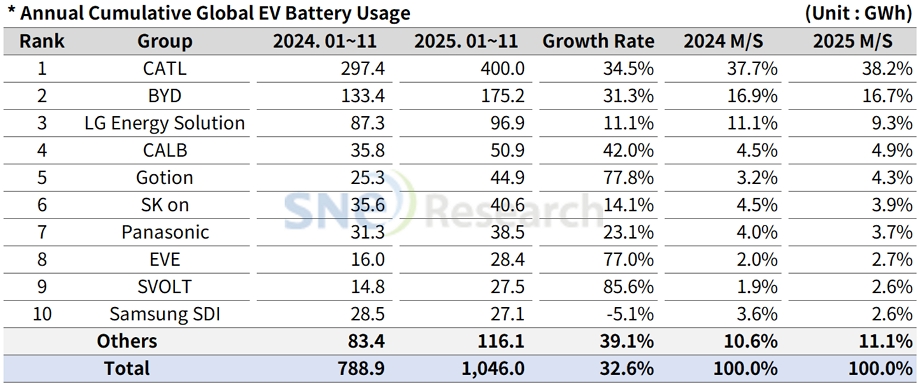

According to the latest data from SNE Research, CATL dominated the global EV battery market through the first 11 months of 2025, holding a 38.2% share. China’s BYD was second with a 16.7% share. CATL supplies EV batteries for major OEMs, including Tesla, BMW, Mercedes-Benz, and Volkswagen. It also provides batteries for commercial vehicles and large-scale energy storage systems.

Last month, CATL said its sodium-ion batteries will be ready for large-scale use by the end of 2026. The new batteries will be used for battery swapping, passenger vehicles, commercial vehicles, and energy storage.

FTC: We use income earning auto affiliate links. More.

Comments