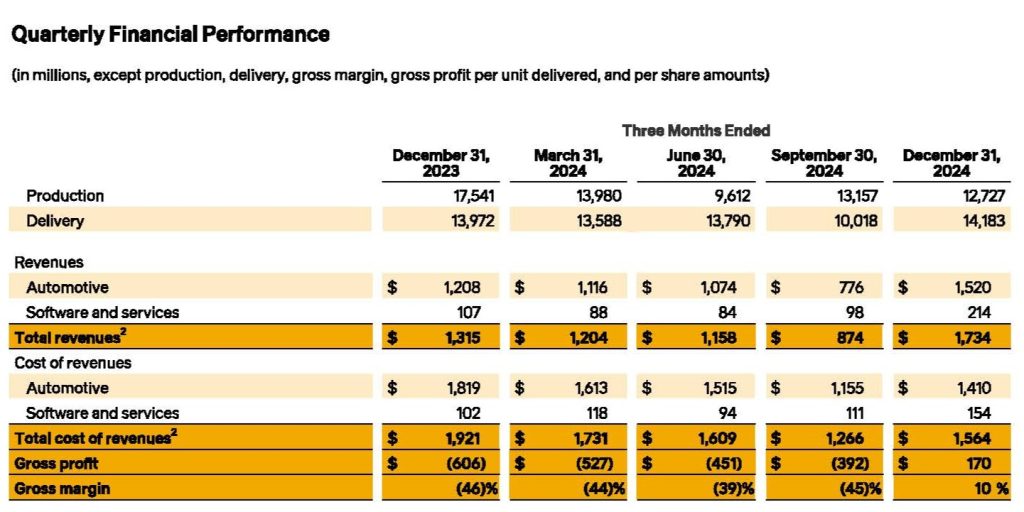

Rivian (RIVN) hit its goal of achieving a positive gross profit in the fourth quarter. The EV maker released its fourth-quarter earnings after the market closed on Thursday. Here’s a full breakdown of Rivian’s Q4 2024 financials.

Rivian achieves first gross profit in Q4 2024 earnings

Yesterday, in our Q4 earnings preview, we noted that the biggest thing investors will be looking for is if Rivian will achieve a positive gross profit as it has guided all year.

Rivian hit its goal, posting a gross profit of $170 million in the fourth quarter, a $776 million improvement from Q4 2023. Of which, $100 million was from auto sales, and the other $60 million was from software and services.

Lower costs, including per vehicle delivered, drove the achievement. In addition to plant upgrades, Rivian saw a noticeable cost improvement after launching its second-generation R1 models.

Rivian posted total fourth-quarter revenue of $1.73 billion, easily topping Wall St expectations of $1.4 billion. Total automotive revenue was $1.52 billion, primarily from the 14,183 vehicles Rivian sold in the quarter. Rivian also generated $299 million from the sale of regulatory credits and $484 million from software and services.

- Rivian Q4 2024 Revenue: $1.73 billion vs $1.4 billion expected

- Rivian Q4 EPS loss: 0.46 loss per share vs 0.68 loss per share expected

CEO RJ Scaringe said, “This quarter, we achieved positive gross profit and removed $31,000 in automotive cost of goods sold per vehicle delivered in Q4 2024 relative to Q4 2023.”

Rivian generated $110 million in automotive gross profit in the quarter compared to a loss of $611 million in Q4 2023. For the full year, Rivian generated a negative automotive gross profit of $7 million, an improvement from the $12 million loss in 2023.

The EV maker produced 49,476 vehicles at its Normal, IL plant last year and delivered 51,579. That includes the R1S SUV, R1T pickup, and electric delivery van (EDV) for Amazon. Earlier this month, Rivian also opened orders for its Commercial Van for customers outside Amazon.

Rivian posted a net loss of $743 million in the fourth quarter, down from an over $1.5 billion loss in Q4 2023. For the full year, Rivian posted a net loss of $4.75 billion, down from $5.43 billion in 2023.

The next growth stage

During the fourth quarter, Rivian also closed its EV joint venture with Volkswagen. The deal is worth up to $5.8 billion, of which Rivian says $3.5 billion is expected to be received over the next few years. Rivian will supply its EV architecture and software for Volkswagen’s next-gen models.

The first will be Rivian’s midsize R2, a smaller, more affordable electric SUV. It will start at around $45,000, or nearly half the current R1S ($77,700) and R1T ($71,700).

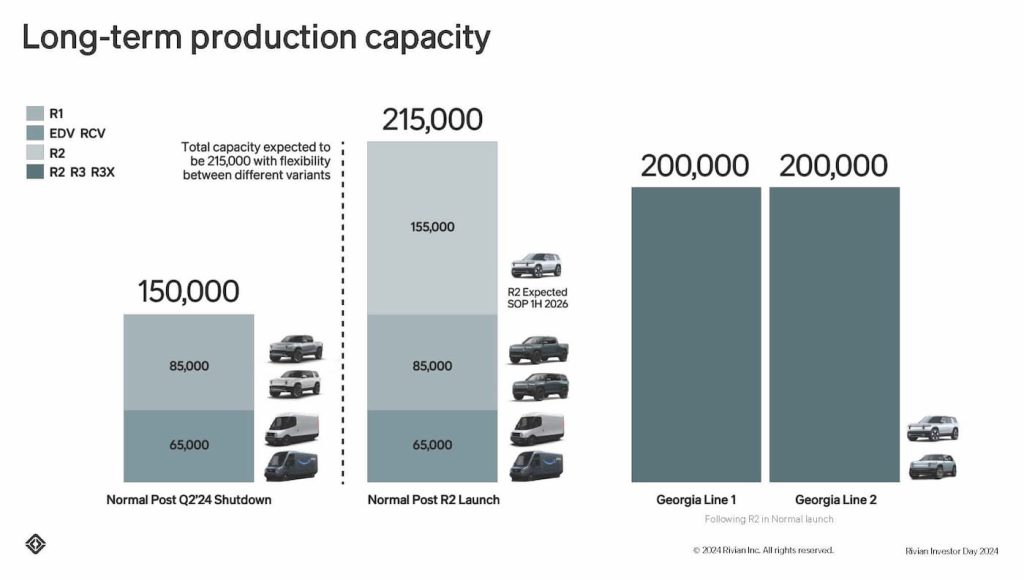

Rivian plans to begin R2 production in Normal early next year, but it expects to significantly scale up with its new manufacturing plant in Georgia.

Although it closed its loan agreement with the US DOE for up to $6.6 billion right before Trump took office last month, Georgia Gov Brian Kemp said this week he’s unsure where the funding stands.

Rivian is still confident the funds will be available when they draw on them next year. The plans include building the plant in two stages, each adding 200,000 units of capacity. Rivian’s upcoming R2 and even smaller R3 are “critical drivers in the company’s long-term growth and profitability.”

The company said on Thursday that the DOE loan and capital from the VW partnership, in addition to its current cash and equivalents, “is expected to provide the capital resources to fund operations through the ramp of R2 in Normal, as well as the midsize platform in Georgia—enabling a path to positive free cash flow and meaningful scale.”

Rivian remains focused on cutting costs, improving efficiency, and launching its mass-market R2 electric SUV. The first R2 development vehicles recently completed winter testing. Meanwhile, Rivian is currently expanding its Normal manufacturing plant to prepare for the R2 launch in the first half of 2026.

Scaringe said, “I couldn’t be more excited about R2, and I believe the combination of capabilities and cost efficiencies, along with the amazing level of excitement from customers, will make R2 a truly transformational product for Rivian.”

| Q1 2024 | Q2 2024 | Q3 2024 | Q4 2024 | Full-Year 2024 | 2025 guidance | |

| Deliveries | 13,588 | 13,790 | 10,018 | 14,183 | 51,579 | 46,000 – 51,000 |

| Production | 13,980 | 9,612 | 13,157 | 12,727 | 49,476 | N/A |

Despite this, Rivian expects lower deliveries of between 46,000 and 51,000 in 2025 due to external factors, including changes in government policies and regulations. After delivering more EDVs to Amazon in Q4, Rivian expects lower volume in 2025

Top comment by Dean C.

This is great to hear. Rivian seems like a very well-run company. Their partnership with VW is interesting (and lucrative). It's curious that one of the world's largest automakers (VW) can't build their own EV platforms -- choosing to outsource core technology to a tiny automaker, paying them $5.8 billion in the process.

I'm sure it makes sense... I'm just curious why.

The company expects an adjusted EBITDA loss between $1.7 billion and $1.9 billion, with Capital Expenditures of $1.6 billion to $1.7 billion.

With “meaningful” improvements, including operational efficiencies and reduced variable costs, in addition to higher selling prices with its Tri-Motor model hitting the market, Rivian expects to achieve a modest gross profit in 2025.

Rivian ended the quarter with $7.7 billion in cash and equivalents. Including other capital, the company ended the year with slightly over $9 billion in liquidity.

Check back for more updates from Rivian’s fourth-quarter earnings call. We’ll post updates below.

FTC: We use income earning auto affiliate links. More.

Comments