After the EU announced new tariffs on Chinese EV imports, BYD is subject to an additional 17.4% duty. However, with BYD reportedly generating higher EV profits on models like the Seal U in the EU than in China, the EV leader is expected to overcome the impact.

BYD announced it would enter the European car market in 2020. After launching in Norway in 2021, BYD showcased its EV lineup, including the Atto 3, Han, and Tang models.

Since then, BYD has strategically expanded in the region, adding models like the Dolphin and Seal. Last year, the Atto 3 was BYD’s best-selling EV in Europe, with 12,363 models sold. It was followed by the Dolphin (1,079), Tang (1,055), and Han (849).

However, BYD sees sales accelerating over the next few years after learning more about the EU market.

The high expectations come despite new EU tariffs on imported EVs from China. After global markets became “flooded with cheaper electric cars” from China, EU Commission President Ursula von Der Leyen announced an investigation in October.

After finding that Chinese EVs benefit from “unfair subsidization,” the EU pre-disclosed additional tariffs that it plans to impose on automakers this week.

BYD EV profits are still higher in the EU with tariffs

The additional Tariff for BYD is 17.4%. If no other resolution is found, it will be applied on July 4, 2024.

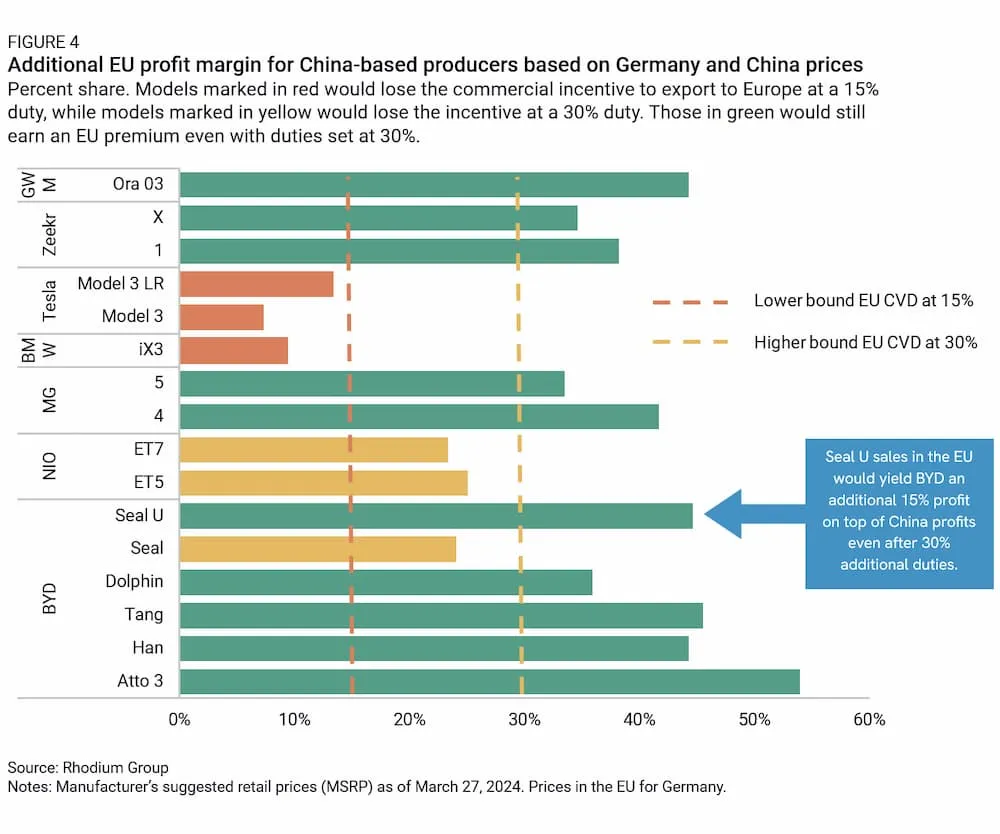

Meanwhile, recent research from Rhodium Group shows the tariffs may not be enough to slow BYD and other Chinese EV makers from gaining market share.

According to the study, duties in the 40 to 50% range, or even higher, would likely be needed to slow the momentum.

An increasingly competitive Chinese market has led to aggressive price cuts. As a result, many electric cars sell for much more in the EU than in China. And it’s not just Chinese automakers.

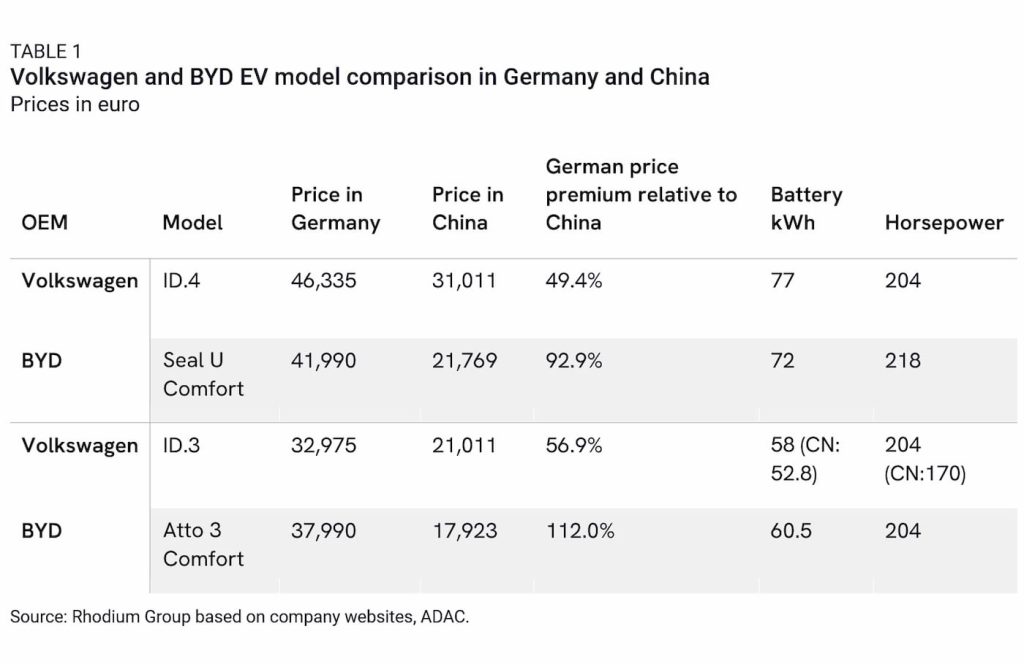

Volkswagen’s ID.4 sells for around 50% more (46,335 euro vs 31,011 euro) in Europe than in China. BYD’s Seal U (Comfort) costs nearly 93% more (41,990 euro vs 21,769 euro). The same goes for other popular models like the BYD Atto 3 (+112%) and Volkswagen ID.3 (57%).

According to Rhodium’s price analysis, BYD makes around 14,300 euros ($15,360) on each Seal U model sold in the EU. In China, BYD earns a profit of 1,300 euros ($1,400) for each model sold.

Based on MSRPs (after shipping, tariffs, distribution, and VAT), BYD earns 13,000 euros ($14,000) more on every Seal U model sold in the EU (the “EU premium).

The EU would need to drastically increase tariffs to reduce the incentive to export. Even a 30% duty would leave BYD with a 15% profit, or 4,700 euros ($5,050) compared to China.

Top comment by Gresteh

That study assumes that the car has the same features in China and the EU and that may not be true as the export version may have different materials and features to comply with different standards. Comparing prices in the EU and China for a car with the same name is not the right way to do an study like this one you have to disassemble both versions to do a proper cost analysis as only a proper teardown will provide you with a complete bill of materials, if both versions are the same then yes, there is a huge profit there, if they are different then you would have to calculate the actual cost of the car in order to calculate profits.

Most assessments like this one are purely superficial, they don't really do a cost analysis or even check if the car is the same other than having the same name nor they consider things like importer margins, homologation costs, differences in safety standards, equipment differences... al that can add to the final cost and significantly reduce profits.

Tariffs around 45% to 55% might be needed to lower profits. However, it would also likely hurt foreign automakers even more, such as BMW and Tesla, which export from China.

BYD’s CEO, Wang Chuanfu, called the US and Europe “afraid” of Chinese EVs last week. “If you are not strong enough, they will not be afraid of you,” he added.

Wang said the tariffs are a testament to China’s auto industry strength. With BYD’s first factory in Europe set to begin production later this year, the EV maker expects to overcome the potential impacts of higher tariffs.

Source: CarNewsChina, Rhodium Group

FTC: We use income earning auto affiliate links. More.

Comments