Rivian has been one of the few EV makers (or automakers in general) to avoid cutting prices. That trend will likely continue. According to Rivian’s CEO, RJ Scaringe, new orders are driving up the average sales price (ASP) on its vehicles.

A day after Rivian easily beat Q3 earnings expectations as several of its peers faltered, Scaringe said average selling prices continue to “trend upwards.”

In an interview with Bloomberg TV, Rivian’s CEO explained, “There’s an evolution of our average selling price which continues to trend upwards as we move in to new orders.”

Rivian’s gross profit per vehicle delivered has improved all year. The EV maker lost about $31K for every vehicle delivered in the third quarter. Although that’s still a big deficit, it’s a significant improvement from last year’s Q3 loss of $139,277 per vehicle.

“There’s a whole host of changes that are happening in our material costs,” Scaringe explained.

He attributed improvements in material costs, plant upgrades, and “fixed cost absorption from running higher volumes” to the narrowing losses.

| Q3 ’22 | Q4 ’22 | Q1 ’23 | Q2 ’23 | Q3 ’23 | |

| Rivian loss per vehicle | $139,277 | $124,162 | $67,329 | $32,594 | $31,000 |

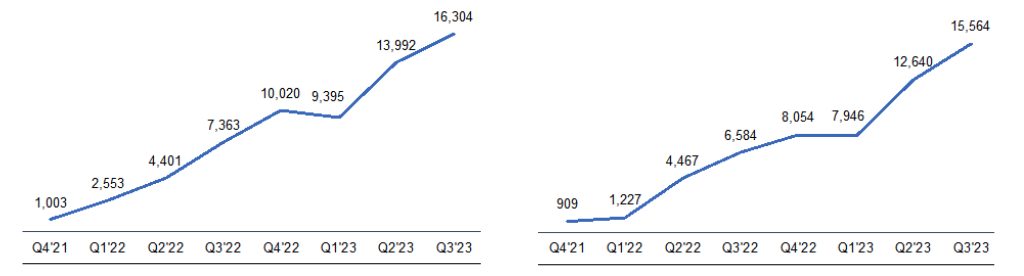

After building 16,304 vehicles in the third quarter, Rivian raised its 2023 production guidance to 54,000. Rivian’s deliveries also rose 24% in Q3.

Meanwhile, Rivian is still working through its backlog of early orders, many of which were around $20K less than current prices.

Rivian’s average selling price per vehicle is higher

On Tuesday, Rivian’s CFO Claire McDonough explained on the company’s earnings call that we will see the “full impacts” of new technology (like its in-house Enduro motors) driving down material costs next year.

Following a shutdown in the second quarter of 2024, Rivian plans to introduce “a number of new technologies to the R1 platform.”

Rivian believes the changes will “meaningfully reduce our material costs and position Rivian to exit 2024 with a much-improved margin profile.”

The downtime will impact two quarters (Q2 and Q3), but Q4 will become the “run rate potential for the business.” Rivian will ramp up both R1 and commercial volumes.

Furthermore, “those elements come together in connection as well with Rivian fulfilling our pre-3/1/2022 preorders.” McDonough added, “which also results in a step change in our average selling price of the vehicle over that period of time as well.”

Rivian also ended its exclusivity deal with Amazon, enabling it to sell its electric delivery vans to anyone. Scaringe said the company was in talks with a “pipeline” of potential customers.

The EV maker will unveil a prototype of its R2 compact electric SUV in early 2024. The R2 lineup will be cheaper but “just as much as Rivian.”

Electrek’s Take

So, is the EV market “slowing,” as many media outlets claim? Rivian seems to be debunking that theory.

The automaker continues seeing higher demand for its vehicles despite the +$70,000 price tag. Not only that, it has consistently improved the profitability of its vehicles.

Other automakers, including Ford and GM, have delayed investments, but Rivian’s vehicles are unique. The automaker sells an electric adventure vehicle designed from the ground up as a functional all-electric workhorse.

Between rising interest rates and Tesla’s price cuts this year, many automakers are struggling to keep up.

With Tesla’s Model Y starting at $43,990 and leases starting at $399 per month, Tesla is squeezing other models like Ford’s Mustang Mach-E out of the segment.

Rivian and Tesla are driving up demand with unique products offered at a value to the customer. With new affordable electric models hitting the market next year, including the Volvo EX30 (see our review), expect EV demand to continue climbing even higher.

FTC: We use income earning auto affiliate links. More.

Comments