It’s common knowledge that Norway is the land of electric cars and that the country keeps breaking EV sales records with virtually no new fossil vehicle sales. But what’s really important is the effect those EVs are having on oil sales, which are in steep decline in the country as a result – and the same thing could happen elsewhere.

Norwegian statistics agency SSB released its latest numbers on motor fuel sales today, showing a whopping 9% decline in motor fuel sales year-over-year for the month of September.

This is a result of Norway’s world-leading EV sales, with over 90% of new vehicles in the country having some sort of plug and vanishingly few having no electrification at all. The country has exceeded its own high expectations, virtually ending fossil vehicle sales years ahead of schedule.

However, there are still fossil vehicles on the road from previous years that are continuing to pollute and use fossil fuels throughout their lifecycle. But as they age and are replaced almost solely with EVs, the vehicle fleet cycles out from fossil to electric. If it takes 10-15 years for the vehicle fleet to cycle out, then that means Norway would remove ~6-10% of fossil cars from the road every year, replace them with electric cars, and thus reduce motor fuel usage by a similar amount every year.

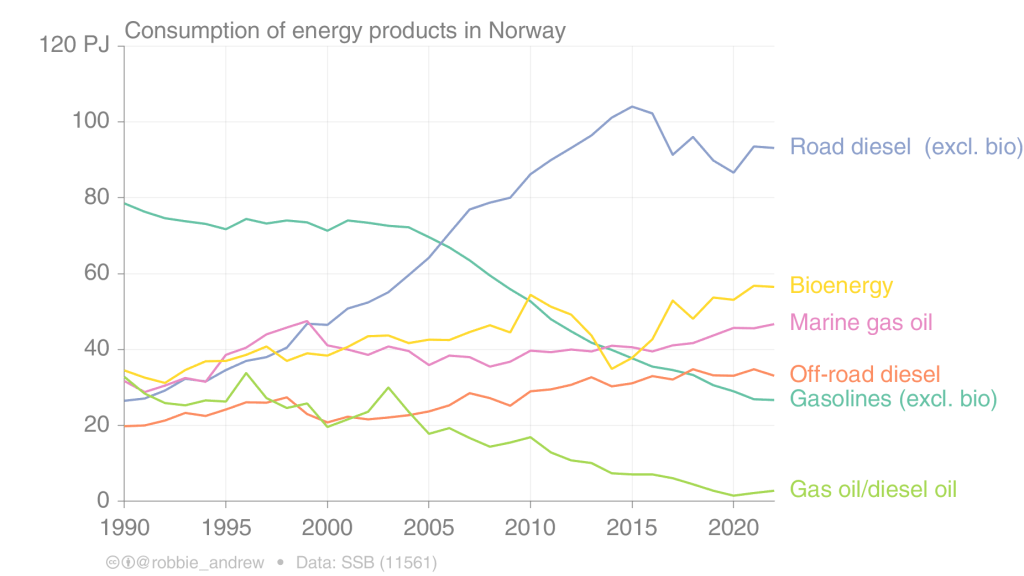

But this trend is nothing particularly new. While this big 9% drop is just a one-month snapshot, petrol/gasoline sales have been in decline for about two decades in the country, as diesel started to replace petrol in the mid-2000s. But diesel has also been in decline for the better part of a decade, as electricity has replaced it as a motor fuel.

To compare against other rapid declines, US coal usage has gone from a peak of 1,045 million tons in 2007 to 469 million tons in 2022, a decline of about 5% per year (and going from ~50% of the US electricity mix to ~20% now, and dropping). Many observers acknowledged, even near the beginning of this trend, that coal was a dead industry. Any subsequent attempts to expand it have been unserious political stunts that were doomed to fail from the start – everyone (with a brain) knows the industry is dead.

But in that context, Norway’s decline in motor fuel sales seems to be happening almost twice as fast on a percentage basis as the United States’ decline in coal use, at least according to today’s data point. And the long-term trend may accelerate as the country now has virtually no gas vehicle sales.

This is important because when we talk about electrifying the auto industry, the point is not just to get people into better cars with neat new technology. The point is to reduce oil consumption, such that carbon that belongs underground stays there – permanently.

This is vitally important because if we burned even a fraction of all the oil that is already discovered and owned by oil companies, the carbon released would cause catastrophic climate change. This was covered in Bill McKibben’s excellent 2012 article “Global Warming’s Terrifying New Math.”

The only way we can avoid this fate is through one of the more wonderful phrases in the English language: “stranded assets.” In this context, the phrase refers to oil reserves owned by oil companies which get written off of those companies’ books because they are uneconomical to extract and sell.

In short, oil companies need to lose money, and lots of them need to go bankrupt.

And while Norway is just one relatively small country, news like this shows how that could happen as EV sales (and better yet, even cleaner methods of transportation like e-bikes and public transit) grow rapidly worldwide.

Oil demand -> oil prices -> oil supply

There is an interplay between oil demand, oil prices, and oil supply that could lead to a death spiral for the oil industry.

Lately, oil prices have been quite high around the world, nearing the historic highs of the 2010s and late 70s. This spike has largely been driven by pandemic-related supply (and demand) disruptions, the Russian invasion of Ukraine, and, as always, the decisions of Saudi Arabia (in this case, their decision to cut supply to buoy oil prices).

But looking back to the last peak, we can see another interesting thing: a giant drop in oil prices in the mid-2010s, which was driven by a “supply glut.” This supply glut was at least partially related to increased usage of hybrid and electric cars, which led to a relatively small decrease in oil demand. However, that small decrease meant that more oil was being pumped than used, which led prices to drop by about two-thirds in a matter of months.

The effect of oil prices on consumer demand is that as oil prices go up, usage (often) goes down, and interest in electric cars goes up. This stands to reason, as people start thinking about more efficient vehicles when the cost of fueling their vehicle becomes too much.

But the effect on supply is less popularly examined. In this case, low oil prices can actually be environmentally advantageous because it means that oil companies are less incentivized to explore new methods of extraction and that more expensive methods (such as tar sands extraction, which is also much more environmentally costly) become uneconomical.

If it costs more to extract the oil than the oil is worth, then the project won’t get started. And if the project doesn’t get started, then the oil stays in the ground to begin with, right where it belongs.

So, in a way, low oil prices can actually be better for the environment than high oil prices. This means fewer projects get started, and more projects and companies go bankrupt due to high costs and low profits.

And this is the spiral that we want to see. As the primary driver of oil demand (vehicles, specifically consumer vehicles) disappears, oil prices can drop because of this supply-demand imbalance. Then, there will be less reason for companies to extract oil in the first place, leading to the stranded assets we spoke of before.

Some regions with low cost of extraction might even prefer it this way and work to ensure this happens. The Middle East can extract oil for cheaper than anywhere else, so it could be to their benefit to put high-cost extraction methods out of business. Norway itself is an oil country (primarily for export, at this point) and has middling oil-extraction costs, but it may benefit in the short term from a shakeout of higher-cost countries. But ideally, Norway’s extraction would soon become uneconomical – and hopefully, so will Saudi Arabia’s.

Top comment by jrharbort

There's another way the supply and demand story can go, and is already heading that direction in the U.S. due to our much larger impact on the oil industry.

Every day in the U.S. now there is enough EVs sold displace an entire gas station-worth of fuel. Per day. And this is rapidly accelerating.

Gas stations already don't make much profit on selling just gas, so what can they do to continue making profit when less gas is being sold? They are forced to raise prices.

Gas stations and their operating oil companies look at the short term profits, not the long term. They're not going to engage in a long term low price war in the hopes that people buy more gasoline cars. They know that is coming to an end.

Additionally, lowering prices wont help in the short term with selling more gas as people already can't buy more than their tanks can hold.

All they'll keep doing is raising prices to compensate for less gasoline sales, which will push more and more people to EVs. It's a vicious cycle where the oil industry will die by thousands of self-inflicted cuts.

The one danger of this path is that if oil demand does drop low enough, low oil prices could jeopardize consumer decision-making to move to cleaner options. Oil is subsidized to the tune of trillions of dollars worldwide per year based on unpriced external costs that all of us are paying on the back end – usually in the form of higher hospital bills or other environmental costs.

This could be solved by finally properly pricing oil globally, as Norway already rightly does. Norway’s realistic pricing for carbon pollution has helped to ensure that the true price of oil is reflected in consumer pricing, making it more apparent to consumers that fossil vehicles are not an economical option for society or their pocketbooks.

In contrast, the artificially low gasoline costs in the US (yes, US gasoline prices are still artificially low, even at today’s “high” prices) work to buoy consumer oil demand. Removing the ~$650 billion in implicit subsidies received by the fossil fuel industry in the US alone would help ensure that fair market conditions could prevail, and consumers would have a clear choice about what the better and cleaner option is.

And if we finally let the market work freely, after more than a century of both direct and implicit oil subsidies that have coddled this lying, deadly industry, we could finally see it spiral into the oblivion it deserves.

FTC: We use income earning auto affiliate links. More.

Comments