Ford Motor released Q2 earnings after market close on Thursday, saying, “EV adoption will be a little slower than expected.” The automaker is pushing back its 600,000 EV run rate goal until next year.

Ford’s second-quarter earnings preview

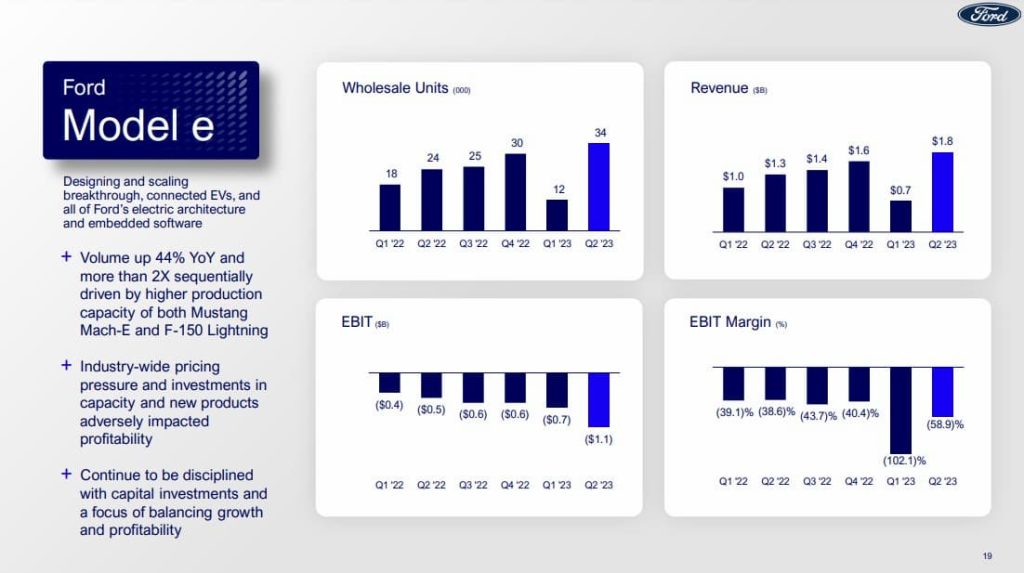

After losing $2.1 billion last year, operating losses grew to $722 million (more than doubling YOY) at Ford’s Model e EV business in the first three months of the year.

Ford’s model e unit generated $700M in revenue, down 27% from the previous year as operating margins fell drastically.

EV sales slipped in the second quarter after Ford faced downtime at its plant in Mexico, where the Mustang Mach-E is produced. As a result, Mach-E sales are down 20% YTD. Sales of Ford’s electric truck, in the meantime, more than doubled to 4,466 in Q2.

The American automaker slashed F-150 Lightning prices earlier this month by nearly $10,000 off certain trims, which could impact margins further.

Ford has already said it expects a full-year loss of $3 billion for its Model e business – it will be worth seeing if Ford adjusts it.

Meanwhile, rival General Motors beat Q2 expectations and raised guidance for the second time this year. So guidance will play a significant factor.

Ford Q2 2023 EV earnings and financial results

Ford Model e reported revenue of $1.8 billion in Q2 2023, more than doubling from last year. However, operating losses reached a massive $1.08 billion while operating margins were -58.9%.

The automaker is now expecting a loss of around $4.5B for its Model e unit for 2023, citing the evolving pricing environment, new investments, and other costs.

Ford’s CEO Jim Farley said, “The near-term pace of EV adoption will be a little slower than expected, which is going to benefit early movers like Ford.”

Farley added, “The shift to powerful digital experiences and breakthrough EVs is underway and going to be volatile, so being able to guide customers through and adapt to the pace of adoption are big advantages for us.”

Top comment by Triangulatorr

These #s don't look good, however long term, I think they'll be fine. As volume increases, costs decrease. NACS connector and SC network access should help also, esp. compared with any brand that doesn't have that!

Down the road, they'll have more models and are likely to iterate for cost.

There are some other automakers that I think will not be fine because they're transitioning too slowly.

With this in mind, Ford is moving its 600,000 annual EV production goal to 2024 (initially expected to be achieved by the end of the year), citing that it “will maintain flexibility, balancing growth and profitability, on the way to attaining a two million run rate.”

The automaker said it had completed the capacity expansion for the Mustang Mach-E, suggesting we should see sales start to pick back up into the second half of the year.

Furthermore, Ford says LFP batteries are now offered in the Mustang Mach-E and coming to the Lightning in 2024, which will help lower costs. The automaker will be the first OEM with an LFP plant in North America.

Overall, Ford raised its company-wide guidance for the year as it expects adjusted EBIT between $11 billion and $12 billion and adjusted free cash flow between $6.5 billion and $7 billion.

FTC: We use income earning auto affiliate links. More.

Comments