Japanese automaker’s reluctance to go all-electric is already taking a toll on the nation’s auto industry. Mitsubishi Motors revealed this week it’s suspending operations in China due to its inability to keep up as EVs continue to take over the market.

China continues to lead the industry in the transition to EVs. Information from the China Association of Automobile Manufacturers (CAAM) shows battery electric passenger vehicle (BEV) sales reached over 2 million through the first five months of the year, up 51.5% YOY.

Meanwhile, CAAM reported sales of gas-powered dropped by 7% through the same period. Many analysts believe the momentum will continue.

Bank of America Securities’ head of Asia Pacific basic materials, Matty Zhao, sees China’s EV market growing another 27% this year, reaching 32% of overall auto sales, up from 26% last year. Some are predicting that number can grow to 50% in the next two years.

The shift comes after the Chinese government supported the transition with tax breaks for EV buyers, subsidies, and other policies that sparked growth in domestic EV makers.

Perhaps more importantly, China is making it harder to buy gas vehicles. The nation is implementing stricter vehicle emissions standards, pressuring automakers to transition their lineups and clear ICE vehicle inventory.

The new rules will ban production, sales, and imports of vehicles that do not comply, pressuring domestic and foreign automakers to go electric.

Mitsubishi, Japanese EV laggards fall behind in China

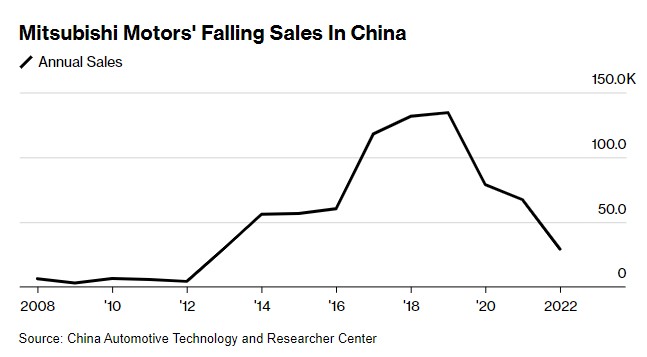

According to a memo released this week (via Bloomberg) making the rounds on Chinese social media, Mitsubishi’s sales have fallen drastically as China’s auto market moves to EVs, causing the automaker to suspend operations in China indefinitely.

The memo states:

In the past few months, management and shareholders have tried to the best of our ability, but due to market conditions and with great reluctance and regret, we must seize the opportunity to transition to new energy vehicles. The company will resurrect after going through trials and tribulations.

Mitsubishi cited China’s transition from ICE vehicles to EVs as the reason why sales are falling, coming in well below expectations.

After peaking in 2019 at around 134,500, Mitsubishi’s sales have nearly vanished in the region, with only 34,500 sold this past year. Its sole EV, the Airtrek electric SUV, sold only 515 units.

And Mitsubishi is not the only Japanese automaker feeling the heat after dragging its feet on EV tech.

Honda, Mazda, and Nissan’s sales have fallen for at least two years, and in 2022, Japan’s largest automaker, Toyota, saw sales decline for the first time in a decade.

Top comment by Blankpoint

Well, Mitsubishi is in steep decline long before the EV transition began, the once leader in commercial vehicles now holds only a fraction of the market share it used to have.

Since its alliance with Daimler Benz, then Nissan Renault, and now Stelantis, its portfolio is stagnant with products that rival Tesla's Model S/X in age.

So, the exit of the Chinese market is hardly a surprise, and cannot be attributed to lack of EV´s

Mazda CEO Masahiro Moro echoed Mitsubishi’s statement on China, saying this week, “Production output will be low for the time being while pressure on profits is increasing.” Although Mazda doesn’t plan to scale back, he said, “The important thing is to turn the tide and introduce electric vehicles one by one.”

Seeing the success EV makers like Tesla and BYD are having, nearly all Japanese automakers (almost all legacy automakers, in fact) have advanced plans to go electric.

Mitsubishi revealed plans in March to electrify its entire lineup by 2035, including four new EVs. Honda overhauled its business operations to ramp up EV efforts earlier this year. Nissan accelerated its strategy in February. And Toyota is now planning its own dedicated EV platform and next-gen batteries that are expected to improve range and efficiency.

To help boost domestic battery output, the Japanese government is awarding nearly 120 billion yen ($847 million) to fuel Toyota’s battery development plants.

FTC: We use income earning auto affiliate links. More.

Comments