Nearly six months into its Accelerator crowdfunding program, solar EV startup Aptera is putting a pause on new investments while it files requested paperwork with the Securities and Exchange Commission (SEC). As a result, many of the loyal believers that make up the Aptera community and have helped get the company this far will no longer be able to invest unless they meet certain criteria.

Aptera first launched the Accelerator Program in late January, one week after officially debuting the Launch Edition version of its flagship solar EV. The unique program enables reservation holders to invest in Aptera in exchange for a secured production slot of the first 2,000 solar EVs off the assembly line. In return, that funding empowers the startup to purchase initial production equipment to be paid back through an awarded grant from the California Energy Commission (CEC).

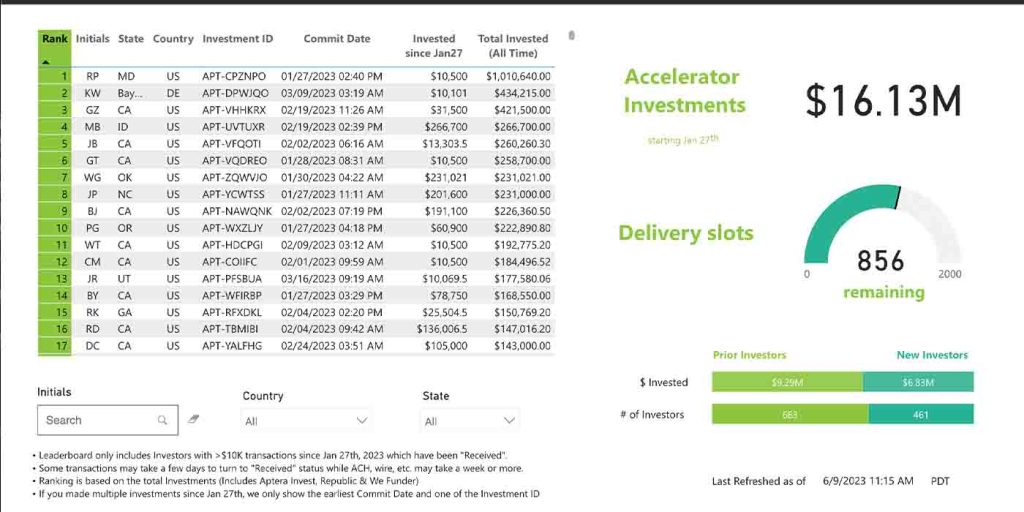

By February, Aptera announced it was extending the program without end until all of the Launch Edition solar EVs were spoken for. We have followed the program’s progress and reported back to you along the way. To date, over 1,110 individuals have committed to investing at least $10,000 each, for a total eclipsing $16 million.

Although over 850 build slots still remain, Aptera shared that it is halting the Accelerator program this weekend, but there is still time to invest.

Aptera will soon only allow accredited people to invest

An email signed by co-founders Chris Anthony and Steve Fambro went out to reservation holders today stating the following:

A lot is happening at Aptera right now and we’re moving swiftly to bring solar mobility to the masses. Through the Accelerator Program, we have surpassed our crowdfunding expectations and over 1,100 trailblazers have joined the effort to accelerate Aptera’s path to production.

To continue our Crowdfunding, the SEC requires us to temporarily pause and file updated documentation. We wanted you to know first that the window for investing in Aptera as a non-accredited investor will be closing soon. We will only continue to accept investments from non-accredited investors here until midnight PDT on Sunday, June 11, 2023.

During this temporary pause, we will still take investments from accredited investors through a Reg D offering at invest.aptera.us. So, if you want to join the future and are an accredited investor, you still can invest during this time.

We’re humbled by the support of so many people who share our commitment to creating a better future for people and our planet.

Aptera was not initially super specific about what sort of files and documentation needs to be updated with the SEC, but in speaking with Electrek, a representative for the company elaborated on the reasoning behind the decision:

At our current pace, we will be oversubscribed in few weeks. So we had to pause this and file an amendment with the SEC to increase the amount we can raise. This will prevent us from have to shut things down abruptly and we can close out the Accelerator strong once we have Gamma back in a couple of weeks.

Top comment by Robert Thompson

I really hope Aptera can bring a quality niche product to market and eventually go into mass production in the future. I've been watching this vehicle platform for a while now and would hate to see it fizzle out, after all the ups and downs.

For now, accredited investors will be the only ones allowed to participate in funding the startup following Sunday’s sudden deadline. According to the SEC website, one must fit the following criteria to claim status as an accredited investor:

- Financial criteria

- Net worth over $1 million, excluding primary residence (individually or with spouse or partner)

- Income over $200,000 (individually) or $300,000 (with spouse or partner) in each of the prior two years, and reasonably expects the same for the current year

- Professional criteria

- Investment professionals in good standing holding the general securities representative license (Series 7), the investment adviser representative license (Series 65), or the private securities offerings representative license (Series 82)

- Directors, executive officers, or general partners (GP) of the company selling the securities (or of a GP of that company)

- Any “family client” of a “family office” that qualifies as an accredited investor

- For investments in a private fund, “knowledgeable employees” of the fund

It will be interesting to see how this all plays out and how Aptera responds to this sudden pause in crowdfunding. As one of the most refreshingly transparent startups in the EV world today, Aptera’s founders have spoken quite openly about the startup’s continuous need for funding in order to reach that holy grail that is scaled solar EV production.

Since the Accelerator program began, there has been a steady and consistent trickle of newcomers joining to invest, so it’s a shame that Aptera will not get to see it through to selling out its first batch of vehicles, at least not to those of us who aren’t millionaires (yet).

It will now be up to the professionals and their checkbooks to see Aptera over the finish line. Remember, there’s still time, though. Non-accredited individuals can still invest until Sunday, and as always, you can still reserve an Aptera of your own without the $10,000 commitment.

FTC: We use income earning auto affiliate links. More.

Comments