Rivian (RIVN) released its fourth quarter and full-year earnings results for 2022 after market close on Tuesday, February 28, showing a slight miss on revenue but significantly lower operating expenses as the EV startup moves to cut costs and drive volume.

Rivian EV sales and earnings expectations

CEO RJ Scaringe previously said it was a “challenging year” for Rivian as it ramped production through supply chain issues and product recalls.

Yesterday, we gave you guys a rundown of what you can expect from Rivian’s fourth-quarter 2022 earnings results.

Rivian revealed last month it had produced 10,020 electric vehicles at its Normal, Illinois plant during Q4 while delivering 8,054 during the same period.

For the full year, Rivian produced 24,337 EVs and delivered 20,332, just missing its goal of 25,000. Despite the miss, Rivian’s production is still growing at an impressive rate, given that it only produced 1,015 total vehicles by the end of 2021.

Wall Street is expecting Rivian to report Q4 revenue of $742 million, up from $536 million in Q3, and EPS of ($1.94).

For delivery and production guidance, Wall St expects between 60,000 to 65,000 models for 2023.

Rivian Q4 2022 financial results

After market close, Rivian released its fourth-quarter financial results, showing the company is implementing cost-cutting procedures.

However, as Rivian explains, the company’s cost of goods sold was impacted by short-term premiums on materials and expedited freight charges, which it expects to continue negatively impacting gross margins.

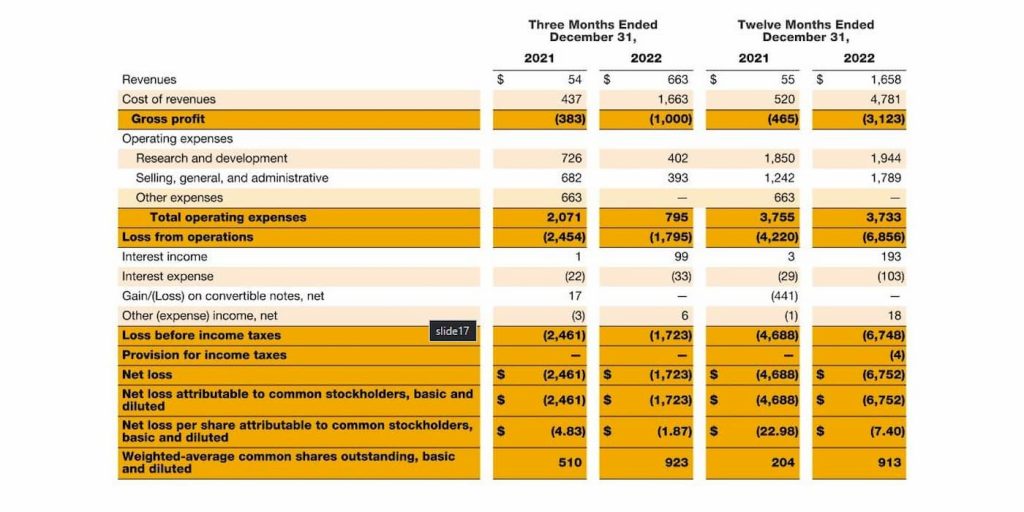

Rivian reported:

- Revenue: $663 million compared to $742 million expected

- EPS: ($1.73) compared to ($1.94) expected

Revenue was up 23% to $663 million compared to $536 million in the third quarter. Operating costs fell to $795 million in Q4 compared to over $2 billion last year.

Rivian generated a negative gross profit of $1 billion in the fourth quarter, which was impacted by a lower cost or net realizable value (LCNRV). Altogether Rivian posted a net loss of $1.7 billion, a decrease from $2.4 billion in the same period last year and about the same as Q3 2022.

Rivian ended the quarter with over $12 billion in cash and equivalents after burning through $1.4 billion in the fourth quarter.

Takeaways from Rivian’s fourth-quarter earnings report

Top comment by Brett Haberle

I am rooting for them and hope they succeed. We could use another company out there. I hope they are able to greatly lower their costs. That being said, they need to lower them enough that they can go back to their original pricing.

Coming into Tuesday, Rivian (RIVN) stock was down about 70% over the past 12 months. The after-hours reaction shows a disappointment, with RIVN falling an additional 8%.

One of the biggest things is guidance; Wall St was expecting about 10,000 more in 2023 delivery guidance, but Rivian is sticking to a modest goal of 50,000. Rivian’s cost-cutting initiatives are working, but investors want to see more from the company’s top line.

The company has sufficient cash to navigate the next phase of its EV rollout, it will come down to execution and staying frugal on its expenses. Rivian says it will be introducing a new battery pack using LFP cell chemistry to broaden its available supply and further reduce costs.

We’ll post any important updates from Rivan’s earnings call below. You can refresh to update.

FTC: We use income earning auto affiliate links. More.

Comments