Ford (F) is slated to release its fourth quarter 2022 earnings after market close on Thursday, February 2, as the auto industry’s shift to electric vehicles heats up. Here’s a rundown of what you can expect.

Ford EV sales in 2022

After ramping up electric vehicle production throughout the year, Ford sold a record 61,575 units in 2022, up 126% year-over-year (YOY), making it the second largest EV maker in the US behind Tesla.

The Ford F-150 Lightning is the best-selling EV truck since its launch in May, selling 15,617 units so far (through December 2022).

Ford is also dominating the electric van market with its E-Transit claiming 73% of the segment selling 6,500 EV vans in 2022. The Mach-E SUV continues building momentum, with sales climbing 45.4% in 2022 to 39,458, making it one of the top-selling EVs of the year.

Is an EV price war coming?

Speaking of the Mach-E, Ford slashed prices earlier this week amid growing speculation of an EV price war on the horizon.

After Tesla dropped the prices across its lineup by up to 20%, the EV maker reported seeing “unprecedented demand,” with many stores breaking records. Although this solved Tesla’s supposed demand problem, analysts predicted it could create a spillover effect with over BEV manufacturers, putting them in a position to compete.

Marin Gjaja, chief customer officer for Ford’s EV division, said this week:

We have to compete. It’s a competitive marketplace, and it just got a lot more competitive because of what Tesla did. We’re not going to cede ground to anyone.

Ford also stated it would significantly ramp production of its Mach-E to meet demand and remain competitive.

Ford Q4 2022 earnings preview

Analysts expect a significant rise in Ford’s fourth-quarter 2022 earnings as the auto industry recovers from supply chain disruptions that have ripped the market over the past few years.

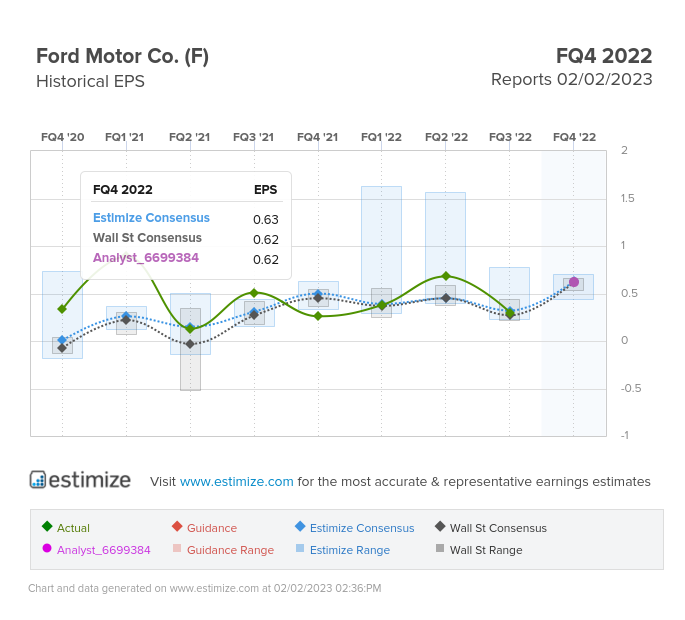

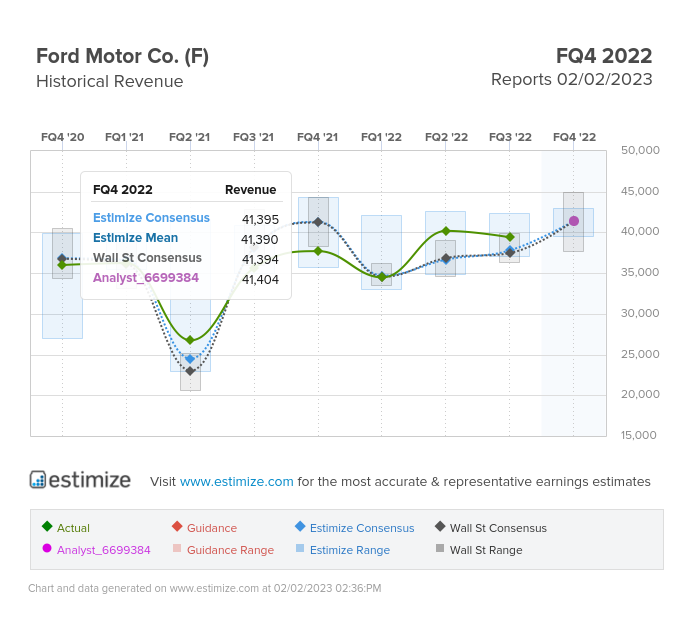

The Wall Street consensus expects Ford to report $0.62 earnings per share (EPS) on $40.73 billion in revenue. Estimize has EPS estimates slightly higher at $0.63 EPS on $41.39 revenue.

A year ago, in Q4 2021, Ford’s sales took a hit from the ongoing semiconductor shortages and other supply chain issues, reporting revenue of $37.68 billion.

Rival General Motors released its Q4 earnings report Tuesday, showing revenue growth of 28% and EPS growth of 57% YOY. However, like many in the industry, rising input costs are squeezing net income margins in the fourth quarter.

With recent price cuts, Ford’s margins will be another thing to look out for. In Q4 2021, Ford’s gross profit margin was 10.99%.

Ford’s stock is up 22% in 2023 but is still down over 40% from its high of $25.87 per share last January.

See Ford’s full year 2022 and Q4 earnings results here.

FTC: We use income earning auto affiliate links. More.

Comments