One of the largest global auto suppliers, BorgWarner, is buying EV charging company Rhombus Energy Solutions, the company announced today. The auto supplier says the deal will accelerate its charging business by leveraging its existing capabilities.

BorgWarner is best known for making and selling quality parts to OEMs. For example, some of the suppliers’ largest customers include legacy automakers like Ford, GM, and Volkswagen.

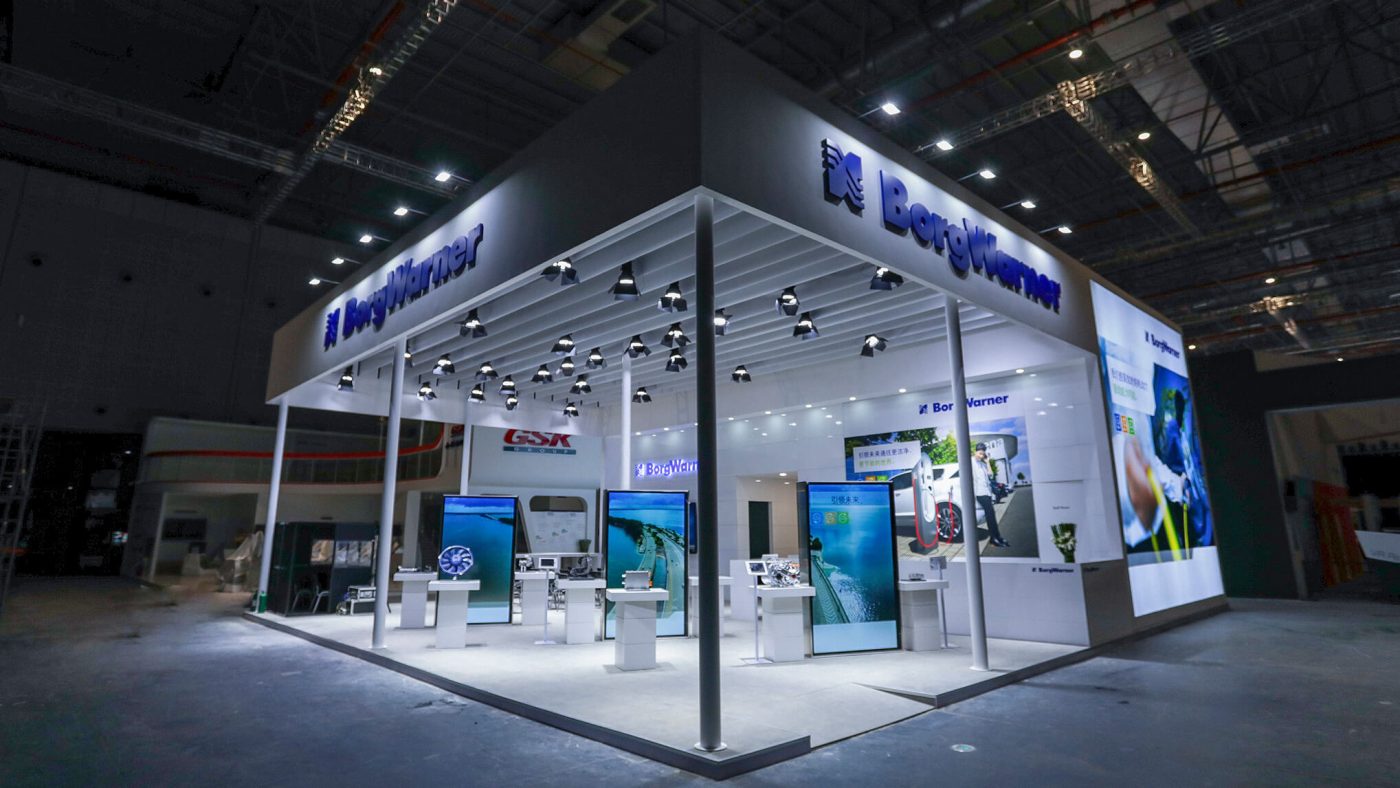

The company operates worldwide with a presence in all major markets; that said, BorgWarner has been growing at a steady rate for the past decade, yet the company is looking to accelerate its growth by moving to support the auto industry’s transition to EVs.

According to recent forecasts, plug-in vehicle sales will make up almost a quarter of new passenger vehicle sales by 2025, up from 10% this past year.

Over the past few years, BorgWarner has made several acquisitions to boost its ability to support EV demand.

- In May 2019, BorgWarner invested in Romeo Power, a leading battery tech company founded by Tesla and SpaceX engineers.

- Then, in September 2019, BorgWarner and Romeo formed a joint venture, BorgWarner Romeo Power. But in February 2022, BorgWarner sold its stake and no longer has any interest.

- On August 2, 2021, the company squeezed out shareholders for 100% interest in AKASOL, a german EV battery company.

- On March 31, 2022, BorgWarner acquired 100% of Santroll Automotive Components, a light vehicle eMotor business.

As you can see, BorgWarner is transitioning along with the rest of the auto industry to support EVs. The auto supplier has won multiple awards for its EV products such as high voltage coolant heaters, commercial battery systems, and fast charging stations.

But the company expects its latest deal to fuel its growth in the EV industry.

BorgWarner is buying Rhombus Energy Solutions to drive EV charging growth

To complement its existing EV charging business, BorgWarner is buying Rhombus Energy Solutions. The deal will boost its EV charging presence in North America while adding to its European market.

Rhombus’s headquarters is in San Diego, CA, and its primary markets include electric buses and trucks. A few of its largest customers include Proterra (electric buses & EV charging) and Nuuve (EV charging and grid solutions).

The deal can be worth up to $185 million, but BorgWarner expects it to add value sooner rather than later. For example, there is a massive push for a national EV charging network to boost accessibility and promote EV buying.

BorgWarner expects the deal to add significant value to the business, with estimated revenue between $175 to $200 million by 2025.

FTC: We use income earning auto affiliate links. More.

Comments