Tesla has now expanded the availability of its real-time data car insurance product to car owners in Illinois.

It’s now the third state to get Tesla Insurance and the second one with the more recent product based on real-time data from the drivers.

Tesla Insurance

Tesla had already introduced its own insurance product in California, but it didn’t utilize real-time driving data and its “safety score,” which had been its original goal.

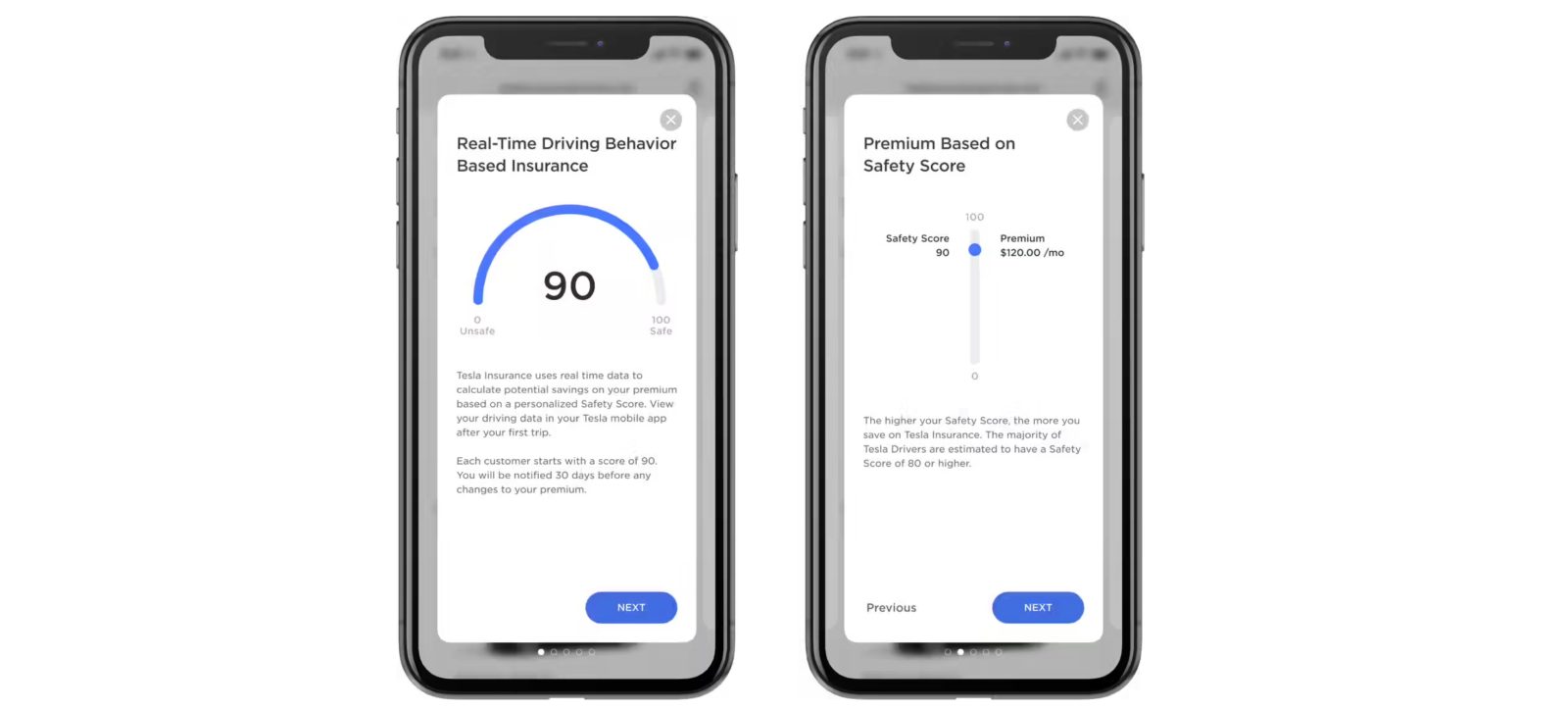

Before expanding its insurance product to other markets, the company wanted to build up its safety score system, which utilizes driving data collected in real-time from Tesla vehicles to determine if you are a “good driver” based on things like the number of “Forward Collision Warnings” you get, the amount of hard braking you do, aggressive turning, unsafe following distance, and if you get forced Autopilot disengagements.

In October, Tesla finally launched its new insurance product based on the safety score in Texas.

The automaker says that it expects those deemed “average” drivers by the safety score should save 20% to 40% on their premium compared to competitors, and those with the safest scores could save between 30% to 60%.

In a review of some quotes compared the existing premiums for Tesla drivers, it was a hit or miss on whether it was cheaper or not, but it seems to make a bigger difference for those who already had a high premium based on age and gender, which Tesla insists it is not using in its own premium calculations, unlike other insurance companies.

Also, when first quoting and starting a policy, Tesla assumes a safety score of 90. The monthly premium price can quickly go down if you improve this score.

Tesla released an example that shows how the premium can change month to month depending on your score:

| Month | Safety Score From Trips* | Safety Score for Rating | Monthly Premium |

|---|---|---|---|

| 1 | 95 | 90 | $121.00 |

| 2 | 88 | 90 | $121.00 |

| 3 | 92 | 95 | $97.00 |

| 4 | 98 | 88 | $130.00 |

| 5 | 96 | 92 | $111.00 |

| 6 | 93 | 98 | $83.00 |

Tesla Insurance expands to Illinois

In an update to its website last night, Tesla confirmed that it expanded its insurance product availability to Illinois:

“Tesla Insurance is a competitively priced insurance product, offering comprehensive coverage and claim management for Tesla owners in California, Illinois and Texas and will expand to additional U.S. states in the future.”

The automaker confirmed that Illinois drivers are getting access to the insurance product based on real-time data, like Texas:

“Get competitive rates in California, Illinois, and Texas in as little as one minute. Insurance based on real-time driving behavior now available in Illinois and Texas.”

The regulatory landscape for insurance is complex and varies state by state.

Therefore, Tesla has a lot of work to do to launch in any new state, which slows the rollout of the new product.

In October, CEO Elon Musk said that Tesla is aiming to be “in most states” by the end of 2022.

FTC: We use income earning auto affiliate links. More.

Comments