Thanks to our sponsor Wunder Capital for sponsoring The Electrek Podcast this month.

The best way to invest in solar is generally having your own rooftop solar array. Of course that may not work for everyone for a number of reasons. Perhaps you are renting rather than a homeowner, have an inadequate roof location/configuration, or your grid electricity is cheap enough that it doesn’t make sense financially. But you might also want to invest in even more than just your own electricity savings.

Colorado-based Wunder Capital enables you to do so by directly investing in other solar projects across the U.S. while providing great returns for investors. The company’s portfolio of solar projects in the U.S. has grown rapidly in recent months and it shared some updated data below. Here’s how it works:

How Wunder Solar works

At its core the idea is simple. Allow people to invest in successful solar projects and get returns while contributing positively to fighting climate change and helping the U.S. in its transition to solar.

Wunder’s solar experts along with its installer network partners work with businesses and organizations that need assistance and funding for planning and/or covering the upfront cost of a solar installation. On the flip side, Wunder has set up funds that it describes as “solar index funds,” allowing investors to get access to that diversified portfolio of solar investments led by Wunder’s team of experts.

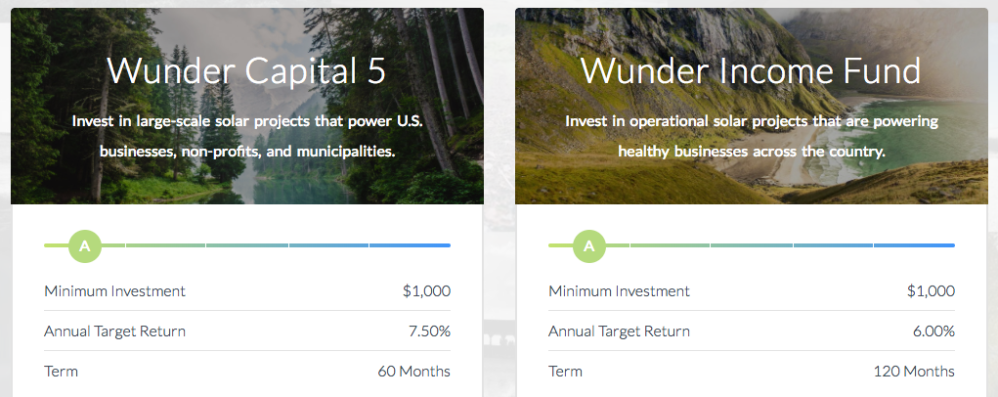

It has two funds currently. The “Wunder Capital 5” gives investors access to large-scale solar projects that power U.S. businesses, non-profits, and municipalities with a 60 month term and a 7.50% annual target return rate. Its other fund is the “Wunder Income Fund,” which is curated with operational solar projects that are powering businesses across the US with an annual target return of 6%. Both payout investors monthly with returns deposited directly into their bank accounts.

Wunder’s solar investment growth in 2017

Wunder has continued to grow tremendously in recent months, rounding out 2017 with 115 projects financed, totalling a 37.3MW generation capacity. It continues to see an increased demand for financing requests too as more businesses and organizations look to adopt solar with over 800 requests totalling more than $517M over 2016.

Some of the projects as detailed in its 2017 Year in Review report include solar installations with the California Department of Water and Power, a DC public charter school, a non-profit theatre in Washington, DC and a Northwest Ohio School District.

For the 37.3MW of solar capacity it did finance, the first year alone will amount to Co2 emission offsets equivalent to 36,421,035 pounds of coal burned; or…1,114,084 Incandescent lamps; or…3,745,789 Gallons of gasoline consumed; or 4,989 Homes’ electricity needs for one year. The projects in their first year along will offset, for example, greenhouse gas emissions of 7,128 cars driven for one year or 23.2M pounds of waste recycled instead of landfilled.

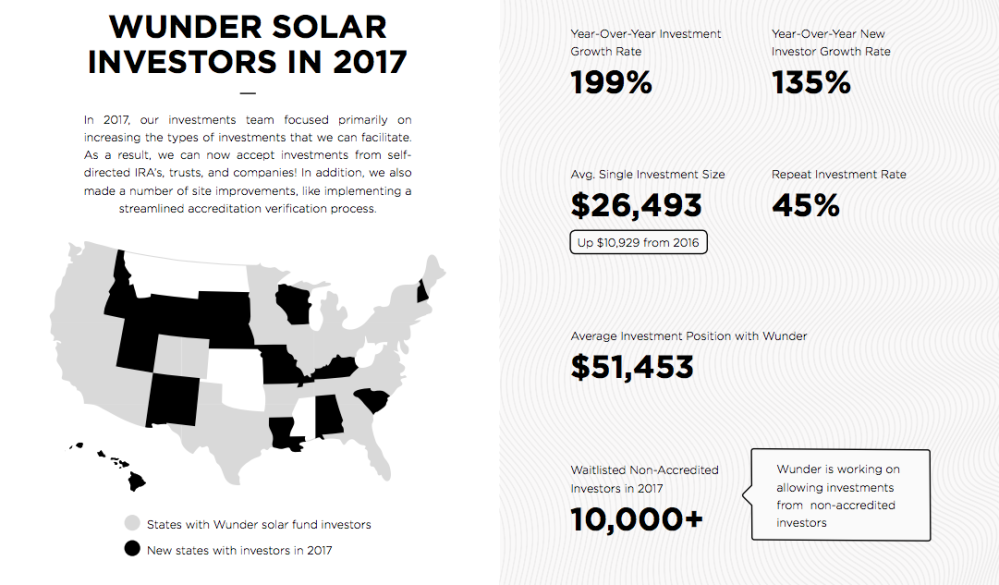

Perhaps more importantly for investors, Wunder was able to increase its year-over-year investment growth rate by about 199% last year, in addition to a 135% increase for its new investor growth rate. Its repeat investment rate is at 45% as of the end of 2017. The company also started accepting investments from self-directed IRA’s, trusts, and companies while streamlining its accreditation verification process. The company is also working towards allowing investments from non-accredited investors with a waitlist totalling 10,000+.

Starting April 16th, new investments will be subject to a 0.25% annual fee. Investments submitted before April 16th will NOT be subject to investment fees.

You can learn more at Wunder.com.

FTC: We use income earning auto affiliate links. More.

Comments