Ford reported Q3 earnings after the market closed on Monday, beating Wall St revenue and EPS expectations. However, the company is still losing billions on its EVs. Here’s a closer look at Ford’s third-quarter 2024 earnings report.

Third-quarter earnings preview

Ford’s US retail sales rose 3% in the third quarter, with overall sales up 1% compared to Q3 2023. Overall vehicle sales are now up 2.7% through the first nine months of 2024.

Despite the growth, Ford was outpaced by GM and Hyundai Motor Group (including Kia and Genesis) in US electric vehicle sales.

Ford’s EV sales were up 12%, with 23,509 vehicles sold in Q3. However, with a record 32,095 EVs sold, an increase of 60% year over year, GM topped its crosstown rival. With 70,450 EVs sold, GM is now ahead of Ford at 67,689.

GM topped estimates last week, reporting $48.8 billion in third-quarter revenue. Although the company doesn’t provide a separate EV breakdown, it says it’s “nearing the crossover point to profitability for EV sales.”

After losing another $1.1 billion on its Model e business, Ford’s EV losses reached $2.5 billion through the first half of 2024. Ford expects EV losses to reach between $5 billion and $5.5 billion this year.

According to Estimize, Ford is expected to report total Q3 revenue of $45.2 billion with an EPS of $0.42.

Ford beats Q3 earnings, but EVs put a drag on profits

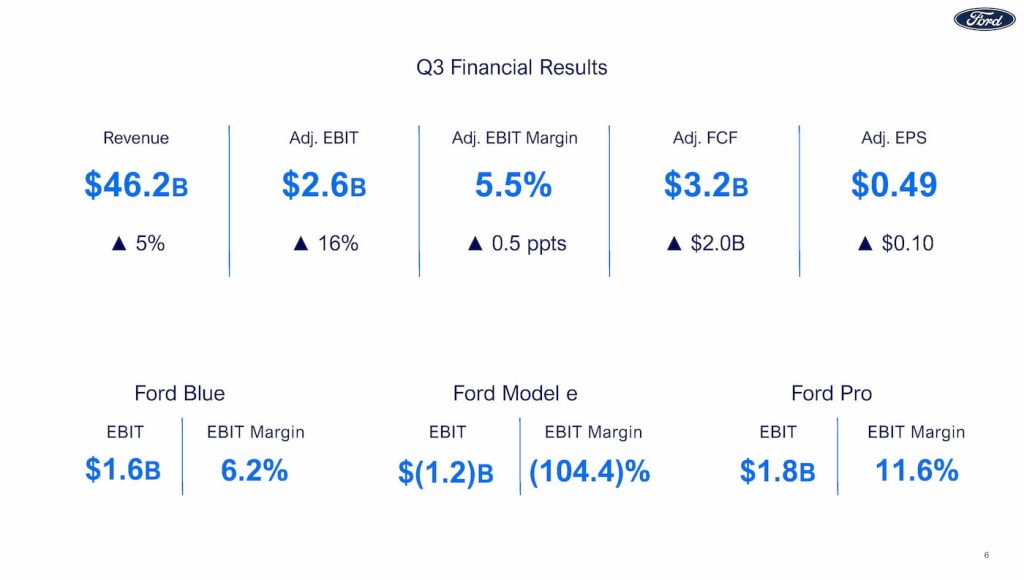

Ford reported Q3 revenue of $46 billion and an Adjusted EPS of $0.49, topping Wall St estimates. This was Ford’s 10th consecutive quarter of YOY growth.

- Q3 2024 Revenue: $46 billion vs $45.2 billion expected.

- Q3 2024 Adjusted EPS: $0.49 vs $0.42 expected.

Meanwhile, Ford’s net income slipped 25% to $900 million in the third quarter. The company said the lower profits included a $1 billion “electric-vehicle related charge” amid its strategy shift.

The company’s commercial and software business, Ford Pro, continues to be the main growth driver, with volume and revenue up 9% and 13%, respectively. The unit also generated $1.8 billion in operating profit with an EBIT margin of 11.6%.

Despite this, Ford’s electric vehicle business continues to feel the pressure. Ford Model e lost another $1.2 billion in Q3.

Although revenue slipped 33% to $1.2 billion, Ford said lower material and battery costs enabled it to achieve nearly $1 billion in cost improvements year-to-date.

The improvements were not enough to overcome “industry-wide pricing pressure,” as Model e losses reached $3.7 billion through the first nine months of 2024.

“We are in a strong position with Ford+ as our industry undergoes a sweeping transformation,” Ford’s CEO Jim Farley said on Monday.

Farley said the company has taken “tough action” to create advantages in key areas like software and next-gen EVs.

Ford expects to lose around $5 billion on its Model e business in 2024. The company now expects adjusted EBIT of around $10 billion, at the lower end of its $10 to $12 billion range.

Ford’s stock was down nearly 5% following its Q3 earnings release as investors hoped for better guidance.

Check back for more info from Ford’s Q3 earnings call. We will post updates below.

FTC: We use income earning auto affiliate links. More.

Comments