Tesla (TSLA) is about to release Q3 2024 financial results on Wednesday, October 23, after the markets close. As usual, a conference call and Q&A with Tesla’s management are scheduled after the results.

Here, we’ll look at what the street and retail investors expect for the quarterly results.

Tesla Q3 2024 deliveries

Elon Musk says that Tesla is now an AI/Robotics company, but its automotive business still drives its financials.

Earlier this month, Tesla disclosed its Q3 2024 vehicle production and deliveries:

| Production | Deliveries | Subject to operating lease accounting | |

| Model 3/Y | 443,668 | 439,975 | 3% |

| Other Models | 26,128 | 22,915 | 1% |

| Total | 469,796 | 462,890 | 3% |

The deliveries were roughly in line with Wall Street’s expectations.

Now that energy storage is starting to contribute to Tesla’s revenue more meaningfully, the company has also started sharing deployment in its quarterly delivery and production numbers.

Tesla confirmed that it deployed 6.9 GWh of energy storage capacity in Q3 2024.

Tesla Q3 2024 revenue

For revenue, analysts generally have a pretty good idea of what to expect, thanks to the delivery numbers, and now the energy storage deployment data.

However, Tesla’s average price per vehicle is changing a lot these days due to frequent price cuts and discounts across many markets, which makes things more difficult.

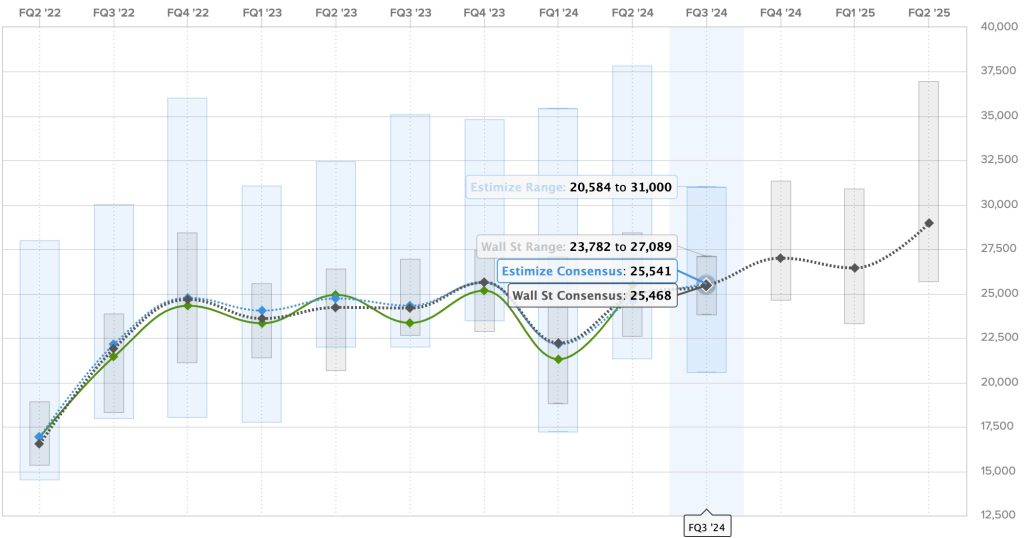

The Wall Street consensus for this quarter is $25.468 billion, and Estimize, the financial estimate crowdsourcing website, predicts a slighty higher revenue of $25.541 billion.

Here are the predictions for Tesla’s revenue over the past two years, with Estimize predictions in blue, Wall Street consensus in gray, and actual results are in green:

Last quarter, Tesla achieved a significant $1 billion beat on revenue expectations.

Interestingly, the expectations are now roughly the same revenue as Tesla achieved last quarter despite Tesla delivering almost 20,000 additional vehicles.

The difference makers are likely the fact that Tesla deployed about 3 GWh less energy storage, which contributed $3 billion to revenue last quarter and the regulatory credit sales, which are hard to predict.

Tesla Q3 2024 earnings

Tesla always attempts to be marginally profitable every quarter as it invests most of its money into growth, and it has been successful in doing so over the last three years.

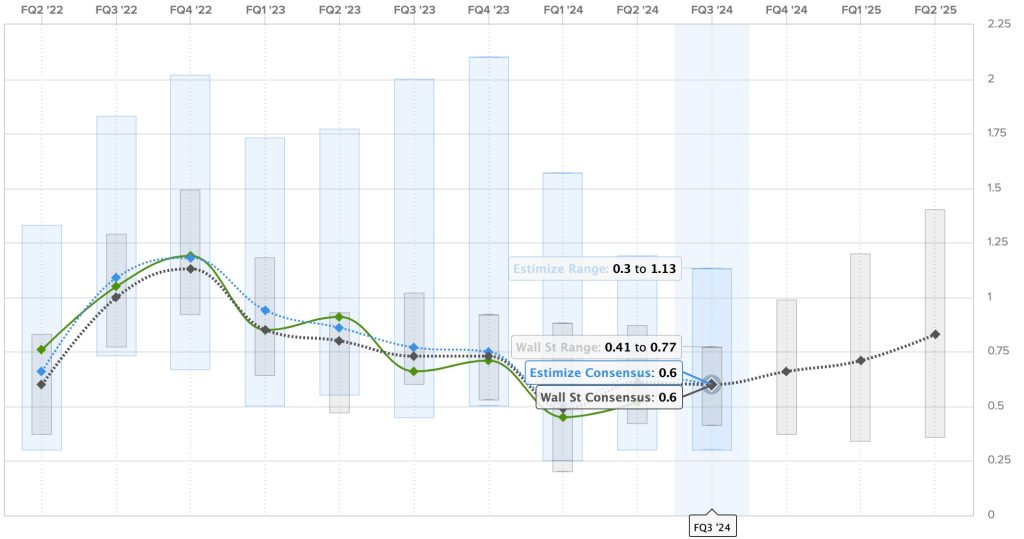

However, like revenues, it has been harder to estimate earnings over the last year with price cuts and subsidized loans digging into Tesla’s industry-leading gross margins.

For Q3 2024, the Wall Street consensus is a gain of $0.60 per share, which Estimize’s crowdsourced prediction.

Tesla had earnings of $0.66 per share during the same period last year.

Here are the earnings per share over the last two years, where Estimize predictions are in blue, Wall Street consensus is in gray, and actual results are in green:

Tesla has rarely beaten EPS estimates over the last year, and the difference maker is often Tesla’s regulatory credit sales.

Other expectations for the TSLA shareholder’s letter and analyst call

Beyond the financial results, Tesla always gives broader updates and answers shareholder questions in its shareholder letter and conference call with management following the release of the results.

Tesla gathers questions from shareholders from the “Say Technologies” website.

Here are the currently most upvoted questions, which are likely to be answered by management, and my comments on them:

Is Tesla still on track to deliver the more affordable model next year, as mentioned by Elon earlier, and how does it align with your AI and product roadmap?”

Musk’s general answer to product questions on earnings calls is “this is not the place for product announcements”, but the fact that the question also mentions Tesla’s AI shift could lead him to comment and clarify Tesla’s plans for vehicles with steering wheels.

When can we expect Tesla to give us the ~$25K, non-robotaxi, regular car model?

As we have previously reported, this vehicle program was canceled by Musk earlier this year and replaced by new vehicle programs based on Model 3 and Model Y that will be more expensive than $25,000, but less expensive than the current ~$40,000 versions of these vehicles.

What is Tesla doing to alleviate long waiting times on service centers ?

More of a consumer-related question, but not a bad one. Tesla is indeed having issues with unacceptable wait times at service centers in some regions. It has been a recurring problem for Tesla, but it became a bigger problem with the layoffs earlier this year.

If Musk gives again his answer of “the best service is no service”, people are going to start taking it with a different meaning.

What’s the plan for 2025?

This is literally the fourth most upvoted question.

When will Tesla incorporate X and Grok in all of the Tesla Vehicles?

Top comment by Scott Titensor

I'm a happy Tesla owner that is more than unhappy about Musk. I'd be ok with Musk voting for Trump, I'm not OK with the CEO of Tesla going all in with Trump, becoming involved in the election and paying people to do things that they think will result in Trump votes. Just wrong. Musk is really hurting the image of Tesla, as CEO he should do what's best for his shareholders, employees and product owners. The Tesla board should take action and remove Musk

And this is the fifth most upvoted one.

Tesla then takes questions from Wall Street analysts, who I hope will be questioning Musk’s all-in bet on self-driving and why Tesla can’t share any data about its FSD program to prove the progress it is claiming to be achieving, but I won’t hold my breath.

The focus will likely be on gross margins and how much they are affected by the subsidized interest rates and discounts.

Also, as the odds of Trump winning the elections are increasing, I expect some will look at the potential impact of his policies on Tesla’s very lucrative business of selling regulatory credits.

FTC: We use income earning auto affiliate links. More.

Comments