Ford reported fourth-quarter and full-year 2025 earnings after the market closed. Despite beating top-line estimates, Ford’s updated EV plans took a bigger toll than expected on profits.

Ford Q4 and full-year 2025 earnings preview

While Ford’s total US sales rose 6% in 2025 to over 2.2 million units, electric vehicles suffered a different fate. Ford sold just over 84,000 all-electric vehicles in the US last year, down 14.7% from 2024.

To put that into perspective, crosstown rival GM sold 169,887 EVs in the US in 2025, up 48% from the prior year and more than double Ford’s sales.

As part of its updated Ford+ plan, revealed in December, Ford is betting on new hybrids and lower-priced EVs based on its Universal EV (UEV) platform. The company plans to launch five new vehicles priced under $40,000, starting with a new midsize electric pickup in 2027.

In the meantime, Ford is reallocating investments to new hybrids and plug-in hybrids (PHEVs) rather than fully electric vehicles.

Ford has already ended production of the current all-electric F-150 Lightning pickup with plans to replace it with an extended-range electric vehicle (EREV) around 2027.

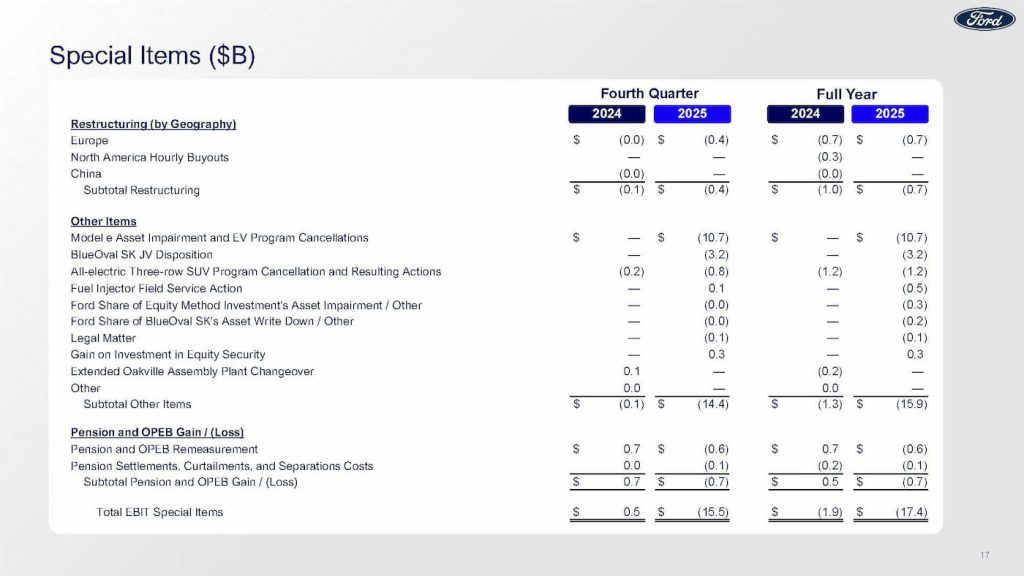

Due to the changes, Ford said it will record around $19.5 billion in special charges, most of which will occur in Q4. According to Estimize, Wall St expects Ford to report Q4 EPS of $0.18 on revenue of $43.5 billion.

Improving EV costs with more affordable models

Ford beat top-line estimates, reporting Q4 revenue of $45.9 billion with an adjusted EPS of $0.13. For the full year, Ford posted $187.9 billion in revenue with an adjusted EPS of $1.09.

Ford’s net loss reached $11.1 billion in the fourth quarter, its worst performance since 2008. For the full year, Ford reported a net loss of $8.2 billion.

The special charges cost Ford $14.4 billion in Q4, including $10.7 billion from “Model e Asset Impairment and EV Program Cancellations,” $3.2 billion from “BlueOval SK JV Disposition,” and another $800 million from cancelling its three-row electric SUV.

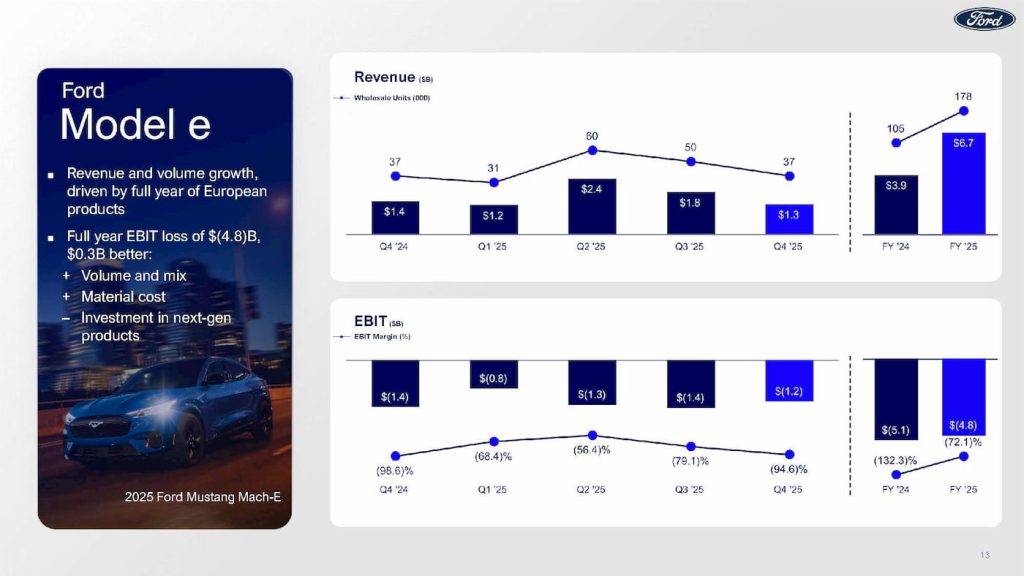

While Ford’s electric vehicle business, Model e, lost another $1.2 billion in Q4, bringing its 2025 EBIT loss to $4.8 billion, the company is focused on improving costs through next-gen affordable EV models.

Ford said it’s leveraging partnerships to reduce capital costs and bring vehicles to market faster. In December, Ford announced a partnership with Renault to develop lower-cost EVs for Europe based on its Ampere platform.

The American automaker said it has a “rationalized role of pure EVs” in the near term, with plans to launch scalable, affordable, and profitable EVs starting in 2027.

For the full-year 2026, Ford expects an adjusted EBIT of $8 billion to $10 billion. Broken down by segment, Ford Pro is expected to report an adjusted EBIT of $6.5 billion to $7.5 billion, Ford Blue $4.0 billion to $4.5 billion, and Ford Model is expected to report an EBIT loss of $4 billion to $4.5 billion, or a slight improvement from 2025.

Check back for updates from Ford’s earnings call. We’ll post the latest updates below.

FTC: We use income earning auto affiliate links. More.

Comments