The data is in for Tesla’s full year 2025 in Europe, and frankly, it’s a bloodbath across most major markets.

There’s a single exception, and Tesla can’t count on it in 2026.

Following years of explosive growth that saw the Model Y become the best-selling car on the continent, Tesla hit a massive demand wall in 2025.

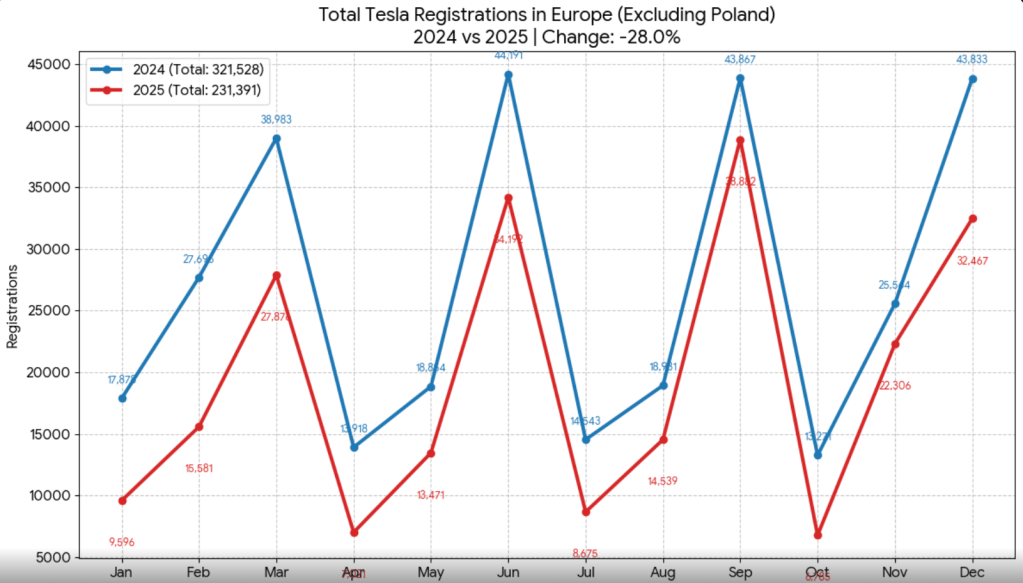

According to registration data compiled from major European markets, Tesla saw its total volume drop from roughly 326,000 units in 2024 to just over 235,000 in 2025. That is a staggering 27.8% year-over-year decline.

If you look at the chart, Tesla started the year way down, partly because of the Model Y refresh limiting supply, but the automaker quickly ramped up production and still couldn’t reach 2024 levels as no demand backlog was created by the Model Y refresh:

When you look at the data for each market, it becomes even more interesting. Tesla’s sales went down in every single market in 2025, with the single exception of Norway:

| Country | 2024 Sales | 2025 Sales | % Change |

| UK | 50,334 | 45,513 | -9.6% |

| Norway | 24,259 | 34,285 | +41.3% |

| France | 40,732 | 25,477 | -37.5% |

| Germany | 37,574 | 19,387 | -48.4% |

| Netherlands | 30,082 | 16,683 | -44.5% |

| Spain | 16,690 | 16,005 | -4.1% |

| Italy | 15,651 | 12,847 | -17.9% |

| Belgium | 21,182 | 9,933 | -53.1% |

| Portugal | 9,760 | 7,585 | -22.3% |

| Denmark | 16,032 | 9,457 | -41.0% |

| Sweden | 21,897 | 7,252 | -66.9% |

| Switzerland | 8,930 | 6,446 | -27.8% |

| Austria | 7,679 | 6,205 | -19.2% |

| Poland | 4,461 | 3,931 | -11.9% |

| Finland | 3,717 | 2,618 | -29.6% |

| Other | 17,009 | 11,698 | -31.2% |

| Total | 325,989 | 235,322 | -27.8% |

Germany was once Tesla’s growth engine in Europe, and in 2025, it saw registrations crash by 48.4%, falling from over 37,500 units to just over 19,000.

It wasn’t just Germany. France implemented new rules for its “bonus écologique” that effectively disqualified the Chinese-made Model 3 Highland, leading to a 37.5% drop.

Other markets that dialed back support, like Sweden and Belgium, saw catastrophic drops of 66.9% and 53.1%, respectively.

The Norwegian Exception

But amidst this sea of red ink, there is one incredibly bright green spot that proves the EV transition is far from over: Norway.

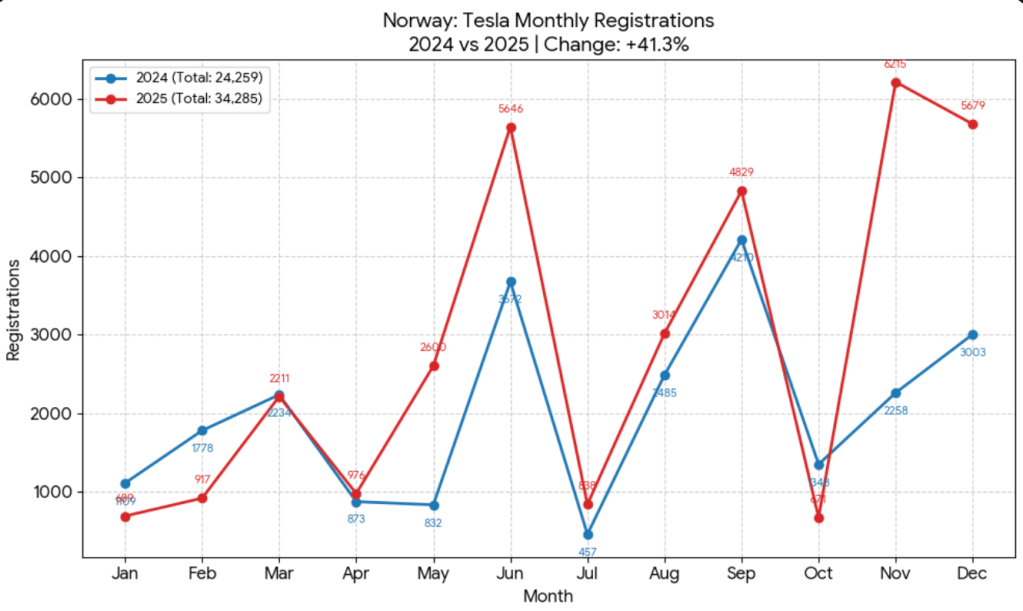

However, this is clearly temporary. Most of Tesla’s growth in Norway in 2025 came from the last two months of the year:

That’s due to Norway changing its EV incentives in 2026, making more expensive EVs, such as Tesla’s, ineligible for some tax incentives.

It resulted in pulling a lot of demand forward into Q4 2025 for Tesla, and consequently, it should make things difficult for the automaker in 2026.

Electrek’s Take

This 2025 data is a tough pill to swallow for Tesla investors, who are coping by telling themselves that Tesla’s EV sales don’t matter anymore.

Top comment by Michael Wolf

In my experience, people work to solve a problem when they believe that the problem can be solved. When they don't have that belief, they tend to ignore the problem, or they try half-heartedly. Tesla's problem is that Musk doesn't think Tesla can compete with the Chinese as a vehicle manufacturer, and it's easy to see the impact of his belief. Rather than finding a leader who will drive the organization to fight for their market share, instead Tesla is letting Musk turn the company into a startup that's focused on AI and robotics, and just coasting along on vehicles. Add in the reputational damage of Musk's antics, and we can expect to see their vehicle sales continue to suffer.

The truth is that this is an impressive demand cliff by any standard that point to significant brand problems, which are due to a mix of Elon Musk, Tesla’s CEO, becoming highly toxic, and Tesla’s EV lineup becoming stale amid tougher competition.

There are some very interesting situations in the data.

Norway being the only exception is fascinating, and I covered it above, but the UK is also an interesting example. It is still Tesla’s biggest market in Europe, but it still saw a significant year-over-year decline and I expect the trend to accelerate in 2026 as Chinese competition is increasing its presence in the market.

I am very curious to see if Tesla can stop the bleeding in Europe in 2026 with the cheaper versions of Model 3 and Model Y. Personally, I think it could be about flat.

FTC: We use income earning auto affiliate links. More.

Comments