We finally have the full picture for Tesla’s 2025 out of Giga Shanghai, and while the headline wholesale numbers look spectacular, digging into the data reveals a significant milestone we’ve been warning about for months: Tesla’s domestic growth story in China has hit a wall.

According to the latest data, Tesla managed a staggering 97,171 wholesale units in December 2025. That’s an incredible number for a single factory, nearing its theoretical maximum capacity.

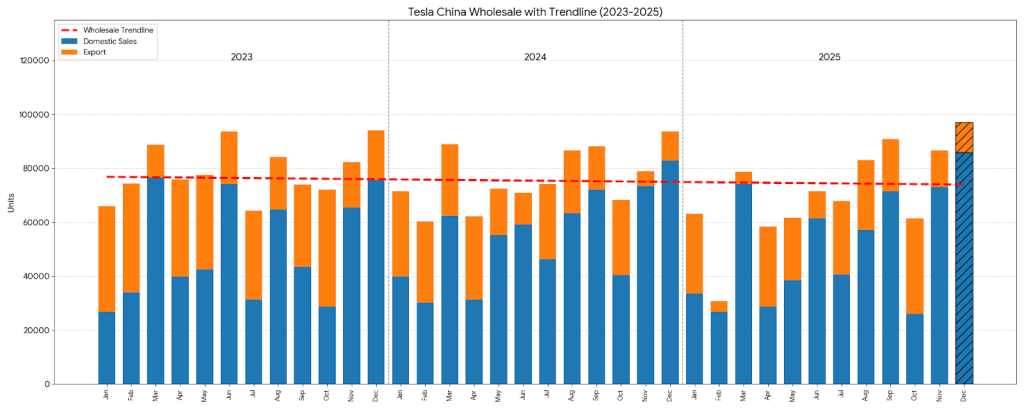

Typically, a number like that would be cause for unbridled celebration. But when you look at the full year of domestic sales versus exports, the picture changes.

We’ve crunched the numbers, and they confirm that 2025 is the first year Tesla has experienced a year-over-year decline in domestic retail sales in China.

Here is the math.

Going into December, Tesla had accumulated roughly 531,855 domestic sales in China from January through November 2025.

In the full year of 2024, Tesla delivered a total of 657,105 vehicles domestically in China.

This meant Tesla needed a miraculous December of over 125,000 domestic sales just to match 2024, a figure well beyond Giga Shanghai’s capacity.

But let’s look at the data we do have. Even if we apply the most optimistic, impossible scenario,assuming Tesla exported zero cars in December and every single one of those 97,171 wholesale units was sold locally, Tesla would still fall short.

- 2025 YTD Domestic (Jan-Nov): 531,855

- The “Impossible” Dec Scenario (100% Domestic): + 97,171

- Theoretical Max 2025 Domestic Total: 629,026

That theoretical maximum is still nearly 30,000 vehicles shy of Tesla’s 2024 domestic performance.

In a more realistic scenario, applying the same sales/export split seen in December 2024 (roughly 88% retail), Tesla likely sold around 86,000 units domestically last month. That puts the final 2025 domestic total closer to 618,000—a roughly 6% drop year-over-year.

This chart, which visualizes the monthly breakdown over the last three years, clearly shows the trend. While the total height of the bars (wholesale) remains strong, the blue sections (domestic sales) in the latter half of 2025 struggled to keep pace with the heights of late 2023 and 2024.

The EV Competition is squeezing Tesla in China

There is no sugarcoating it: the Chinese EV market is a bloodbath right now. It is easily the most competitive auto market on the planet.

While Tesla is relying on the Model 3 and Model Y, great cars that are getting long in the tooth, domestic rivals are flooding the market with fresh models every few months.

BYD is relentless, offering competitive EVs at aggressive price points across every segment. You have startups like Nio and Xpeng refining their offerings, and new tech giants like Xiaomi entering the fray with incredibly compelling vehicles that directly target Tesla’s demographic.

These domestic brands are iterating faster, undercutting prices, and matching Tesla on tech features in the eyes of many Chinese consumers.

Tesla still benefits from the perception, even from Chinese people, that Chinese automakers are not up to the quality and safety standards as foreign brands. That perception is mainly held by older Chinese people who remember a time, not too long ago, when it was the case, but that’s not really true anymore.

Electrek’s Take

This isn’t doom and gloom for Tesla, but it is a massive reality check.

For years, the narrative was that China was Tesla’s boundless growth engine. That engine has now plateaued domestically. Giga Shanghai is maxed out, and the local market is saturated with incredible alternatives.

Top comment by john

Don't worry, while next year they will introduce no new models but maybe some new paint colors and maybe some different wheels plus a price cut that ought to do the trick. Plus never forget Tesla is not a car company. Surrealism has escaped the art world and landed in the business world

December wholesale numbers do point to more than decent domestic sales for Tesla in December, but part of that is due to some fear that incentives might have been reduced next year, something the Chinese government finally decided against.

It’s also worth noting that Tesla had its second full year of decline in wholesale deliveries from China in 2025. And the decline is accelerating. From 2023 to 2024, it was down 3.2%, and now it is down 7% in 2025 compared to 2024.

2026 should see even more competition in the EV sector for Tesla in China.

FTC: We use income earning auto affiliate links. More.

Comments