A major Tesla shareholder announced that they are voting against Elon Musk’s CEO compensation package, but the odds are still in his favor.

As we have been extensively reporting over the last few weeks, Tesla shareholders are set to vote on a new compensation package for Elon Musk worth up to $1 trillion.

The package is highly controversial. On one hand, the board, Musk, and his fans are presenting it as an “all or nothing” situation on which the “future of Tesla”, or even “the world” (actual quote from Musk) hangs in the balance.

The CEO has threatened to quit if he doesn’t get the package, which he claims is mainly about increasing his stake and control over Tesla as the automaker continues to develop AI technology, which he claims to fear in the wrong hands.

On the other hand, critics point to Musk getting more stock options than all other Tesla employees combined, despite being a part-time CEO for the better part of the last 3 years.

Furthermore, there are issues with the way the package is structured, which could lead to Musk banking tens of billions of dollars worth of options without delivering any major advancements at Tesla.

Now, Norges Bank Investment Management, Norway’s massive sovereign-wealth fund, has pronounced itself on the compensation package as a shareholder.

They are firmly against it:

“While we appreciate the significant value created under Mr. Musk’s visionary role, we are concerned about the total size of the award, dilution, and lack of mitigation of key person risk — consistent with our views on executive compensation.”

As of the last disclosure, the fund owns over 1% of Tesla’s stock, making it one of the most significant shareholders.

California Public Employees’ Retirement System, branded as CalPERS, also announced that it is voting against Musk’s pay package, citing reasons very similar to Norges’. The fund holds approximately 5 million shares of Tesla stock.

On the other hand, Baron Capital Management also pronounced itself on the pay package at the same time as the Norwegian fund. Unsurprisingly, given Ron Baron’s long-time support for Musk, Baron sided with Musk.

But his fund is much smaller and reportedly holds approximately 0.4% of Tesla.

The vote will be final at Tesla’s annual shareholders meeting on November 6th.

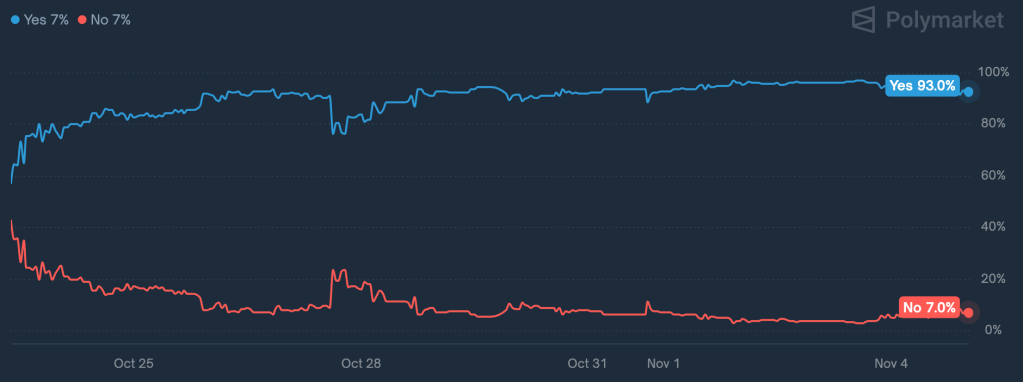

Prediction market Polymarket currently puts the odds of the package passing at 93% with $66,000 in trading volume:

Electrek’s Take

Institutional shareholders are going to make or break the vote for Musk. We know insiders and retail investors are going to vote for the package, since if you fall within either of those categories at this point, you are probably a fan.

Top comment by BCV

The absurdity of this pay package shows exactly why individual investors should stay away from Tesla stock for the time being. Believing this is a good deal for shareholders represents a level of naivety that is impossible to handwave away.

Remember how the US is considered to has the world's most overpaid CEO's? It is a thing. I challenge anyone who thinks this is a good deal for Tesla shareholders to look at the compensation of the other most-overpaid CEO's out there. Not a single one makes over $100M/yr. Yet if Musk delivers stock returns roughly inline with what would be expected from an index fund, he will receive a payday roughly 100x higher than the highest paid CEO in the US. And this is on top of the gains from the stock he already owns.

In order to believe this is a good deal, you have to believe that Elon Musk is truly irreplaceable and no other CEO in the world can run Tesla. This is an absurdity from any rational analysis, but plenty of Tesla fans apparently believe it.

This leads to a third level of absurdity. If you believe Elon Musk is truly irreplaceable, you also have to recognize that Tesla stock should trade at a discount because of it.

If Elon Musk is irreplaceable, the share value should be discounted by the probability that Elon Musk will get distracted by a new shiny object, have a drug overdose, or otherwise sabotage the value of Tesla. There's a demonstrated meaningful probability of any of those things happening.

But the institutional shareholders have other people to answer to, and they need to justify their votes.

“I like Elon and I believe in his ridiculous predictions about AI and robots” is just not enough. The proxy firms that advise those institutional shareholders have already pronounced themselves against, but the question remains: how many of them will follow the advice?

For now, it looks quite split, which would point to a yes passing as long as there’s a strong 90% yes turnout from retail shareholders, which appears to be the case.

After November 6th, Elon Musk will own Tesla forever. For better or worse.

FTC: We use income earning auto affiliate links. More.

Comments